Az Sales Tax Rate

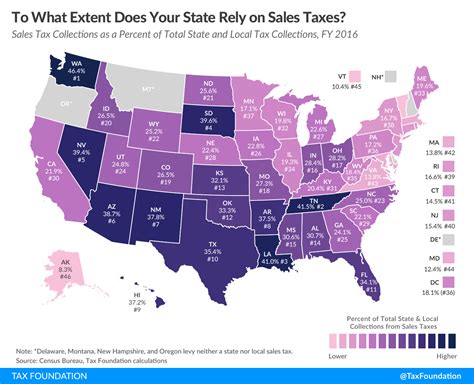

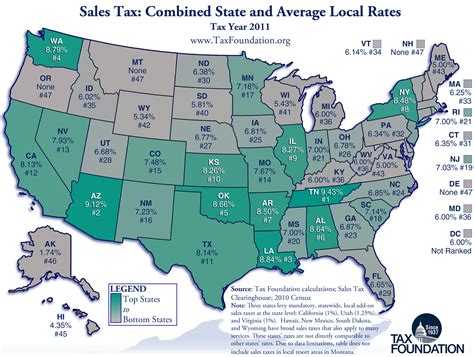

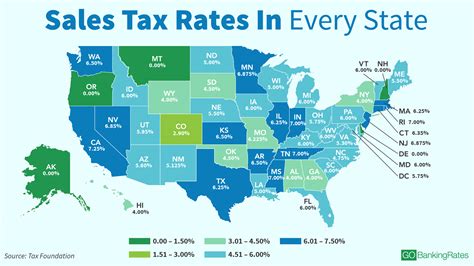

When it comes to understanding sales tax rates, it's crucial to have a comprehensive overview of the landscape. Sales tax rates in the United States can vary significantly across states, counties, and even cities, making it a complex yet fascinating topic for those interested in taxation and economic geography.

Understanding the Complexity of Sales Tax Rates

Sales tax is an essential component of the revenue generation strategies for state and local governments in the US. It is imposed on the sale of goods and services and is typically added to the purchase price at the point of sale. The rate can vary based on numerous factors, including the type of goods or services, the location of the seller, and the purpose of the purchase.

As of my last update in January 2023, the average combined state and local sales tax rate across the US was approximately 7.05%. However, this is just an average, and the actual rates can range from as low as 2.9% in Alaska to over 10% in some cities and counties.

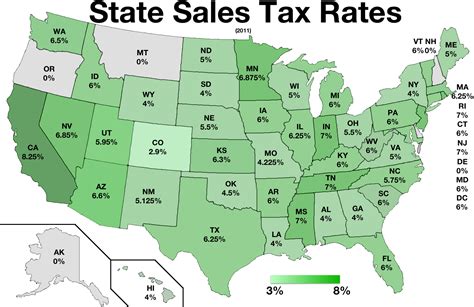

State Sales Tax Rates

Every state has its own sales tax rate, which can vary significantly. For instance, California has a base state sales tax rate of 7.25%, while Texas has a slightly lower rate of 6.25%. Some states, like Alaska, Delaware, Montana, New Hampshire, and Oregon, do not levy a state sales tax, making them attractive destinations for tax-conscious consumers.

In states that do impose a sales tax, the rate can be further adjusted by local governments, leading to a wide range of rates within the same state. For example, in California, the state sales tax rate is just the base, and local governments can add their own taxes on top, resulting in rates as high as 10.75% in certain areas.

Sales Tax Exemptions and Special Rates

The complexity of sales tax rates is further increased by the various exemptions and special rates applied to certain goods and services. For instance, many states offer reduced or zero sales tax rates for essential items like groceries, prescription drugs, and clothing. This is done to ease the tax burden on low-income households and to promote the purchase of necessary items.

Additionally, some states have special sales tax rates for specific industries or activities. For example, many states have a reduced sales tax rate for manufacturing equipment, while others might offer incentives for tourism-related purchases. These exemptions and special rates can significantly impact the overall sales tax burden on businesses and consumers.

| State | Sales Tax Rate |

|---|---|

| Alabama | 4% |

| Arizona | 5.6% |

| California | 7.25% |

| Florida | 6% |

| Illinois | 6.25% |

| Texas | 6.25% |

| New York | 4% |

| Ohio | 5.75% |

| Pennsylvania | 6% |

| Washington | 6.5% |

The Impact of Sales Tax on Businesses and Consumers

Sales tax rates can have a significant impact on both businesses and consumers. For businesses, especially those operating in multiple states, understanding and managing these rates is essential for accurate tax collection and compliance. Mismanagement of sales tax can lead to penalties and legal issues.

