Roth Ira Conversion Tax Calculator

The Roth IRA, a powerful retirement savings tool, offers significant benefits but also introduces complexities, particularly when considering conversions and their tax implications. This article delves into the intricacies of Roth IRA conversion taxes, offering a comprehensive guide to help individuals navigate this crucial aspect of financial planning.

Understanding Roth IRA Conversion and Its Tax Implications

A Roth IRA is a unique retirement savings account that allows individuals to invest after-tax dollars, with the promise of tax-free withdrawals in retirement. While traditional IRAs provide tax advantages during the contribution phase, Roth IRAs focus on the withdrawal phase, offering tax-free income during retirement.

The beauty of a Roth IRA lies in its ability to grow tax-free, and conversions play a pivotal role in this process. When converting a traditional IRA to a Roth IRA, individuals can leverage the power of tax-free growth by paying taxes upfront on the converted amount. This strategic move, however, comes with a price—the tax liability on the conversion.

The tax calculation for a Roth IRA conversion can be complex, as it involves understanding the tax rules, determining the tax bracket, and factoring in any applicable deductions or credits. This is where a Roth IRA conversion tax calculator becomes an invaluable tool, simplifying the process and providing accurate estimates of the tax liability.

The Role of a Roth IRA Conversion Tax Calculator

A Roth IRA conversion tax calculator is a sophisticated tool designed to assist individuals in understanding the tax consequences of converting a traditional IRA to a Roth IRA. By inputting relevant financial information, this calculator provides a personalized estimate of the tax liability associated with the conversion.

One of the key advantages of using a Roth IRA conversion tax calculator is its ability to offer a comprehensive view of the tax landscape. It takes into account the individual's income, tax bracket, and other relevant factors to provide an accurate estimate of the tax due on the conversion. This allows individuals to make informed decisions about their retirement savings strategy.

Moreover, a Roth IRA conversion tax calculator can also help individuals explore different scenarios and understand the potential tax implications of various conversion strategies. By adjusting variables such as the amount of the conversion, the timing of the conversion, and the individual's income level, users can gain a deeper understanding of the tax landscape and make more strategic decisions.

Key Features and Benefits

- Accuracy: These calculators utilize advanced algorithms and tax formulas to provide precise estimates, ensuring individuals have a clear understanding of their tax liability.

- Scenario Analysis: Users can input different conversion amounts and assess the tax impact, aiding in the decision-making process.

- Tax Bracket Awareness: The calculator helps individuals identify their tax bracket and understand how it affects the conversion tax.

- Deduction and Credit Considerations: It accounts for deductions and credits, offering a holistic view of the tax landscape.

- Real-Time Updates: Reputable calculators are updated regularly to reflect the latest tax laws and regulations, ensuring accuracy.

Step-by-Step Guide: Using a Roth IRA Conversion Tax Calculator

- Gather Information: Collect necessary details, including current IRA balance, income, and tax bracket.

- Access a Reliable Calculator: Choose a reputable online calculator, ensuring it’s up-to-date and offers accurate estimates.

- Input Data: Enter the required information, such as conversion amount, income, and tax filing status.

- Review Results: Analyze the estimated tax liability and consider the impact on your overall financial plan.

- Adjust and Optimize: Experiment with different scenarios to find the most tax-efficient strategy for your conversion.

Example: John’s Roth IRA Conversion

Let’s illustrate the process with an example. John, a 45-year-old professional, is considering converting his traditional IRA to a Roth IRA. He has a current IRA balance of 150,000 and an annual income of 120,000. By using a Roth IRA conversion tax calculator, he estimates a tax liability of approximately $32,000 for a full conversion.

| Conversion Amount | Estimated Tax Liability |

|---|---|

| $150,000 | $32,000 |

John can now make an informed decision, weighing the benefits of tax-free growth against the upfront tax cost. He might also consider partial conversions or exploring other strategies to optimize his retirement savings plan.

Maximizing the Benefits: Strategies for Roth IRA Conversions

While a Roth IRA conversion tax calculator provides valuable insights, it’s essential to explore strategies to optimize the conversion process. Here are some expert tips to consider:

1. Timing Your Conversion

The timing of your conversion can significantly impact the tax liability. Consider converting during years when your income is lower, as this can reduce the tax bracket and minimize the tax impact.

