Can I File My Taxes Late

For many individuals and businesses, tax season is a critical period that requires careful preparation and timely submission of tax returns. However, life is unpredictable, and sometimes circumstances arise that prevent taxpayers from meeting the official tax filing deadlines. In such situations, taxpayers often find themselves asking, "Can I file my taxes late?" This comprehensive guide aims to provide an in-depth analysis of the process, considerations, and potential consequences of filing taxes after the due date.

Understanding Late Tax Filing

Late tax filing refers to the act of submitting tax returns after the designated deadline set by the relevant tax authority, such as the Internal Revenue Service (IRS) in the United States. The tax code and regulations vary across jurisdictions, so it’s essential to understand the specific rules and procedures applicable to your region.

While filing taxes late is not ideal, it is important to note that the tax system recognizes that unexpected events and valid reasons may prevent timely submissions. Therefore, tax authorities have established processes and provisions to accommodate late filers while maintaining the integrity of the tax system.

Common Reasons for Late Filing

There are several common scenarios that can lead to late tax filing. Understanding these reasons can help taxpayers navigate the process more effectively:

- Complex Tax Situations: Some tax returns involve intricate calculations, multiple income sources, or complex financial transactions. Preparing such returns may require additional time and professional assistance, potentially leading to a delay in filing.

- Lack of Required Documentation: Taxpayers may encounter situations where they are missing crucial documents or information necessary for accurate tax reporting. Obtaining these documents can take time, resulting in a delayed filing.

- Unforeseen Life Events: Personal or family emergencies, illnesses, or other unforeseen circumstances can disrupt an individual’s ability to meet tax deadlines. In such cases, taxpayers may prioritize their immediate needs over tax compliance.

- Business Operations: For businesses, tax compliance can be even more challenging. Fluctuating income, complex financial structures, or changes in ownership can lead to delays in tax preparation and filing.

The Impact of Late Filing

Filing taxes late can have various consequences, and it’s crucial to understand these implications to make informed decisions:

- Penalties and Interest: Tax authorities typically impose penalties and interest charges for late filing. These financial repercussions can add up quickly, increasing the overall tax liability. The specific penalties vary depending on the jurisdiction and the circumstances of the late filing.

- Delayed Refunds: If a taxpayer is due a refund, filing late can result in a delayed refund process. The tax authority may prioritize processing timely returns first, leading to a longer wait for the refund.

- Audit Risk: In some cases, late filing may increase the likelihood of an audit. Tax authorities may scrutinize late returns more closely to ensure compliance and accuracy. However, this risk varies depending on the jurisdiction and the individual’s tax history.

- Legal Consequences: Extreme cases of chronic late filing or intentional non-compliance may lead to legal consequences, including fines, criminal charges, or even imprisonment. It is essential to understand the legal implications in your jurisdiction.

Navigating the Late Filing Process

When faced with the need to file taxes late, it’s important to take a systematic approach to navigate the process effectively. Here are some key steps to consider:

Request an Extension

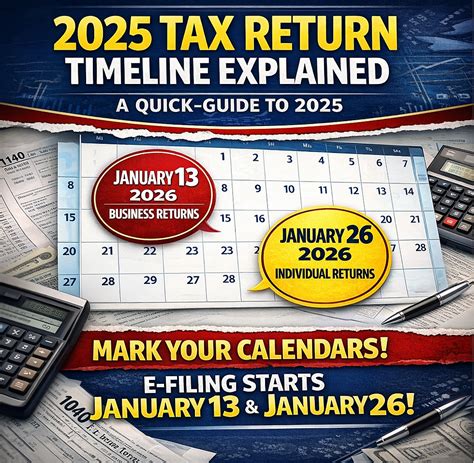

Before the official tax filing deadline, taxpayers can request an extension to file their tax returns. This extension provides additional time to prepare and submit the returns accurately. The process of requesting an extension varies by jurisdiction, but it typically involves filing a specific form or making an electronic request.

It's crucial to note that an extension to file does not extend the deadline for paying taxes owed. Taxpayers are still expected to make estimated tax payments or pay the full amount due by the original deadline to avoid penalties and interest.

Gather Required Documentation

To prepare an accurate tax return, taxpayers should gather all necessary documentation, including income statements, expense records, receipts, and any other relevant financial information. This step is crucial to ensure that the tax return reflects the taxpayer’s actual financial situation.

If any documentation is missing or incomplete, taxpayers should prioritize obtaining the required information to avoid further delays and potential penalties.

Seek Professional Assistance

For complex tax situations or when facing a late filing scenario, seeking professional assistance from tax experts or accountants can be beneficial. These professionals can provide guidance, ensure compliance with tax regulations, and help taxpayers navigate the late filing process effectively.

Tax professionals can also assist in identifying potential deductions, credits, or strategies to minimize tax liabilities and optimize the tax return, even when filing late.

Estimate Taxes Owed

Taxpayers should estimate the amount of taxes they owe to the tax authority. This estimation is crucial to avoid underpayment penalties and ensure compliance with tax regulations. Various online tools and calculators are available to assist taxpayers in estimating their tax liability accurately.

If the estimated tax liability exceeds a certain threshold, taxpayers may need to make estimated tax payments to avoid additional penalties.

File the Tax Return

Once all the necessary documentation is gathered, and the taxes owed are estimated, taxpayers can proceed with filing their tax returns. It’s essential to follow the official filing procedures and guidelines set by the tax authority.

Taxpayers should double-check the accuracy of the information provided in the tax return to avoid errors and potential audits. Additionally, it's advisable to keep records and documentation for a certain period to address any future inquiries or audits.

