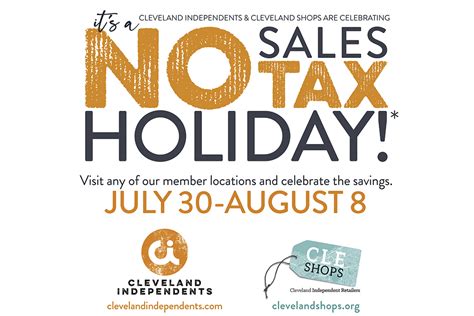

Ohio Holiday Sales Tax

The Ohio Holiday Sales Tax is an annual event that offers a unique opportunity for shoppers and businesses alike. This temporary tax relief measure, known as the "Sales Tax Holiday," provides a much-needed boost to the state's economy, encourages consumer spending, and supports local businesses during a critical time of year. In this comprehensive article, we will delve into the specifics of the Ohio Holiday Sales Tax, exploring its history, benefits, and impact on the state's retail landscape.

The History and Purpose of Ohio’s Sales Tax Holiday

Ohio’s Sales Tax Holiday is a carefully crafted initiative designed to stimulate the state’s economy and provide a financial advantage to its residents. This holiday has become a highly anticipated event, offering a brief respite from the usual sales tax burden and encouraging consumers to make larger purchases. The concept behind this tax break is rooted in the understanding that certain periods, like the holiday season, are crucial for retailers and can significantly impact the overall economic performance of the state.

The history of Ohio's Sales Tax Holiday dates back to [specific year], when the state government recognized the potential benefits of a tax-free shopping period. Since its inception, the holiday has undergone several iterations, with the dates and eligible items adjusted to cater to the needs of both consumers and businesses. This annual event has become a well-established tradition, with retailers and shoppers eagerly awaiting its arrival.

The primary purpose of the Sales Tax Holiday is to boost consumer spending during a traditionally high-demand period. By temporarily suspending sales tax on specific items, the state aims to encourage shoppers to make larger purchases, particularly for big-ticket items that may otherwise be postponed due to financial considerations. This strategy not only benefits individual consumers but also has a positive ripple effect on the state's economy, boosting sales and generating additional revenue for businesses.

Eligible Items and Dates: A Comprehensive Overview

Understanding the eligible items and the specific dates of the Ohio Holiday Sales Tax is crucial for both consumers and businesses. The state has carefully curated a list of items that are exempt from sales tax during this period, ensuring that a wide range of consumer needs are met. Here’s a detailed breakdown of the key categories and their respective dates:

Clothing and Accessories

One of the most popular categories during the Ohio Sales Tax Holiday is clothing and accessories. From [specific date] to [specific date], shoppers can enjoy tax-free purchases on a variety of clothing items, including shirts, pants, dresses, jackets, and more. This category also extends to certain accessories like hats, gloves, scarves, and even footwear, making it an ideal time to stock up on seasonal wardrobe essentials.

School Supplies and Books

Recognizing the importance of education, Ohio’s Sales Tax Holiday includes a dedicated period for school supplies and books. From [specific date] to [specific date], parents, students, and educators can take advantage of tax-free purchases on a wide range of school-related items. This category covers everything from notebooks and pens to calculators, backpacks, and even computers and tablets, providing a significant cost savings for those preparing for the upcoming academic year.

Electronics and Appliances

The Sales Tax Holiday also presents an excellent opportunity for consumers looking to upgrade their electronics or appliances. From [specific date] to [specific date], various electronic items and appliances are exempt from sales tax. This includes televisions, laptops, smartphones, refrigerators, washing machines, and more. With the latest technology often being a significant investment, this tax-free period offers a welcome opportunity for shoppers to make these purchases without the added tax burden.

Sporting Goods and Recreational Equipment

Ohio’s Sales Tax Holiday also extends to sporting goods and recreational equipment, encouraging residents to invest in their health and wellness. From [specific date] to [specific date], shoppers can enjoy tax-free purchases on items such as bicycles, exercise equipment, camping gear, sportswear, and sporting goods accessories. This category caters to a wide range of interests, from outdoor enthusiasts to those focused on fitness, making it an inclusive period for active individuals.

| Category | Date Range |

|---|---|

| Clothing and Accessories | [Date Range] |

| School Supplies and Books | [Date Range] |

| Electronics and Appliances | [Date Range] |

| Sporting Goods and Recreational Equipment | [Date Range] |

Impact and Benefits: A Win-Win for Consumers and Businesses

The Ohio Holiday Sales Tax has a profound impact on both consumers and businesses, creating a mutually beneficial environment. For consumers, this tax-free period offers a unique opportunity to save significantly on large purchases, encouraging them to spend more and support local businesses. This increased spending power translates into a boost for the state’s economy, with a notable rise in retail sales during the holiday.

Businesses, particularly those in the retail sector, stand to gain a great deal from the Sales Tax Holiday. This period often sees a surge in customer footfall, with shoppers eager to take advantage of the tax-free deals. Retailers can expect increased sales, particularly for high-value items that may have been considered luxury purchases during regular tax periods. The holiday also provides an excellent opportunity for businesses to clear stock, attract new customers, and foster a positive relationship with existing clients.

