Clackamas County Tax Records

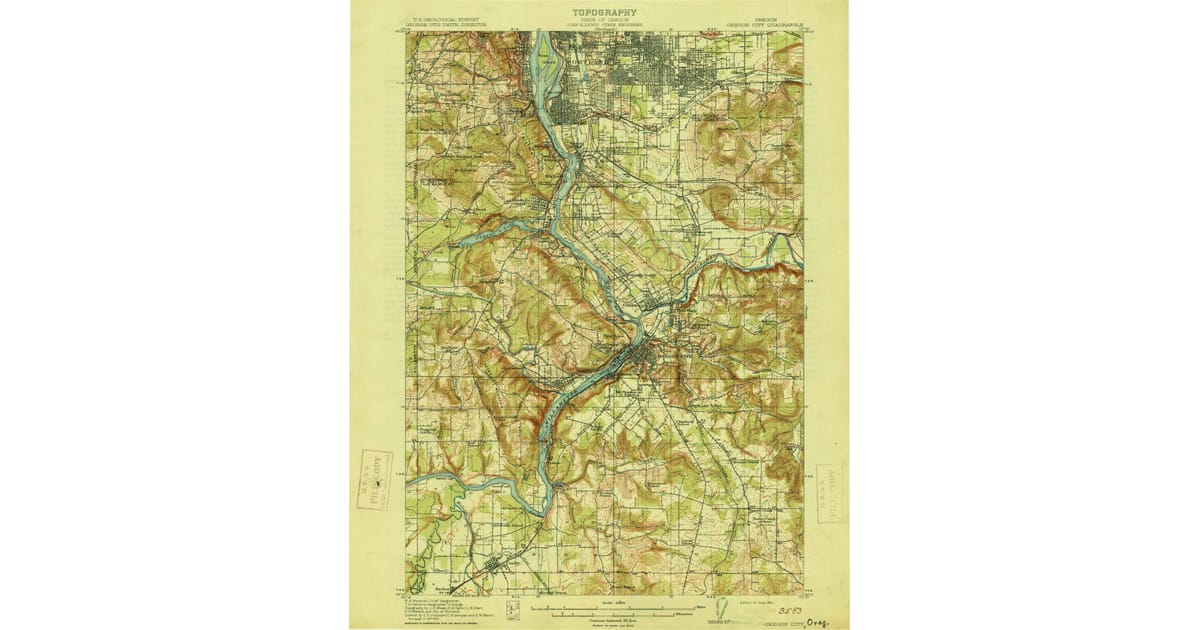

Clackamas County, nestled in the heart of Oregon, is a region known for its natural beauty and vibrant communities. One crucial aspect of living and doing business in this county is understanding the local tax system and how it affects property owners. In this comprehensive guide, we delve into the world of Clackamas County tax records, exploring the processes, insights, and implications for residents and businesses alike.

Unraveling the Complexity of Clackamas County Tax Records

The tax system in Clackamas County is a vital component of the local economy, ensuring the provision of essential services and infrastructure. Property taxes, in particular, form a significant portion of the county’s revenue stream. Understanding how these taxes are assessed, calculated, and recorded is essential for both property owners and prospective buyers.

The Clackamas County Assessment and Taxation Department plays a pivotal role in this process, overseeing the evaluation of properties, collection of taxes, and maintenance of comprehensive tax records. These records provide a wealth of information, offering insights into property values, tax rates, and historical data that can greatly benefit homeowners and investors.

The Assessment Process: A Step-by-Step Breakdown

The assessment process in Clackamas County is a meticulous endeavor, ensuring fair and accurate valuation of properties. Here’s an insider’s view of how it works:

- Data Collection: The county assesses properties based on various factors, including market value, location, and improvements. Trained assessors visit properties or utilize remote sensing technologies to gather data on size, age, and condition.

- Value Estimation: Using advanced valuation methods, the assessors estimate the property's market value. This value is a critical determinant of the property tax, as it forms the basis for tax calculations.

