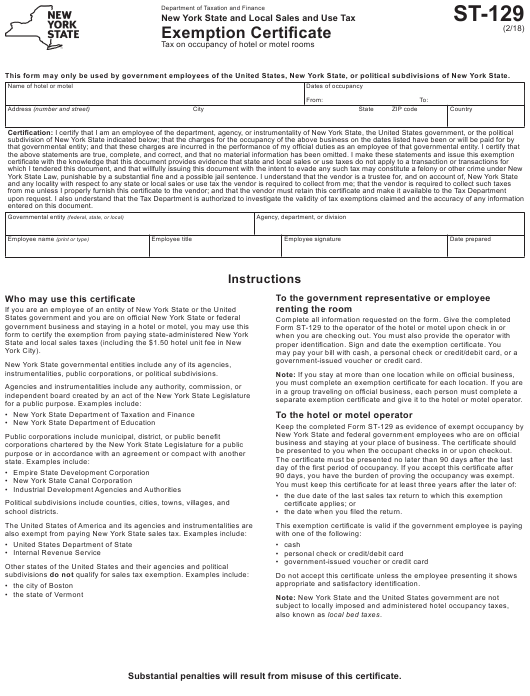

Denver Property Taxes

When it comes to property ownership, understanding the intricacies of property taxes is essential. In Denver, Colorado, property taxes play a significant role in the local economy and directly impact homeowners and investors. This comprehensive guide aims to unravel the complexities of Denver property taxes, providing an in-depth analysis of the assessment process, tax rates, exemptions, and strategies to optimize your financial obligations.

Unraveling Denver’s Property Tax Landscape

Denver, known for its vibrant culture, stunning natural surroundings, and thriving economy, attracts residents and businesses alike. However, with the allure of this vibrant city comes the responsibility of property ownership, including the often-confusing world of property taxes. Let’s delve into the specifics of Denver’s property tax system to empower homeowners and investors with the knowledge they need to navigate this essential aspect of financial planning.

Property Assessment: The Foundation of Taxation

The journey towards understanding Denver property taxes begins with the assessment process. The Denver Assessor’s Office plays a pivotal role in determining the taxable value of properties within the city. This process involves evaluating various factors such as location, size, improvements, and market trends to assign a fair market value to each property. The assessed value forms the basis for calculating property taxes, ensuring a transparent and equitable system.

Here’s a breakdown of the key stages in the assessment process:

- Data Collection: Assessors gather information about properties, including recent sales data, building permits, and other relevant details.

- Property Inspection: Physical inspections may be conducted to verify the accuracy of property characteristics and ensure fair valuation.

- Valuation Methods: Assessors employ recognized valuation techniques, such as the cost approach, sales comparison approach, and income approach, to determine the property’s fair market value.

- Notices of Value: Property owners receive notices of their assessed value, allowing them to review and appeal if necessary.

| Assessment Timeline | Key Dates |

|---|---|

| Notice of Value Mailing | Typically sent out in February or March each year. |

| Appeal Deadline | Usually 30 days after the Notice of Value mailing. |

By understanding the assessment process, property owners can actively participate in ensuring their taxable value is accurate and fair, mitigating potential disputes and misunderstandings.

Tax Rates: Calculating Your Obligations

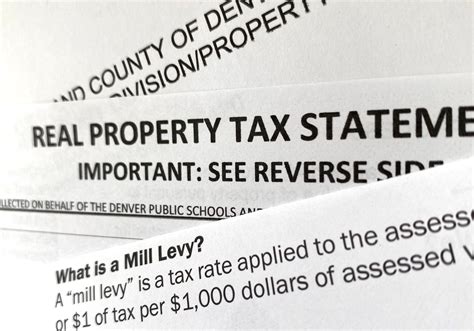

Once the assessed value is determined, the next step is to calculate the property tax owed. Denver’s property tax system operates on a mill levy, which is a rate expressed in mills, with one mill equivalent to 1 for every 1,000 of assessed value. This mill levy is then applied to the assessed value to determine the tax liability.

The mill levy is composed of several components, including:

- City Mill Levy: This rate is set by the City of Denver and funds essential city services.

- County Mill Levy: The Denver County mill levy supports county operations and services.

- Special District Mill Levies: These levies fund specific services or infrastructure within designated districts, such as fire protection, transportation, or open space preservation.

- School District Mill Levies: Each school district has its own mill levy, contributing to the funding of public education.

The total mill levy for a property is the sum of all these components, providing a comprehensive picture of the tax obligations.

| Tax Rate Example | Mill Levy Components |

|---|---|

| Residential Property |

|

Exemptions and Discounts: Reducing Your Tax Burden

To alleviate the financial burden on certain property owners, Denver offers a range of exemptions and discounts. These incentives aim to promote homeownership, support seniors, and encourage economic development.

Here are some of the key exemptions and discounts available in Denver:

- Senior Homestead Exemption: Eligible seniors (65 years or older) can receive a reduction in their property taxes. The exemption is based on the assessed value of the primary residence and income limits apply.

- Veteran’s Exemption: Active-duty military personnel and veterans may be eligible for a partial or full exemption on their property taxes, depending on their service status and disability rating.

- Agricultural Land Exemption: Property owners with agricultural land may qualify for a reduced assessment based on the land’s agricultural value rather than its market value.

- Economic Development Incentives : Denver offers various incentives to attract businesses and stimulate economic growth. These may include tax abatements, tax increment financing, or enterprise zone benefits.

Strategies for Effective Tax Management

Navigating Denver’s property tax landscape requires a strategic approach to ensure your financial obligations are managed efficiently. Here are some key strategies to consider:

- Understand Your Assessment: Regularly review your Notice of Value and assess whether the valuation is accurate. If you disagree with the assessment, consider appealing to ensure fairness.

- Explore Exemptions: Research and apply for applicable exemptions to reduce your tax burden. Stay informed about new exemptions or changes in existing programs.

- Consider Investment Strategies: For investors, diversification and strategic property acquisitions can optimize tax obligations. Consult with tax professionals to develop a tailored investment strategy.

- Stay Informed: Keep up-to-date with changes in tax laws, assessment practices, and local initiatives that may impact your property taxes. Attend community meetings and engage with local government to stay involved.

The Future of Denver Property Taxes

As Denver continues to thrive and evolve, its property tax system will adapt to meet the changing needs of the community. The city’s commitment to transparency and equity in taxation ensures that property owners can navigate the system with confidence. By staying informed and actively participating in the process, homeowners and investors can contribute to a vibrant and sustainable Denver.

How often are property taxes assessed in Denver?

+Property taxes in Denver are typically assessed annually. The assessment process occurs in cycles, with notices of value sent to property owners in the early part of the year.

Can I appeal my property’s assessed value?

+Yes, if you believe your property’s assessed value is inaccurate, you have the right to appeal. The appeal process involves submitting evidence and justifications to support your case. Consult the Denver Assessor’s Office for detailed guidelines.

Are there any tax incentives for energy-efficient improvements?

+Denver offers tax incentives for energy-efficient improvements through the Denver Energy Challenge program. These incentives can reduce your property taxes and promote sustainable practices. Contact the Denver Office of Sustainability for more information.

How can I estimate my property tax bill before receiving the official notice?

+You can estimate your property tax bill by multiplying your property’s assessed value by the total mill levy rate. However, this estimate is subject to change based on the official assessment and any applicable exemptions.