Illinois Auto Sales Tax

When purchasing a vehicle in Illinois, it's essential to understand the state's auto sales tax, as it can significantly impact your overall expenses. The Illinois auto sales tax is a crucial component of the state's revenue generation and is applied to all vehicle purchases, whether new or used. This article aims to provide an in-depth analysis of the Illinois auto sales tax, its implications, and how it affects car buyers in the state.

Understanding the Illinois Auto Sales Tax

The Illinois auto sales tax is a state-imposed tax that is added to the purchase price of a vehicle. It is calculated as a percentage of the vehicle’s sale price and is paid by the buyer at the time of purchase. This tax is a significant source of revenue for the state, contributing to various public services and infrastructure development.

The auto sales tax in Illinois is known for its straightforward structure. It operates on a flat rate system, meaning the tax percentage remains constant regardless of the vehicle's price or type. This uniformity simplifies the calculation process for both buyers and sellers, ensuring transparency in transactions.

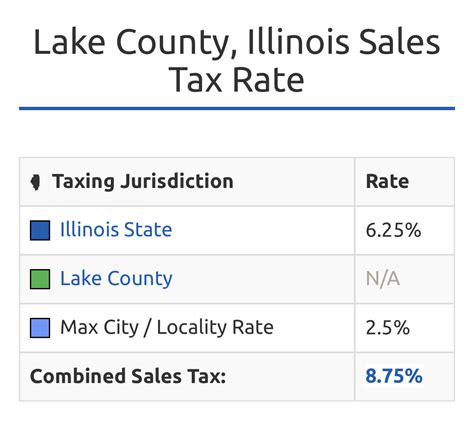

As of my last update in January 2023, the current auto sales tax rate in Illinois is 6.25%. This rate applies to the total purchase price of the vehicle, including any additional fees or add-ons. It's important to note that this rate is subject to change, so it's advisable to verify the current tax rate before finalizing a vehicle purchase.

Calculating the Auto Sales Tax

To calculate the auto sales tax in Illinois, you simply multiply the vehicle’s purchase price by the tax rate. For example, if you are purchasing a car for $25,000, the auto sales tax would be:

$25,000 x 0.0625 = $1,562.50

Therefore, the total cost of the vehicle, including tax, would be $26,562.50.

It's worth mentioning that the auto sales tax is separate from other fees and taxes that may be associated with vehicle purchases, such as registration fees, title fees, and emissions testing fees. These additional charges can further increase the overall cost of owning a vehicle in Illinois.

Exemptions and Special Considerations

While the Illinois auto sales tax is generally applicable to all vehicle purchases, there are certain exemptions and special considerations that buyers should be aware of:

- Trade-Ins: If you are trading in your old vehicle as part of the purchase, the sales tax is calculated based on the difference between the trade-in value and the purchase price of the new vehicle. This can result in a lower tax liability.

- Military Personnel: Active-duty military personnel stationed in Illinois may be eligible for a sales tax exemption. This exemption applies to the purchase of a vehicle, provided certain criteria are met.

- Special Vehicles: Certain types of vehicles, such as recreational vehicles (RVs), boats, and motorcycles, may have different tax rates or requirements. It's essential to consult the Illinois Department of Revenue for specific guidelines regarding these vehicles.

- Vehicle Donations: When a vehicle is donated to a qualified charitable organization, the sales tax may be waived. However, specific conditions must be met, and it's advisable to seek professional advice in such cases.

It's crucial to carefully review the applicable laws and regulations regarding these exemptions and ensure that you meet all the necessary criteria to qualify.

Impact on Vehicle Buyers

The Illinois auto sales tax can have a significant impact on vehicle buyers, both financially and in terms of planning their purchases. Here are some key considerations:

Financial Implications

The auto sales tax directly affects the overall cost of purchasing a vehicle. For example, on a 30,000</strong> vehicle, the sales tax would amount to <strong>1,875, which is a considerable addition to the purchase price. Buyers should factor in this tax when budgeting for a new vehicle and consider it as a mandatory expense.

Additionally, the sales tax can influence financing options. When taking out a loan to purchase a vehicle, the sales tax is typically included in the loan amount, increasing the overall debt and potentially affecting the borrower's credit utilization.

Planning and Negotiation

Understanding the auto sales tax can be crucial in negotiating the final purchase price. Buyers can strategically negotiate with dealerships, considering the tax as a separate line item. By doing so, they may be able to secure a better overall deal, especially if they are well-informed about the tax implications.

Moreover, buyers can explore various financing options to manage the tax liability. Some dealerships offer financing packages that may include the tax, spreading the cost over the loan term. This can provide flexibility and make the purchase more affordable in the short term.

Comparison with Other States

Illinois’ auto sales tax rate is relatively moderate compared to some other states. For instance, neighboring states like Indiana and Wisconsin have slightly higher sales tax rates for vehicle purchases. This can influence buying decisions, as some buyers may consider crossing state lines to make their purchases.

However, it's essential to consider the overall tax environment and other factors, such as registration fees and emissions regulations, when comparing states. Each state has its own unique tax structure, and a comprehensive analysis is necessary to determine the most cost-effective option.

Performance Analysis and Future Implications

The Illinois auto sales tax has been a stable source of revenue for the state, contributing significantly to its budget. Over the years, the tax has played a crucial role in funding various public projects and initiatives. The consistency of the tax rate has provided a predictable revenue stream for the state government.

Looking ahead, there are potential implications for the auto sales tax in Illinois. As the state's economy evolves and transportation needs change, the tax structure may need adjustments to remain effective. The state may consider reevaluating the tax rate or exploring alternative revenue streams to adapt to emerging trends in the automotive industry.

Additionally, with the rise of electric vehicles (EVs) and alternative fuel options, the auto sales tax may need to be reexamined to accommodate these changes. States are increasingly exploring incentives and tax breaks for EV purchases to promote sustainability and reduce carbon emissions. Illinois may follow suit, offering tax incentives to encourage the adoption of environmentally friendly vehicles.

Frequently Asked Questions

Can I negotiate the auto sales tax in Illinois?

+No, the auto sales tax is a mandatory state-imposed tax, and it cannot be negotiated. However, you can negotiate the purchase price of the vehicle, which will indirectly impact the tax amount.

Are there any tax deductions or credits available for vehicle purchases in Illinois?

+Illinois offers specific tax credits and deductions for certain vehicle-related expenses, such as fuel-efficient vehicle credits and tax deductions for disability-related vehicle modifications. Consult with a tax professional to determine your eligibility.

How often does the Illinois auto sales tax rate change?

+The auto sales tax rate in Illinois has been relatively stable, but it can change based on legislative decisions. It’s important to verify the current rate at the time of your vehicle purchase to ensure accuracy.

Are there any online resources to calculate the auto sales tax in Illinois?

+Yes, several online calculators and tax estimation tools are available to help you estimate the auto sales tax. These tools consider factors like the vehicle’s purchase price and any applicable exemptions or discounts.