British Value Added Tax

Welcome to a comprehensive guide to the British Value Added Tax (VAT), a vital component of the UK's taxation system. In this in-depth article, we will delve into the intricacies of VAT, exploring its history, structure, impact, and future prospects. By understanding the nuances of this tax, we can gain valuable insights into the economic landscape of the United Kingdom.

Unraveling the Complexity of British VAT

The Value Added Tax, commonly known as VAT, is a consumption tax levied on most goods and services supplied for use or consumption in the UK. It is an essential revenue generator for the government, contributing significantly to the country’s economic stability and public spending.

With a long history dating back to the 1970s, VAT has evolved to become a cornerstone of the UK's taxation framework. Over the years, it has undergone several reforms and adjustments to align with the changing economic landscape and to meet the needs of a modern, globalized economy.

The Structure of British VAT

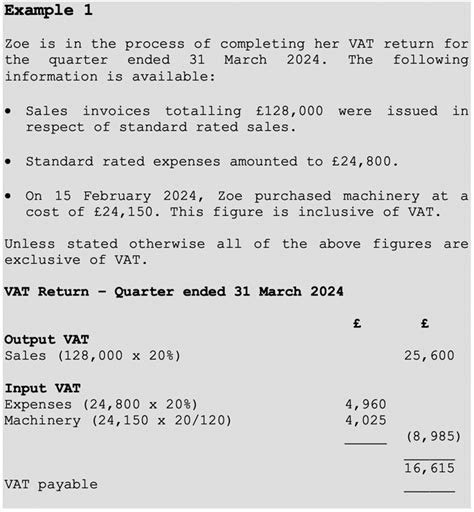

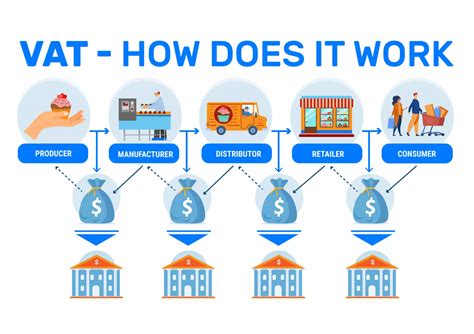

At its core, VAT is a multi-stage tax that is applied at each stage of the supply chain, from production to final sale. This unique structure ensures that the tax is ultimately borne by the end consumer, while businesses act as intermediaries in the collection and remittance process.

The UK VAT system operates on a standard rate, reduced rates, and a zero rate. The standard rate, currently set at 20%, is applicable to most goods and services. Reduced rates, such as the 5% rate for domestic fuel and power, are applied to specific items, while the zero rate is reserved for essential items like most food products and children's clothing.

| VAT Rate | Description |

|---|---|

| Standard Rate | 20% - Applies to most goods and services. |

| Reduced Rate | 5% - Used for domestic fuel, power, and some other items. |

| Zero Rate | 0% - Reserved for essential items like food and children's clothing. |

Impact on Businesses and Consumers

For businesses, VAT compliance is a critical aspect of their financial operations. It involves careful record-keeping, accurate invoicing, and timely remittance to HM Revenue and Customs (HMRC). Failure to comply with VAT regulations can result in penalties and legal repercussions.

From a consumer perspective, VAT is an ever-present component of their daily spending. While it may seem like an additional cost, it is essential to remember that VAT contributes to the provision of public services and infrastructure that benefit society as a whole. It is a vital part of the social contract between taxpayers and the government.

VAT Registration and Thresholds

Not all businesses are required to register for VAT. The UK’s VAT registration threshold currently stands at £85,000 for the 2023-24 tax year. This means that businesses with a taxable turnover below this threshold are not obligated to register for VAT.

However, there are advantages to voluntary registration even if a business's turnover is below the threshold. Voluntary registration allows businesses to reclaim VAT on their purchases, which can be a significant financial benefit. It also enhances a business's credibility and can improve its standing with suppliers and customers.

VAT Registration Process

The process of registering for VAT is straightforward and can be completed online through the HMRC website. Businesses will need to provide basic information about their operations, including their turnover, the nature of their business, and their anticipated VAT liability.

Once registered, businesses will receive a VAT registration certificate, which includes their unique VAT registration number. This number must be displayed on all invoices and official documents related to VAT.

VAT Returns and Compliance

VAT-registered businesses are required to submit regular VAT returns to HMRC, detailing their VAT liabilities and reimbursements. The frequency of these returns depends on the business’s turnover and can be monthly, quarterly, or annually.

VAT returns are a crucial aspect of compliance, as they ensure that businesses accurately report their VAT obligations. Failure to submit accurate and timely returns can result in penalties and interest charges.

VAT Compliance Challenges

While the VAT system is designed to be straightforward, compliance can present challenges, particularly for small and medium-sized enterprises (SMEs). The complexity of the tax system, coupled with the administrative burden of record-keeping and submission, can be a significant hurdle for businesses.

To mitigate these challenges, many businesses turn to accounting software and VAT experts who can provide guidance and support throughout the compliance process. These professionals ensure that businesses meet their VAT obligations while maximizing their financial benefits.

The Future of British VAT

As the UK navigates a post-Brexit landscape and adapts to global economic shifts, the future of VAT is likely to see continued evolution. The government may consider further reforms to enhance efficiency and adaptability in the face of changing economic conditions.

One potential area of focus is the digital economy, where the VAT system may need to be adapted to accommodate the rise of e-commerce and digital services. Ensuring a level playing field for both traditional and digital businesses will be crucial in maintaining a fair and effective tax system.

Potential Reforms and Adjustments

The UK government has already taken steps to address some of the challenges posed by the digital economy. The introduction of the Digital Services Tax (DST) in 2020 was a response to the need for a more equitable tax system in the digital age. The DST applies a 2% rate to the revenues of large tech companies providing certain digital services in the UK.

Additionally, the government has been exploring the concept of a "single market VAT" to streamline cross-border transactions and simplify the VAT system for businesses operating across multiple European jurisdictions.

Conclusion

In conclusion, the British Value Added Tax is a complex yet essential component of the UK’s taxation system. Its impact extends beyond revenue generation, shaping the economic landscape and influencing the daily lives of businesses and consumers alike.

As we've explored in this article, VAT is a dynamic and evolving system, constantly adapting to meet the challenges and opportunities presented by a changing world. By understanding its intricacies and staying informed about potential reforms, we can navigate the VAT landscape with confidence and contribute to a sustainable and prosperous economy.

Frequently Asked Questions

How often must businesses submit VAT returns?

+

The frequency of VAT returns depends on the business’s turnover. Monthly, quarterly, and annual returns are the most common options. However, businesses can also opt for a flat-rate scheme, which simplifies VAT calculation and submission.

Are there any exemptions from VAT in the UK?

+

Yes, there are several exemptions and special provisions in the UK’s VAT system. These include exports, international services, and certain charitable activities. It’s important for businesses to understand these exemptions to ensure compliance and maximize their financial benefits.

What happens if a business fails to register for VAT when it should have?

+

If a business fails to register for VAT when its turnover exceeds the threshold, it may face penalties and interest charges. In some cases, the business may also be required to pay the VAT it should have charged and collected from customers. Therefore, it’s crucial for businesses to stay informed about their VAT obligations and register promptly when necessary.