- Notification: Once the assessed value is determined, property owners receive a notification. This document provides details on the estimated value, tax rate, and the projected tax amount.

- Review and Appeal: Property owners have the right to review the assessed value and, if necessary, appeal the decision. The county provides a transparent process for appeals, ensuring fairness and accuracy.

Tax Records: A Treasure Trove of Information

Clackamas County’s tax records offer a wealth of information, making them an invaluable resource for various stakeholders. Here’s a glimpse of what these records contain:

| Property Information | Details |

|---|---|

| Owner Details | Name, contact information, and ownership history. |

| Property Characteristics | Size, location, improvements, and land use. |

| Assessed Value | Estimated market value and tax assessment. |

| Tax History | Previous tax rates, payments, and any applicable exemptions. |

| Lien and Encumbrance | Information on any outstanding liens or legal claims on the property. |

These records provide a comprehensive overview of a property's financial standing and can be instrumental in decision-making processes.

Insights for Homeowners and Investors

Clackamas County tax records offer valuable insights for both homeowners and investors. For homeowners, these records can provide a clear understanding of their property’s value, tax obligations, and potential exemptions. Investors, on the other hand, can use these records to conduct thorough due diligence, assessing the financial health of a property and its potential for growth.

Navigating the Tax Landscape: Tips and Strategies

While Clackamas County’s tax system is designed to be fair and transparent, navigating it can be complex. Here are some expert tips and strategies to make the process smoother:

Understanding Tax Rates and Exemptions

Clackamas County operates on a progressive tax system, where tax rates vary based on the assessed value of the property. It’s crucial to understand these rates and any applicable exemptions. The county offers various exemptions, such as the Homeowner’s Exemption, which can significantly reduce the tax burden for eligible homeowners.

Timely Payment and Penalty Avoidance

Property taxes in Clackamas County are due twice a year. Timely payment is essential to avoid penalties and interest. The county offers various payment options, including online payment platforms, making it convenient for taxpayers.

Utilizing Online Resources

The Clackamas County Assessment and Taxation Department maintains an extensive online presence, offering a wealth of resources and tools. Property owners can access their tax records, view payment history, and even estimate future tax obligations using online calculators.

Seeking Professional Advice

For complex tax scenarios or when facing challenges with tax assessments, seeking professional advice is advisable. Tax consultants or attorneys with expertise in property tax laws can provide valuable guidance and ensure compliance.

The Future of Clackamas County Tax Records

As technology advances, the management and accessibility of tax records are set to improve. Clackamas County is exploring innovative solutions, such as blockchain-based record-keeping, to enhance security and transparency. Additionally, the county is investing in data analytics to improve assessment accuracy and efficiency.

In the coming years, we can expect more user-friendly platforms, real-time data updates, and streamlined processes for accessing and utilizing tax records. These advancements will further empower property owners and stakeholders, ensuring a more transparent and efficient tax system.

Conclusion: Empowering Clackamas County Residents

Clackamas County’s tax records are a powerful tool, offering transparency and insight into the local tax system. By understanding these records, homeowners and investors can make informed decisions, optimize their tax strategies, and contribute to the vibrant community of Clackamas County.

How often are properties reassessed in Clackamas County?

+Properties in Clackamas County are typically reassessed every two years, but certain changes, such as significant improvements or damage, may trigger a reassessment sooner.

Can I appeal my property’s assessed value?

+Yes, property owners have the right to appeal their assessed value. The county provides a clear process for appeals, which includes submitting evidence and attending a hearing if necessary.

What are the penalties for late property tax payments?

+Late payments in Clackamas County incur a penalty of 10% of the unpaid tax amount, plus a 1% interest charge per month until the tax is paid in full.

How can I access my tax records online?

+You can access your tax records online by visiting the Clackamas County Property Search portal. You’ll need to provide your property’s address or Assessor’s Parcel Number (APN) to view your records.