Hawaii Get Tax

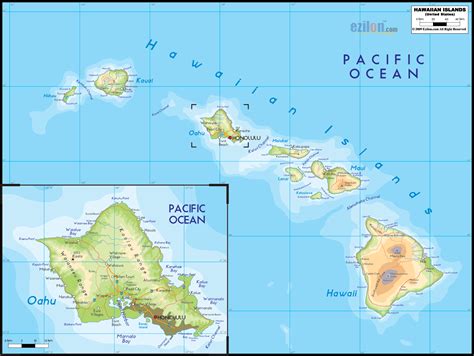

Nestled in the vast Pacific Ocean, Hawaii, the 50th state of the United States, is renowned for its breathtaking natural beauty, vibrant culture, and welcoming spirit. However, when it comes to taxation, Hawaii presents a unique set of rules and regulations that are essential for both residents and visitors to understand. This comprehensive guide aims to demystify the process of navigating Hawaii's tax system, offering insights and clarity on the various taxes applicable in this tropical paradise.

Understanding Hawaii’s Tax Landscape

Hawaii’s tax system is multifaceted, encompassing a range of taxes designed to support the state’s infrastructure, services, and cultural preservation efforts. From the iconic General Excise Tax to the Transient Accommodation Tax, each levy plays a crucial role in sustaining the state’s economy and maintaining its world-class reputation.

Let's delve into the specifics of Hawaii's tax structure, exploring the types of taxes, their rates, and the ways they impact residents and businesses alike.

General Excise Tax: The Backbone of Hawaii’s Revenue

At the heart of Hawaii’s tax system lies the General Excise Tax, a broad-based tax levied on the privilege of doing business in the state. This tax is applied to most services and tangible property sales, with a few notable exemptions. The current General Excise Tax rate in Hawaii is 4%, making it a significant contributor to the state’s revenue stream.

However, it's important to note that the General Excise Tax is not a simple flat tax. It operates on a gross income basis, meaning it is calculated on the total income derived from a business activity, without considering expenses. This can make it a substantial financial burden for businesses, especially those with high overhead costs.

To provide a clearer picture, consider the following example: A construction company in Hawaii generates $500,000 in revenue annually. With the 4% General Excise Tax, the company is liable to pay $20,000 in taxes. This is a substantial sum, which underscores the importance of understanding and managing this tax effectively.

Transient Accommodation Tax: Catering to Visitors

Hawaii’s vibrant tourism industry is a major contributor to its economy, and the Transient Accommodation Tax is specifically designed to tap into this revenue stream. This tax is levied on the cost of rooms and accommodations provided to transient guests, including hotels, resorts, and vacation rentals.

The Transient Accommodation Tax rate varies across the Hawaiian Islands, with rates ranging from 9.25% to 14.25%, depending on the specific location. For instance, on the island of Oahu, where Honolulu and Waikiki Beach are located, the rate is set at 14.25%, while on the island of Kauai, it is slightly lower at 13.25%.

| Island | Transient Accommodation Tax Rate |

|---|---|

| Oahu | 14.25% |

| Hawaii (The Big Island) | 13.25% |

| Maui | 13.25% |

| Kauai | 13.25% |

| Molokai | 13.25% |

| Lanai | 13.25% |

The Transient Accommodation Tax is a significant source of revenue for Hawaii, as it directly ties into the state's thriving tourism sector. It helps fund essential services and infrastructure improvements, ensuring that Hawaii remains an attractive and welcoming destination for visitors from around the world.

Other Notable Taxes in Hawaii

Beyond the General Excise Tax and Transient Accommodation Tax, Hawaii has a range of other taxes that residents and businesses should be aware of.

- Real Property Tax: Hawaii levies a tax on real property, including land and improvements. The tax rate varies depending on the county and the type of property. For instance, on Oahu, the real property tax rate is set at 5.625% for residential properties and 9.25% for commercial properties.

- Individual Income Tax: Hawaii has a progressive individual income tax system, with rates ranging from 1.4% to 11%. The specific rate depends on the taxpayer's income level and filing status.

- Corporate Income Tax: Corporations doing business in Hawaii are subject to a corporate income tax. The rate is currently set at 4.4%, making it one of the lower corporate tax rates in the United States.

- Motor Vehicle Weight Tax: This tax is levied on the gross weight of motor vehicles, with rates varying based on the vehicle's weight and usage. It is an important source of revenue for Hawaii's transportation infrastructure.

Tax Incentives and Exemptions: Navigating Hawaii’s Tax Benefits

While Hawaii’s tax system may seem comprehensive, it also offers a range of incentives and exemptions that can provide significant financial relief to businesses and individuals.

General Excise Tax Exemptions

The General Excise Tax, while broad-based, does have certain exemptions. These exemptions are designed to support specific sectors and activities, and they can significantly reduce a business’s tax liability.

- Resale Exemption: Businesses that purchase goods for resale are exempt from the General Excise Tax on their purchases. This exemption is a significant benefit for retailers and wholesalers.

- Export Exemption: Goods exported from Hawaii are exempt from the General Excise Tax. This exemption encourages international trade and helps Hawaiian businesses compete globally.

- Manufacturing Exemption: Manufacturing activities are exempt from the General Excise Tax on their purchases of raw materials and equipment. This exemption aims to promote local manufacturing and job creation.

Tax Incentives for Businesses

Hawaii offers a range of tax incentives to attract and support businesses, especially those in sectors that align with the state’s economic development goals.