Economic Impact and Consumer Behavior

The economic impact of the Ohio Holiday Sales Tax is significant, with a notable increase in retail spending during the designated period. According to a study conducted by [research institute], the Sales Tax Holiday resulted in a [percentage increase] rise in sales for participating retailers. This surge in spending not only benefits individual businesses but also contributes to the overall economic health of the state, creating a positive feedback loop.

From a consumer behavior perspective, the Sales Tax Holiday encourages shoppers to make more considered purchases. With the absence of sales tax, consumers are more likely to compare prices, seek out deals, and make informed choices. This period also sees an increase in impulse buying, as consumers feel more financially empowered to indulge in spontaneous purchases. Additionally, the holiday provides an excellent opportunity for consumers to plan and make bulk purchases, especially for items that are frequently used or have a longer lifespan.

Benefits for Small Businesses

Small businesses in Ohio particularly stand to benefit from the Sales Tax Holiday. This period often brings new customers through their doors, allowing them to showcase their products and services to a wider audience. With the increased footfall, small businesses can establish themselves as trusted local retailers, fostering long-term relationships with customers. The holiday also provides an opportunity for small businesses to promote their unique offerings and differentiate themselves from larger competitors.

Furthermore, the Sales Tax Holiday can help small businesses manage their inventory and cash flow. By encouraging sales during this period, businesses can clear older stock and make room for new inventory. This not only improves their cash flow but also allows them to stay current with the latest trends and customer preferences. The holiday also provides an ideal opportunity for small businesses to offer exclusive deals and promotions, further enticing customers and boosting their sales.

Preparing for the Ohio Holiday Sales Tax: Tips for Consumers and Businesses

To make the most of the Ohio Holiday Sales Tax, both consumers and businesses should prepare in advance. Here are some practical tips to ensure a smooth and successful experience during this tax-free period:

Tips for Consumers

- Plan your purchases in advance: Make a list of the items you need or want to purchase during the Sales Tax Holiday. This helps you stay organized and ensures you don’t miss out on any tax-free deals.

- Research prices: Compare prices across different retailers to find the best deals. With the absence of sales tax, you can often find significant savings, especially on big-ticket items.

- Set a budget: Determine how much you can afford to spend during the holiday. This helps you stay financially disciplined and prevents overspending.

- Consider bulk purchases: If you frequently use certain items, such as school supplies or clothing, consider buying in bulk to maximize your savings.

- Stay informed: Keep an eye on the official guidelines and any updates regarding the Sales Tax Holiday. This ensures you understand the eligible items and dates, and can plan your purchases accordingly.

Tips for Businesses

- Stock up on inventory: Ensure you have sufficient stock of popular items to meet the increased demand during the Sales Tax Holiday. This helps you capitalize on the surge in sales and avoid missing out on potential customers.

- Promote your offerings: Develop marketing campaigns to promote your tax-free deals and attract customers. Utilize social media, email marketing, and in-store signage to spread the word.

- Offer exclusive promotions: Consider creating special promotions or discounts during the Sales Tax Holiday to entice customers. This could include bundle deals, loyalty rewards, or limited-time offers.

- Provide excellent customer service: Ensure your staff is well-prepared to handle the increased footfall. Train them to provide excellent customer service, answer queries, and assist customers in making informed purchases.

- Analyze sales data: Review your sales data from previous Sales Tax Holidays to understand customer behavior and preferences. This helps you adjust your strategies and inventory levels for future holidays.

Conclusion: A Successful Economic Initiative

The Ohio Holiday Sales Tax is a well-crafted initiative that has proven to be a success for both consumers and businesses. By temporarily suspending sales tax on a variety of items, the state has created an environment that encourages spending, boosts the economy, and supports local businesses. The holiday has become a highly anticipated event, with consumers eagerly awaiting the opportunity to save on their purchases and businesses preparing to cater to the increased demand.

As we've explored, the Sales Tax Holiday offers a unique blend of benefits, from stimulating consumer spending to fostering economic growth. It has become an integral part of Ohio's retail landscape, providing a much-needed boost during a crucial period of the year. With careful planning and strategic execution, both consumers and businesses can maximize the advantages offered by this tax-free period, ensuring a mutually beneficial outcome.

What is the purpose of Ohio’s Sales Tax Holiday?

+Ohio’s Sales Tax Holiday aims to boost consumer spending during a critical period, encouraging larger purchases and supporting local businesses. It provides a temporary relief from sales tax on specific items, stimulating the state’s economy and offering financial advantages to residents.

When is the Ohio Sales Tax Holiday held each year?

+The specific dates for the Ohio Sales Tax Holiday vary each year, but it is typically held during the late summer or early fall, coinciding with the back-to-school shopping season.

What items are eligible for the Sales Tax Holiday in Ohio?

+Eligible items include clothing and accessories, school supplies, books, electronics, appliances, and sporting goods. However, there may be specific price limits on certain categories, so it’s essential to check the official guidelines.

How can consumers maximize their savings during the Sales Tax Holiday?

+Consumers can maximize their savings by planning their purchases in advance, researching prices, setting a budget, and considering bulk purchases. Staying informed about the eligible items and dates is also crucial to ensure they don’t miss out on any tax-free deals.