For consumers, sales tax rates can influence purchasing decisions and overall spending habits. In states with higher sales tax rates, consumers might opt to make larger purchases online or in neighboring states with lower rates. This can impact local businesses and the overall economy of a region.

Strategies for Businesses

To navigate the complex world of sales tax rates, businesses often employ strategies such as tax rate lookup tools, which help them determine the applicable rate for each transaction based on the customer’s location. Some businesses also offer tax-free shopping events or have pricing strategies that include or exclude sales tax to make their products more competitive.

Furthermore, businesses can explore options like tax exemption certificates for specific purchases or tax incentives offered by states to promote certain industries. These strategies can help businesses manage their tax obligations effectively and remain competitive in the market.

Consumer Considerations

Consumers, on the other hand, need to be aware of sales tax rates when making purchasing decisions. In states with high sales tax rates, consumers might opt for online shopping, where sales tax rates can be lower or even nonexistent. However, this trend can also lead to a decrease in local business support and a shift in the economic landscape of a region.

Additionally, consumers should be aware of the potential for tax disparities when making purchases across state lines. For example, a consumer living near a state border might choose to shop in a neighboring state with a lower sales tax rate, impacting the tax revenue of their home state.

Future Implications and Tax Reform

The future of sales tax rates is closely tied to economic and political trends. As states face budgetary constraints and the need to fund various public services, sales tax rates might undergo changes to generate more revenue. On the other hand, there are also calls for tax reform to simplify the complex system and reduce the burden on businesses and consumers.

One potential development is the adoption of a uniform sales tax rate across states, which could simplify tax collection and compliance for businesses. However, such a move would likely face significant opposition from states that rely heavily on sales tax revenue or have unique economic circumstances.

Furthermore, the ongoing shift towards online shopping and the growth of e-commerce could lead to changes in sales tax regulations. States might need to adapt their tax laws to ensure that online businesses contribute their fair share to the state's revenue, potentially leading to new tax collection mechanisms or updated sales tax rates.

The Role of Technology

Technology is playing an increasingly significant role in sales tax management. Advanced tax calculation software and platforms can help businesses and consumers navigate the complex web of sales tax rates, ensuring accurate tax collection and compliance. These tools can provide real-time tax rate information, automate tax calculation, and even offer tax exemption options where applicable.

Conclusion

Sales tax rates are a fascinating and complex aspect of the US economic landscape. From state-level rates to local variations and special exemptions, understanding sales tax is crucial for businesses and consumers alike. As we’ve explored in this article, sales tax rates can have a significant impact on purchasing decisions, business strategies, and the overall economic health of a region.

With ongoing economic and technological developments, the world of sales tax is likely to continue evolving. Staying informed about these changes will be key to making informed decisions and staying compliant with tax regulations. Whether you're a business owner, a consumer, or simply interested in economic geography, understanding sales tax rates is an essential part of navigating the modern economy.

How do sales tax rates vary across states and counties in the US?

+Sales tax rates in the US can vary significantly, with each state setting its own base rate. Local governments, such as counties and cities, can also add additional taxes on top of the state rate, leading to a wide range of rates within the same state. For example, California’s base state sales tax rate is 7.25%, but with local taxes added, rates can exceed 10% in certain areas.

Are there any states in the US without a sales tax?

+Yes, as of my last update in January 2023, there are five states that do not levy a state sales tax: Alaska, Delaware, Montana, New Hampshire, and Oregon. These states rely on other forms of taxation to generate revenue, such as income tax or property tax.

What are some common exemptions or special rates for sales tax in the US?

+Many states offer reduced or zero sales tax rates for essential items like groceries, prescription drugs, and clothing. Additionally, some states have special sales tax rates for specific industries or activities, such as a reduced rate for manufacturing equipment or incentives for tourism-related purchases.