Kansas Sales Tax Car

When purchasing a vehicle in Kansas, it's essential to understand the state's sales tax laws to ensure you're prepared for the process and can make informed decisions. This article aims to provide a comprehensive guide to Kansas sales tax on cars, covering everything from the applicable rates to exemptions and common questions. By the end of this article, you'll have a clear understanding of how sales tax applies to vehicle purchases in Kansas and what to expect.

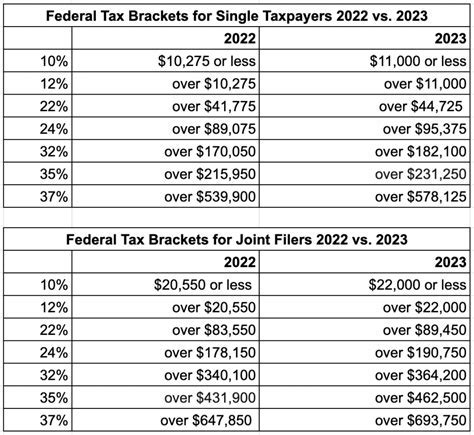

Understanding Kansas Sales Tax Rates

Kansas has a relatively straightforward sales tax system for vehicle purchases. The state imposes a 6.5% sales tax rate on most tangible personal property, including vehicles. This rate is uniform across the state and applies to both new and used cars.

However, it's important to note that local jurisdictions in Kansas may also levy additional sales taxes. These local option sales taxes can vary by county and city, adding up to a maximum of 4% on top of the state rate. Therefore, the total sales tax you pay on a vehicle purchase in Kansas can range from 6.5% to 10.5%, depending on your location.

To calculate the sales tax on your vehicle purchase, you can use the following formula:

Sales Tax = (Vehicle Purchase Price) x (Sales Tax Rate)

For example, if you're buying a used car priced at $20,000 in a county with a local option sales tax rate of 3%, your sales tax calculation would be:

Sales Tax = $20,000 x (6.5% + 3%) = $20,000 x 9.5% = $1,900

Sales Tax on Trade-Ins

If you’re trading in your old vehicle as part of your purchase, the sales tax calculation can get a bit more complex. In Kansas, the sales tax is applied to the difference between the trade-in value and the purchase price of the new vehicle.

Let's say you're trading in a car valued at $5,000 towards the purchase of a new vehicle priced at $30,000. The sales tax would be calculated on the $25,000 difference:

Sales Tax = ($30,000 - $5,000) x (6.5% + Local Option Rate)

This calculation ensures that you're not taxed on the full value of the trade-in vehicle, but rather on the net cost of the new vehicle after the trade-in value is applied.

Exemptions and Special Considerations

Kansas offers certain exemptions and special considerations when it comes to sales tax on vehicles. Here are a few notable ones:

- Military Personnel: Active-duty military personnel stationed in Kansas are exempt from sales tax on the purchase of a vehicle if they've been stationed in the state for less than 18 months.

- Disabled Veterans: Veterans with a service-connected disability of 100% may be eligible for a sales tax exemption on vehicle purchases. This exemption is also extended to their spouses and children.

- Leased Vehicles: When leasing a vehicle in Kansas, the sales tax is typically calculated based on the monthly lease payment. The tax is collected over the life of the lease agreement.

- Vehicle Exports: If you're purchasing a vehicle with the intent to export it outside of Kansas within 90 days, you may be eligible for a refund of the sales tax paid. This exemption applies to both residents and non-residents.

It's important to consult with a tax professional or the Kansas Department of Revenue for specific guidance on these exemptions and to ensure you meet all the necessary requirements.

Sales Tax Payment and Filing

When purchasing a vehicle in Kansas, the sales tax is typically collected by the dealership at the time of sale. The dealership will add the sales tax to the total purchase price, and you’ll pay this amount as part of the transaction.

