Do You Pay Taxes On Cd Interest

Taxation on CD interest is an important aspect of personal finance, and understanding how it works can help you make informed decisions about your savings and investments. This comprehensive guide will delve into the world of CD interest taxation, exploring the various aspects that impact your financial obligations and strategies.

Understanding CD Interest and Taxation

A CD, or Certificate of Deposit, is a financial product offered by banks and credit unions. It allows individuals to invest a fixed amount of money for a predetermined period, typically ranging from a few months to several years. In return, investors receive a guaranteed interest rate, providing a secure and predictable source of income.

When it comes to taxes, CD interest is considered taxable income in most countries, including the United States. This means that the interest earned on your CD investment must be reported to the relevant tax authorities and is subject to taxation.

Tax Treatment of CD Interest

The tax treatment of CD interest depends on various factors, including your residency, the type of CD, and the tax regulations in your jurisdiction. Here's a breakdown of how CD interest is typically taxed:

- Ordinary Income Taxation: In many cases, CD interest is treated as ordinary income and is taxed at your marginal tax rate. This means that the interest earned is added to your other income sources, and you pay taxes based on the resulting total income.

- Capital Gains Taxation: Some CDs, particularly those with longer maturities, may be subject to capital gains tax treatment. If the CD is held for a specific period (usually longer than a year), the interest may be taxed at a lower capital gains rate instead of the ordinary income tax rate.

- Tax-Advantaged Accounts: If you hold your CD within a tax-advantaged account like an Individual Retirement Account (IRA) or a 401(k), the interest earned may be tax-deferred or tax-free, depending on the account type and its specific rules.

Reporting and Paying Taxes on CD Interest

Reporting and paying taxes on CD interest involves several key steps:

1. Tracking Interest Earnings

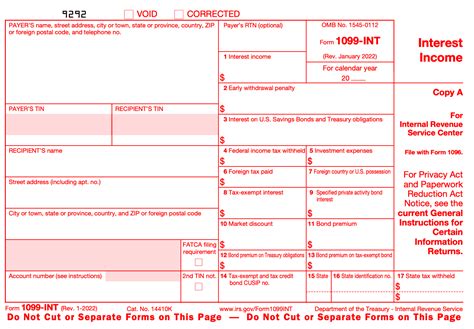

It's crucial to keep accurate records of the interest earned on your CDs. Banks typically provide interest statements or send them electronically, detailing the interest paid during the tax year. Ensure you retain these records for tax purposes.

2. Completing Tax Returns

When filing your tax returns, you must report the interest income from your CDs. The exact process may vary depending on your country's tax system. In the US, for example, you would report CD interest on IRS Form 1040, Schedule B.

3. Calculating Tax Liability

The tax liability on CD interest depends on your tax bracket and the applicable tax rates. You can use tax calculators or consult a tax professional to determine your exact tax obligation.

| Tax Bracket | Tax Rate |

|---|---|

| 10% | 10% |

| 12% | 12% |

| 22% | 22% |

| 24% | 24% |

| ... | ... |

For instance, if your CD interest income is $500 and you fall into the 12% tax bracket, your tax liability would be $60.

Strategies for Maximizing CD Interest and Minimizing Taxes

While CD interest is taxable, there are strategies you can employ to maximize your earnings and minimize your tax burden:

1. Laddering CDs

Laddering involves spreading your CD investments across different maturities. By doing so, you can take advantage of higher interest rates for longer-term CDs while also benefiting from the flexibility of shorter-term CDs. This strategy can help you manage your tax liability more effectively, as you can stagger the interest payments and potentially benefit from different tax rates over time.

2. Tax-Advantaged Accounts

Consider opening tax-advantaged accounts, such as IRAs or CD-specific retirement accounts, to shelter your CD interest from taxes. These accounts offer tax benefits, allowing you to grow your savings tax-free or tax-deferred.

3. Tax-Efficient Withdrawals

If you need to withdraw funds from your CD before it matures, be mindful of the potential tax implications. Early withdrawals may incur penalties and additional taxes. Plan your withdrawals strategically to minimize the impact on your tax liability.

4. Maximizing Interest Rates

Research and compare CD interest rates from different financial institutions. Shopping around for the best rates can help you earn more interest, which in turn can offset some of your tax obligations.

The Impact of CD Interest Taxation on Financial Planning

Understanding the taxation of CD interest is crucial for effective financial planning. It allows you to make informed decisions about your savings and investment strategies, taking into account the tax implications.

Financial Planning Considerations

- Long-Term Goals: When planning for long-term financial goals, such as retirement, consider the tax implications of CD interest. Tax-advantaged accounts can be powerful tools for building wealth over time.

- Cash Flow Management: Understanding your tax obligations on CD interest can help you manage your cash flow effectively. Plan for tax payments and consider the timing of interest payments to align with your financial needs.

- Risk Management: CDs are generally considered low-risk investments, but the tax implications should be part of your risk assessment. Consider the impact of taxes on your overall return and make adjustments as needed.

Future Trends and Considerations

The taxation of CD interest is an evolving topic, and staying informed about potential changes is essential. Here are some future trends and considerations:

1. Tax Law Changes

Tax laws and regulations are subject to change, and keeping up with these changes is crucial. Stay informed about any updates that may impact the taxation of CD interest. Consult tax professionals or financial advisors to understand the latest developments.

2. Alternative Investment Options

As tax laws evolve, alternative investment options may become more attractive. Explore other low-risk investment vehicles that offer tax benefits or lower tax obligations. Diversifying your portfolio can help you optimize your overall tax strategy.

3. Technological Advances

The rise of fintech and digital banking has made it easier to manage CD investments and track interest earnings. Utilize digital tools and platforms to streamline your CD management and ensure accurate tax reporting.

Conclusion

Taxation on CD interest is an important aspect of financial management, and understanding it empowers you to make informed decisions about your savings and investments. By adopting strategic approaches and staying informed about tax regulations, you can optimize your CD portfolio and maximize your returns while minimizing your tax obligations.

Remember, the information provided here is general in nature, and tax laws can vary widely based on your jurisdiction and individual circumstances. Always consult a qualified tax professional for personalized advice and guidance.

How often do I need to report CD interest earnings to tax authorities?

+Typically, you report CD interest earnings annually when filing your tax returns. However, it’s important to consult your country’s tax regulations for specific requirements.

Are there any tax advantages to holding CDs in joint accounts?

+Holding CDs in joint accounts can provide certain tax advantages, such as the ability to split interest income and potentially lower your overall tax liability. However, the specific benefits depend on your jurisdiction’s tax laws.

Can I deduct any expenses related to CD investments from my taxable income?

+In most cases, expenses related to CD investments, such as account maintenance fees, are not deductible. However, it’s advisable to consult a tax professional for guidance specific to your situation.

What happens if I forget to report CD interest on my tax returns?

+Failing to report CD interest can result in penalties and additional taxes. It’s important to maintain accurate records and consult a tax professional if you have any concerns or questions.