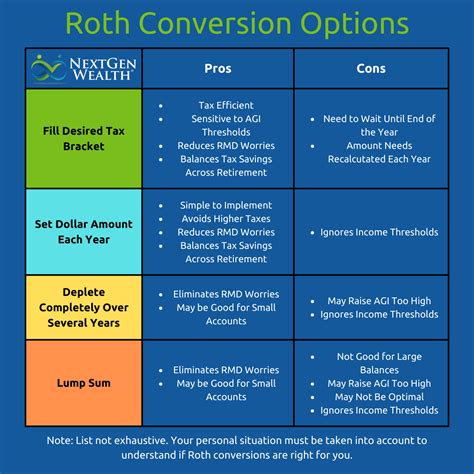

2. Partial Conversions

Instead of a full conversion, explore the option of partial conversions. This strategy allows you to convert smaller amounts over multiple years, potentially spreading the tax liability and taking advantage of varying tax brackets.

3. Rollover Strategies

Consider a rollover from your traditional IRA to a Roth IRA through a qualified rollover. This strategy can help you manage the tax liability by spreading it over multiple tax years, making it more manageable.

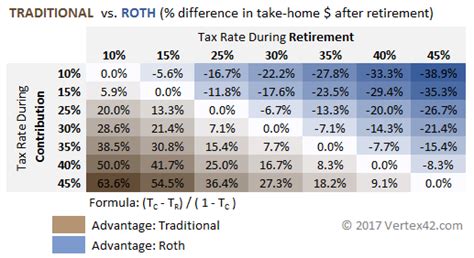

4. Income Tax Brackets

Understand your tax bracket and how it affects the conversion tax. Aim to convert when you are in a lower tax bracket to reduce the tax burden.

5. Roth IRA Conversion Ladder

For those nearing retirement, a Roth IRA conversion ladder can be a strategic move. This involves converting a portion of your traditional IRA each year, ensuring a steady stream of tax-free income during retirement.

Conclusion: Navigating Roth IRA Conversions with Confidence

Understanding the tax implications of a Roth IRA conversion is crucial for effective retirement planning. By utilizing a Roth IRA conversion tax calculator and exploring various strategies, individuals can make informed decisions to maximize the benefits of their retirement savings. Remember, seeking professional advice is essential to ensure compliance and optimize your financial strategy.

Frequently Asked Questions

What is the difference between a traditional IRA and a Roth IRA conversion?

+

A traditional IRA offers tax advantages during the contribution phase, allowing you to deduct contributions from your taxable income. In contrast, a Roth IRA conversion involves paying taxes upfront on the converted amount, but it offers tax-free growth and withdrawals during retirement.

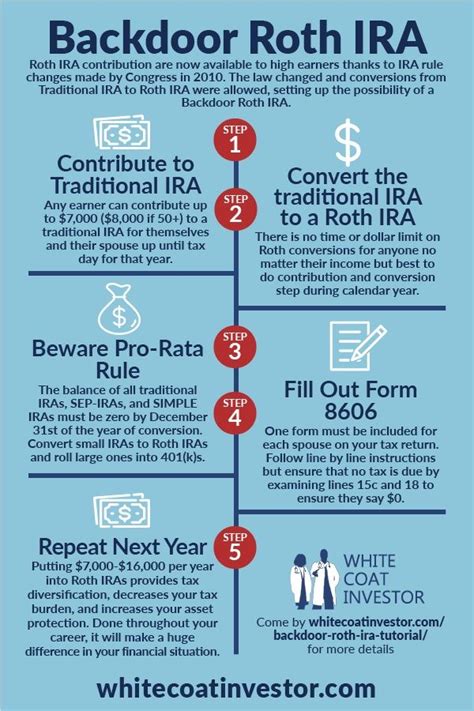

Are there any income limits for Roth IRA conversions?

+

Yes, there are income limits for Roth IRA conversions. For single filers, the income limit is 144,000, and for married couples filing jointly, it's 214,000. Above these limits, the conversion may not be allowed or may be subject to additional restrictions.

Can I convert my entire traditional IRA to a Roth IRA in one go?

+

Yes, you can convert your entire traditional IRA to a Roth IRA in a single conversion. However, it’s important to consider the tax implications and ensure you have sufficient funds to cover the tax liability. It’s advisable to consult a financial advisor for personalized guidance.