However, if you're purchasing a vehicle from a private seller or an out-of-state dealership, you're responsible for paying the sales tax directly to the Kansas Department of Revenue. You'll need to complete the necessary paperwork and submit it along with the sales tax payment within a certain timeframe after the purchase.

It's crucial to keep all documentation related to your vehicle purchase, including the bill of sale, to ensure accurate reporting and avoid any penalties or complications.

Late Payment Penalties

If you fail to pay the sales tax on time, Kansas imposes penalties and interest charges. The penalty for late payment is 5% of the tax due, and interest accrues at a rate of 0.5% per month or portion thereof. It’s important to stay on top of your sales tax obligations to avoid these additional costs.

Title and Registration

After paying the sales tax, the next step in the vehicle purchase process is obtaining a title and registering your vehicle. In Kansas, you must apply for a title and registration within 60 days of the purchase.

The title application process involves submitting the necessary documentation, such as the bill of sale and proof of insurance, to the Kansas Department of Revenue. Once the title is issued, you'll need to register your vehicle with the county treasurer's office in the county where you reside.

Transferring Titles

If you’re purchasing a vehicle from a private seller within Kansas, the process for transferring the title is straightforward. The seller must complete and sign the title endorsement, and you’ll need to provide the necessary identification and proof of insurance.

However, if you're purchasing a vehicle from out of state, the process can be a bit more complex. You'll need to obtain a Kansas title and registration by providing the out-of-state title, bill of sale, and other required documentation. The specific requirements can vary depending on the state from which the vehicle is being transferred.

Vehicle Sales Tax Tips

To ensure a smooth and hassle-free experience when dealing with vehicle sales tax in Kansas, here are a few tips to keep in mind:

- Research Local Option Taxes: Before making a vehicle purchase, research the local option sales tax rates in the county where you'll be registering the vehicle. This will help you budget accurately and avoid surprises.

- Negotiate Trade-Ins: When negotiating a trade-in, consider the impact on sales tax. A higher trade-in value can reduce the taxable amount, potentially saving you money.

- Explore Exemptions: If you think you may qualify for an exemption, such as the military or disabled veteran exemption, research the requirements thoroughly and consult with the appropriate authorities to ensure you meet all the criteria.

- Keep Records: Maintain detailed records of your vehicle purchase, including the bill of sale, sales tax payment receipts, and any other relevant documentation. This will make it easier to file your taxes accurately and provide proof if needed.

- Stay Informed: Sales tax laws and regulations can change over time. Stay updated on any changes or new policies that may impact your vehicle purchase. The Kansas Department of Revenue's website is a valuable resource for the latest information.

Frequently Asked Questions

Can I negotiate the sales tax on my vehicle purchase?

+No, the sales tax is a mandatory charge imposed by the state and local jurisdictions. While you may be able to negotiate the purchase price of the vehicle, the sales tax is a fixed percentage based on the final purchase price.

Do I need to pay sales tax if I’m a non-resident purchasing a vehicle in Kansas?

+Yes, non-residents are generally subject to the same sales tax laws as residents. However, if you plan to export the vehicle out of Kansas within 90 days, you may be eligible for a sales tax refund.

Can I deduct the sales tax on my vehicle purchase from my federal taxes?

+No, the sales tax on vehicle purchases is not deductible for federal tax purposes. However, you may be able to deduct certain vehicle-related expenses if you use the vehicle for business purposes.

What happens if I fail to pay the sales tax on time?

+Failing to pay the sales tax on time can result in penalties and interest charges. It’s important to stay on top of your sales tax obligations to avoid these additional costs.

How long do I have to apply for a title and registration after purchasing a vehicle in Kansas?

+You have 60 days from the date of purchase to apply for a title and registration in Kansas. Failure to do so may result in penalties and fees.

Understanding the intricacies of Kansas sales tax on cars is crucial for a smooth and informed vehicle purchase process. By familiarizing yourself with the applicable rates, exemptions, and filing requirements, you can ensure a hassle-free experience and make the most of your vehicle investment.