Self Employment Tax Form

Welcome to this comprehensive guide on understanding and navigating the complexities of self-employment tax forms. In the world of entrepreneurship and independent contracting, tax obligations can be a critical aspect of running a successful business. This article aims to provide an in-depth analysis of the tax forms relevant to self-employed individuals, offering clarity and insights to ensure compliance and effective financial management.

Unraveling the Complexity: A Deep Dive into Self-Employment Tax Forms

The journey of a self-employed individual often begins with an understanding of their unique tax responsibilities. Unlike traditional employment, where tax deductions are automatically managed by employers, self-employed individuals must actively navigate the tax landscape. This involves a thorough grasp of the forms and processes involved in declaring and managing self-employment taxes.

The Anatomy of Self-Employment Tax Forms: A Step-by-Step Guide

Let’s break down the process into manageable steps. First and foremost, it’s crucial to differentiate between the various tax forms applicable to self-employed individuals. While the specific forms may vary based on jurisdiction and the nature of the business, some key forms include:

- Schedule C (Form 1040): This form is integral for reporting profits or losses from a business. It's a detailed document that captures all income and expenses related to your self-employment.

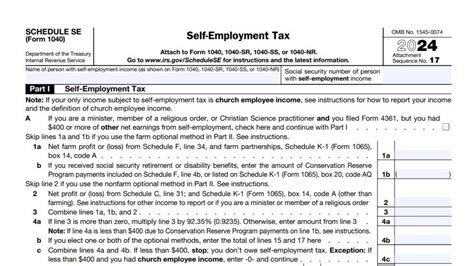

- Schedule SE (Form 1040): Schedule SE is specifically designed to calculate the self-employment tax. This form ensures that self-employed individuals contribute to Social Security and Medicare, much like traditional employees.

- Form 1040-ES: For those with significant self-employment income, Form 1040-ES is crucial. It's used to estimate and pay taxes throughout the year, ensuring that you're not faced with a large tax bill at the end of the financial year.

Each of these forms plays a vital role in ensuring compliance and managing tax obligations effectively. It's essential to understand the purpose and requirements of each form to ensure accurate reporting and avoid potential penalties.

| Form | Purpose |

|---|---|

| Schedule C | Reports business income and expenses, crucial for calculating net profit or loss. |

| Schedule SE | Calculates self-employment tax, including Social Security and Medicare contributions. |

| Form 1040-ES | Estimates and pays quarterly taxes for self-employed individuals with substantial income. |

Key Considerations and Strategies for Self-Employment Tax Management

Navigating the world of self-employment taxes requires a strategic approach. Here are some essential considerations and tips to keep in mind:

- Record-Keeping: Maintain meticulous records of all income and expenses. This practice simplifies the process of filling out tax forms and provides a clear financial overview of your business.

- Quarterly Tax Payments: If your self-employment income is significant, consider making quarterly tax payments. This helps avoid large tax bills at the end of the year and ensures a more manageable cash flow.

- Deductions and Credits: Be aware of the deductions and credits available to self-employed individuals. These can significantly reduce your tax liability and improve your financial position. Examples include home office deductions, health insurance premiums, and retirement plan contributions.

Real-World Scenarios: Navigating Self-Employment Taxes with Confidence

Let’s explore some real-world scenarios to bring these concepts to life. Imagine you’re a freelance graphic designer with a thriving business. Your income fluctuates, but on average, you earn a comfortable living. In this case, accurate record-keeping is crucial. You’ll need to track all your income, including payments from clients, and carefully manage your expenses, such as software subscriptions, equipment purchases, and marketing costs.

As your business grows, you may consider hiring additional help. In this scenario, understanding the tax implications of hiring employees becomes essential. You'll need to navigate payroll taxes, unemployment taxes, and worker's compensation insurance, in addition to your existing self-employment tax obligations.

The Future of Self-Employment Taxes: Trends and Implications

The landscape of self-employment is evolving, and so are the associated tax obligations. Here’s a glimpse into the future and some potential implications:

- Digital Nomads and Remote Work: With the rise of remote work and digital nomadism, self-employment is becoming increasingly global. This trend presents unique tax challenges, as individuals may need to navigate tax obligations across multiple jurisdictions.

- Gig Economy and Micro-Entrepreneurship: The gig economy continues to grow, with more individuals taking on freelance or contract work. This trend may lead to increased scrutiny and evolving tax regulations to ensure fair tax contributions from this burgeoning workforce.

- Tax Simplification and Automation: Efforts towards tax simplification and automation are ongoing. This could potentially streamline the tax filing process for self-employed individuals, making it more accessible and less daunting.

Conclusion: Empowering Self-Employed Individuals with Tax Knowledge

Understanding and effectively managing self-employment taxes is a critical skill for any independent contractor or business owner. By familiarizing yourself with the relevant tax forms, adopting strategic tax management practices, and staying informed about evolving trends, you can ensure compliance and optimize your financial position.

Remember, tax obligations are an integral part of running a successful business. By treating them with the seriousness they deserve and seeking professional guidance when needed, you can navigate the complex world of self-employment taxes with confidence and peace of mind.

What are the key differences between self-employment tax forms and traditional employment tax forms?

+Self-employment tax forms, such as Schedule C and Schedule SE, are designed specifically for individuals who are self-employed or run their own businesses. These forms are used to report business income and calculate self-employment tax. In contrast, traditional employment tax forms, like W-2 and Form 941, are used by employers to report wages and taxes withheld from employees. The key difference lies in the reporting entity and the nature of the income.

Are there any tax advantages for self-employed individuals?

+Absolutely! Self-employed individuals have access to a range of tax deductions and credits that can significantly reduce their tax liability. These include deductions for business expenses, such as office rent, equipment, and travel, as well as tax credits for things like health insurance premiums and retirement plan contributions. It’s essential to consult a tax professional to maximize these benefits.

How can I stay compliant with self-employment tax obligations?

+To stay compliant, it’s crucial to keep accurate records of your income and expenses throughout the year. This ensures that you have the necessary information to complete your tax forms accurately. Additionally, consider making estimated tax payments quarterly to avoid penalties and ensure you’re meeting your tax obligations on time. Regular consultations with a tax professional can also help ensure compliance and provide peace of mind.