Potential Benefits of Late Filing

While late filing is generally not encouraged, there are certain situations where it may provide some advantages. Understanding these potential benefits can help taxpayers make informed decisions:

More Time for Tax Planning

Filing taxes late can provide additional time for tax planning and strategy development. Taxpayers can analyze their financial situation, explore potential deductions and credits, and optimize their tax returns to minimize their tax liability.

However, it's important to balance the benefits of extra time with the potential penalties and interest that may accrue during the delay.

Increased Accuracy

Taking the time to file taxes late can result in a more accurate tax return. By gathering all the necessary documentation and seeking professional assistance, taxpayers can ensure that their tax returns reflect their actual financial position.

Accurate tax returns not only help taxpayers avoid potential audits but also ensure that they are not overpaying or underpaying their taxes.

Flexibility in Payment Options

When filing taxes late, taxpayers may have more flexibility in choosing payment options. Tax authorities often offer various payment plans or installment agreements to help taxpayers manage their tax liabilities.

Understanding these payment options can assist taxpayers in making informed decisions about managing their tax obligations and avoiding financial strain.

The Role of Tax Authorities

Tax authorities play a crucial role in facilitating the tax filing process, including late filing scenarios. Understanding the policies and procedures set by these authorities is essential for taxpayers to navigate the process effectively.

Tax Authority Policies

Each tax authority has its own set of policies and guidelines regarding late filing. These policies outline the penalties, interest rates, and procedures for late filers. It’s crucial for taxpayers to familiarize themselves with these policies to make informed decisions and avoid unnecessary complications.

Tax authorities may also provide resources and guidance to help taxpayers understand their rights and responsibilities when filing late.

Enforcement and Compliance

Tax authorities have enforcement mechanisms in place to ensure compliance with tax regulations. These mechanisms include audits, investigations, and legal actions to address non-compliance and tax evasion.

However, tax authorities also recognize that taxpayers may face genuine challenges in meeting deadlines. As such, they provide avenues for taxpayers to resolve issues, pay outstanding taxes, and return to compliance.

Support and Assistance

Tax authorities aim to provide support and assistance to taxpayers throughout the tax filing process. They offer resources, publications, and helplines to help taxpayers understand their obligations, access forms and guidelines, and address common queries.

Additionally, tax authorities may provide specialized assistance for specific taxpayer groups, such as small businesses or individuals with complex tax situations.

The Future of Late Tax Filing

The tax landscape is constantly evolving, and late filing is no exception. As technology advances and tax systems become more efficient, the future of late tax filing may undergo significant changes.

Technological Advancements

The integration of technology in the tax system, such as online filing platforms and electronic tax records, can streamline the tax filing process. These advancements can make it easier for taxpayers to file their returns accurately and on time.

Additionally, technology can enhance the efficiency of tax authorities in processing returns, reducing the time and resources required for late filing scenarios.

Simplification of Tax Codes

Efforts to simplify tax codes and regulations can reduce the complexity of tax compliance, making it easier for taxpayers to understand their obligations. Simplification can lead to fewer errors and late filings, as taxpayers may find it more straightforward to navigate the tax system.

Increased Education and Awareness

Tax authorities and educational institutions can play a vital role in increasing tax literacy among taxpayers. By providing accessible resources and educational programs, taxpayers can better understand their tax obligations and the consequences of late filing.

Increased tax literacy can empower taxpayers to plan and prepare their tax returns more effectively, reducing the need for late filing.

Conclusion

Filing taxes late is a challenging situation that taxpayers may encounter due to various reasons. While it is important to prioritize timely filing, understanding the late filing process, potential consequences, and available options can help taxpayers navigate this scenario effectively.

By requesting extensions, gathering documentation, seeking professional assistance, and estimating taxes owed, taxpayers can minimize the impact of late filing. Additionally, taxpayers should stay informed about tax authority policies, enforcement measures, and support resources to ensure compliance and avoid unnecessary penalties.

As the tax landscape evolves, technological advancements, simplified tax codes, and increased tax education can contribute to a more efficient and accessible tax system, reducing the need for late filing and promoting timely tax compliance.

What happens if I file my taxes late without an extension?

+Filing taxes late without an extension can result in penalties and interest charges. The specific penalties vary by jurisdiction but typically include a failure-to-file penalty and a failure-to-pay penalty. These penalties can add up quickly, increasing your overall tax liability.

Can I still request an extension after the tax filing deadline?

+In most cases, you cannot request an extension after the tax filing deadline. Extensions are typically granted before the deadline to provide additional time for tax preparation. However, there may be exceptional circumstances where an extension can be granted post-deadline. It is advisable to consult with a tax professional or the tax authority for specific guidance.

Are there any situations where late filing is not penalized?

+In certain situations, tax authorities may waive penalties for late filing if the taxpayer can demonstrate reasonable cause for the delay. Reasonable cause could include circumstances beyond the taxpayer’s control, such as a natural disaster or serious illness. However, each case is evaluated individually, and it is crucial to provide adequate documentation to support the claim.

How long do tax authorities typically take to process late returns?

+The processing time for late returns can vary depending on the tax authority and the volume of returns received. Generally, tax authorities aim to process returns as quickly as possible, but it may take several weeks or months. It is advisable to check with the specific tax authority for their estimated processing times.

Can I still receive a refund if I file my taxes late?

+Yes, you can still receive a refund if you file your taxes late, provided you are due a refund. However, filing late may delay the refund process as tax authorities prioritize processing timely returns first. It is important to note that any refund owed will not be subject to interest, even if the return is filed late.