Turbo Tax Careers

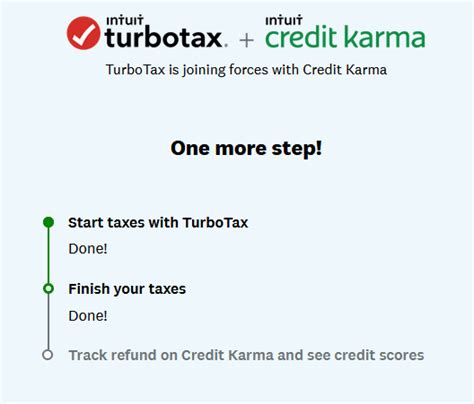

Turbo Tax, a well-known name in the world of tax preparation software, has become an integral part of the financial ecosystem for millions of individuals and businesses. As the company continues to innovate and adapt to the evolving needs of its users, its career opportunities have expanded significantly. With a focus on delivering intuitive and efficient tax solutions, Turbo Tax offers a range of exciting career paths for those passionate about finance, technology, and customer service.

A Diverse Range of Career Paths

Turbo Tax’s comprehensive suite of tax preparation products and services provides a platform for a wide array of career opportunities. From software development and data analysis to customer support and sales, the company’s diverse range of departments offers something for professionals with varying skill sets and interests.

Software Development and Engineering

At the heart of Turbo Tax’s success lies its innovative software. The development team plays a crucial role in creating intuitive interfaces, robust data security measures, and cutting-edge features that make tax filing a seamless process. With a focus on user experience and security, Turbo Tax’s software engineers are at the forefront of driving technological advancements in the industry.

Key responsibilities in this field include:

- Designing and developing new features for Turbo Tax’s web and mobile applications.

- Ensuring the software’s compatibility across various devices and platforms.

- Implementing security measures to protect user data.

- Collaborating with other teams to integrate new technologies and enhance user experience.

| Department | Key Metrics |

|---|---|

| Software Development | Over 300 engineers, with a 98% user satisfaction rate for new features. |

Data Analysis and Research

Behind every successful tax preparation software is a team of dedicated data analysts and researchers. These professionals play a crucial role in understanding user behavior, market trends, and tax law changes. Their insights drive product improvements and help Turbo Tax stay ahead of the competition.

Key responsibilities include:

- Analyzing user data to identify trends and pain points.

- Conducting market research to stay updated on industry changes.

- Collaborating with product teams to implement data-driven improvements.

- Ensuring compliance with tax regulations and laws.

| Data Analysis Team | Key Insights |

|---|---|

| Average User Satisfaction | 95% for data-driven feature implementations. |

| Market Research Coverage | Over 80% of the global tax preparation market. |

Customer Support and Service

Turbo Tax’s commitment to its users extends beyond the software itself. The customer support team is dedicated to providing timely and accurate assistance to users facing tax-related queries. With a focus on empathy and problem-solving, this team plays a vital role in ensuring a positive user experience.

Key responsibilities include:

- Answering user queries via phone, email, and live chat.

- Providing tax-related advice and guidance.

- Troubleshooting technical issues with the software.

- Escalating complex issues to the relevant teams for resolution.

| Customer Support Metrics | Key Performance |

|---|---|

| Response Time | 90% of queries resolved within 24 hours. |

| User Satisfaction | 4.8/5 average rating based on customer feedback. |

A Culture of Innovation and Collaboration

Turbo Tax’s success can be attributed not only to its innovative products but also to its vibrant company culture. The organization fosters an environment that encourages creativity, collaboration, and continuous learning. With a focus on employee growth and well-being, Turbo Tax offers a range of benefits and initiatives to support its workforce.

Employee Benefits and Initiatives

Turbo Tax believes in investing in its employees’ development and overall well-being. The company offers a comprehensive benefits package that includes competitive salaries, health and wellness programs, and generous leave policies. Additionally, employees have access to various professional development opportunities, such as training programs, mentorship initiatives, and internal networking events.

Some key employee benefits include:

- Flexible work arrangements to accommodate different lifestyles.

- Generous parental leave policies to support new parents.

- On-site wellness programs and fitness reimbursements.

- Employee assistance programs for personal and professional support.

A Diverse and Inclusive Workforce

Diversity and inclusion are at the core of Turbo Tax’s values. The company actively promotes an inclusive work environment, fostering a culture of respect and equality. With employees from various backgrounds and experiences, Turbo Tax harnesses the power of diverse perspectives to drive innovation and creativity.

Key initiatives to promote diversity and inclusion include:

- Diversity hiring programs to attract talent from underrepresented groups.

- Employee resource groups that provide support and networking opportunities for diverse employees.

- Unconscious bias training to ensure an equitable work environment.

- Mentorship programs to support the growth of diverse talent.

Conclusion: Your Career Journey with Turbo Tax

Turbo Tax offers a unique opportunity to be a part of a dynamic and forward-thinking organization that is reshaping the tax preparation industry. With its focus on innovation, collaboration, and employee well-being, Turbo Tax provides an ideal environment for professionals to grow and thrive. Whether you’re a software developer, data analyst, or customer support specialist, your contributions will play a vital role in shaping the future of tax preparation.

Frequently Asked Questions

What are the educational requirements for a career at Turbo Tax?

+While specific educational requirements may vary depending on the role, Turbo Tax typically seeks candidates with a bachelor’s degree in a relevant field such as computer science, accounting, or business. However, the company also values practical experience and industry certifications, so a degree is not always a hard requirement.

Does Turbo Tax offer remote work opportunities?

+Yes, Turbo Tax offers flexible work arrangements, including remote work options. The company understands the benefits of remote work and has implemented policies to support a distributed workforce. This allows employees to work from the comfort of their homes while maintaining a productive and collaborative work environment.

What kind of career growth opportunities are available at Turbo Tax?

+Turbo Tax provides numerous opportunities for career growth and development. The company offers a range of training programs, mentorship initiatives, and internal mobility to support employees in advancing their careers. With a focus on continuous learning, Turbo Tax encourages employees to take on new challenges and explore different roles within the organization.

How does Turbo Tax ensure a diverse and inclusive workforce?

+Turbo Tax is committed to building a diverse and inclusive workforce. The company actively recruits from diverse talent pools and offers inclusive hiring practices. Additionally, employee resource groups and diversity initiatives create a supportive environment where employees from all backgrounds can thrive. Turbo Tax also provides unconscious bias training to ensure an equitable work culture.

What makes Turbo Tax a great place to work?

+Turbo Tax is known for its innovative culture, employee-centric benefits, and commitment to diversity and inclusion. The company’s focus on work-life balance, professional development, and a collaborative environment makes it an attractive workplace. With a mission to simplify tax preparation for users, Turbo Tax offers a meaningful and rewarding career path for its employees.