- Research and Development Tax Credit: Businesses engaged in research and development activities may be eligible for a tax credit, which can offset their General Excise Tax liability. This incentive encourages innovation and technological advancement.

- Economic Opportunity Tax Credit: This credit is available to businesses that create new jobs or make significant investments in Hawaii. It provides a direct reduction in the General Excise Tax liability, making it an attractive incentive for businesses looking to expand.

- Film and Digital Media Tax Credit: Hawaii's vibrant film and digital media industry benefits from a tax credit that offsets production costs. This incentive has been instrumental in attracting major film and television productions to the state.

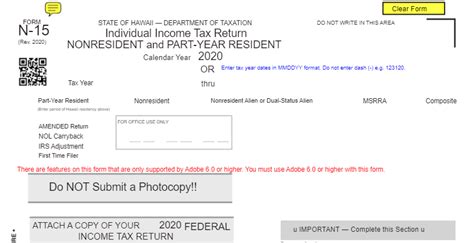

Tax Compliance and Reporting in Hawaii

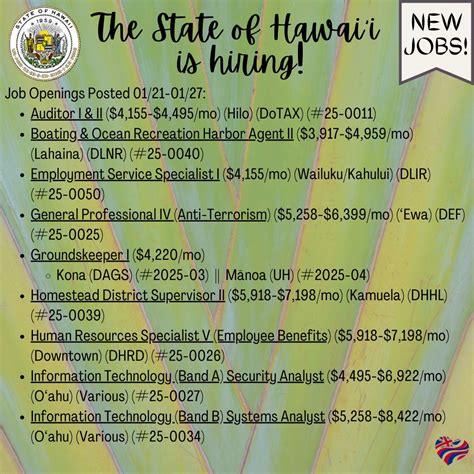

Navigating Hawaii’s tax system requires meticulous compliance and timely reporting. The Hawaii Department of Taxation provides comprehensive guidelines and resources to assist taxpayers in meeting their obligations.

Registration and Tax Identification

Businesses operating in Hawaii are required to register with the Department of Taxation and obtain a General Excise Tax License. This license serves as the business’s tax identification number and is essential for all tax filings and payments.

Individuals and businesses can register online through the Hawaii Tax Online System (HTOS), a user-friendly platform that streamlines the registration process. Once registered, taxpayers receive a unique Taxpayer Identification Number (TIN), which is used for all future tax transactions.

Tax Filing and Payment Deadlines

Taxpayers in Hawaii are responsible for filing their tax returns and making payments by the specified deadlines. These deadlines vary depending on the type of tax and the taxpayer’s filing status.

- General Excise Tax: Returns and payments are due on the 20th day of the month following the reporting period. For example, for the month of January, the filing and payment deadline is February 20th.

- Individual Income Tax: Tax returns are due on April 20th of each year, while payments are due on the 20th day of the month following the reporting period.

- Corporate Income Tax: Corporations must file their returns and make payments by the 15th day of the third month following the end of their fiscal year. For example, for a corporation with a fiscal year ending on December 31st, the filing and payment deadline is March 15th.

Online Filing and Payment Options

To facilitate compliance, the Hawaii Department of Taxation offers convenient online filing and payment options through HTOS. Taxpayers can register, file returns, make payments, and manage their tax accounts entirely online, providing a secure and efficient process.

Additionally, taxpayers have the option to make payments via credit card, electronic funds transfer, or by mailing a check or money order. The Department of Taxation provides detailed instructions and resources to guide taxpayers through these processes, ensuring a smooth and hassle-free experience.

Conclusion: Embracing Hawaii’s Tax System

Hawaii’s tax system, while comprehensive and unique, is designed to support the state’s vibrant economy and its rich cultural heritage. By understanding the various taxes, incentives, and compliance requirements, individuals and businesses can navigate this system with confidence and contribute to Hawaii’s continued prosperity.

Whether you're a resident, a business owner, or a visitor, taking the time to understand Hawaii's tax landscape is a crucial step towards embracing the aloha spirit and ensuring a positive impact on this beautiful island state.

FAQ

What is the General Excise Tax rate in Hawaii, and how is it calculated?

+

The General Excise Tax rate in Hawaii is 4%, and it is calculated on the gross income derived from a business activity, without considering expenses. This means that the tax is applied to the total revenue generated, making it a significant financial consideration for businesses.

How does Hawaii’s Transient Accommodation Tax work, and what are the rates across the islands?

+

The Transient Accommodation Tax is levied on the cost of rooms and accommodations provided to transient guests. The rates vary across the Hawaiian Islands, ranging from 9.25% to 14.25%. Oahu, for instance, has a rate of 14.25%, while Kauai’s rate is slightly lower at 13.25%.

Are there any notable tax incentives or exemptions available in Hawaii for businesses or individuals?

+

Yes, Hawaii offers a range of tax incentives and exemptions. For businesses, there are exemptions for resale, exports, and manufacturing activities under the General Excise Tax. Additionally, there are tax credits available for research and development, economic opportunities, and the film and digital media industry.

How can I register my business for tax purposes in Hawaii, and what are the key deadlines for filing and payment?

+

Businesses can register online through the Hawaii Tax Online System (HTOS). The key deadlines for filing and payment vary depending on the type of tax. For General Excise Tax, returns and payments are due on the 20th day of the month following the reporting period. Individual Income Tax returns are due on April 20th, while payments are due on the 20th day of the month following the reporting period. Corporate Income Tax returns and payments are due on the 15th day of the third month following the end of the fiscal year.