Wake County Property Tax Lookup

In Wake County, North Carolina, property owners and interested parties have access to a wealth of information through the Wake County Property Tax Lookup system. This online tool serves as a comprehensive database, providing transparent details about property assessments, tax rates, and payment information. It is an essential resource for homeowners, prospective buyers, investors, and anyone seeking insights into the local real estate market and tax landscape.

Navigating the Wake County Property Tax Lookup: A Comprehensive Guide

The Wake County Property Tax Lookup is designed to offer a user-friendly experience, allowing individuals to easily retrieve detailed property information. Whether you’re a resident curious about your own property or an investor researching potential investments, this guide will walk you through the process, highlighting the key features and benefits of this valuable resource.

Understanding Property Assessments and Tax Rates

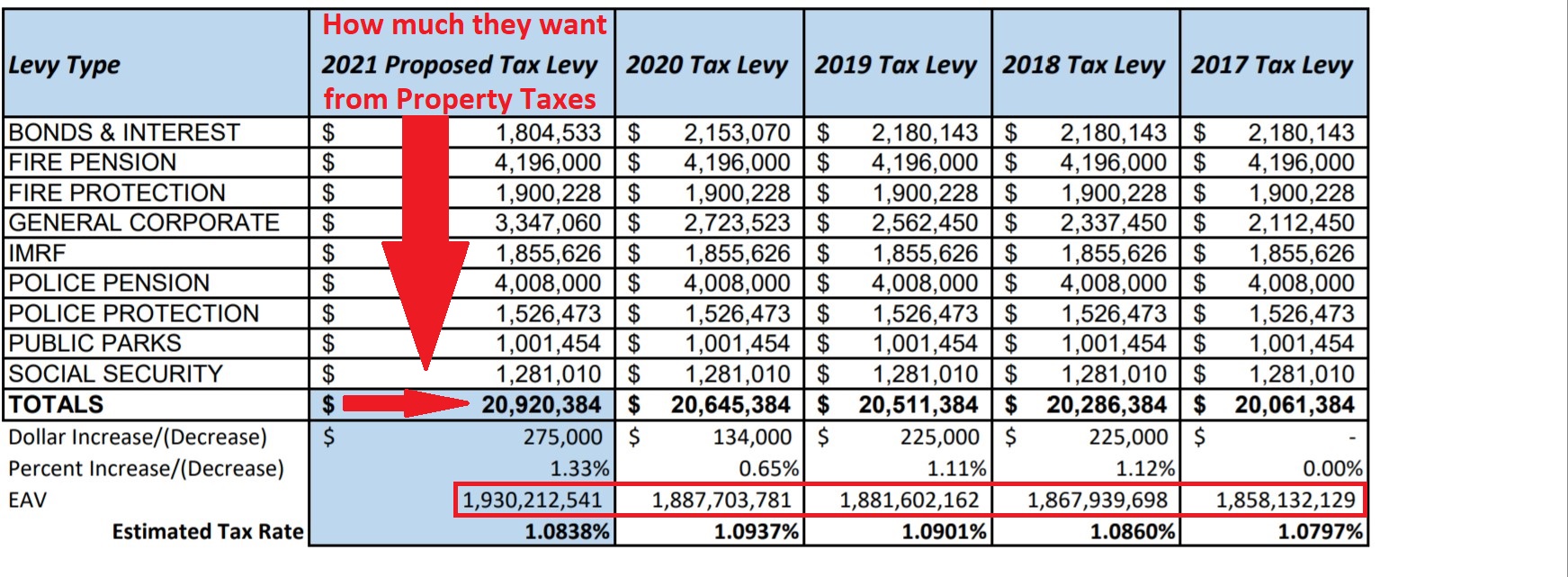

At the core of the Wake County Property Tax Lookup is the property assessment process. This system provides access to detailed property assessments, including the assessed value, which is the basis for property tax calculations. The assessment data is typically updated annually, reflecting any changes in property value due to improvements, market fluctuations, or other factors.

Furthermore, the lookup tool offers insights into the tax rates applicable to each property. Wake County utilizes a combination of county, municipal, and special district tax rates, which are determined by local governing bodies. These rates can vary based on the location and type of property, with residential, commercial, and agricultural properties often subject to different rates.

| Property Type | Average Tax Rate (%) |

|---|---|

| Residential | 0.89 |

| Commercial | 0.92 |

| Agricultural | 0.55 |

Note: The average tax rates provided above are for illustrative purposes and may not reflect the actual rates for specific properties. Always refer to the Wake County Property Tax Lookup for the most accurate and up-to-date information.

Exploring Property Details and Ownership Information

The Wake County Property Tax Lookup provides a treasure trove of details about each property, including physical attributes, such as the property’s size, number of rooms, and any unique features. It also offers a historical perspective, tracking changes in ownership, sales, and improvements made to the property over time.

For those interested in purchasing or investing, the lookup tool can be a valuable research companion. It allows users to compare properties based on their assessed values, tax obligations, and other relevant factors. This transparency fosters a more informed real estate market, benefiting both buyers and sellers.

Assessing Tax Obligations and Payment Options

One of the most critical aspects of property ownership is understanding and managing tax obligations. The Wake County Property Tax Lookup simplifies this process by providing a clear breakdown of the taxes owed on each property. It displays the total tax amount, the due dates, and any applicable discounts or penalties.

The lookup tool also integrates with the county's tax payment system, offering a seamless experience for property owners to pay their taxes online. This feature ensures convenience and efficiency, especially for those who prefer digital transactions. Additionally, it provides a record of past payments, allowing property owners to easily track their tax history.

Analyzing Tax Bills and Appeal Processes

The Wake County Property Tax Lookup goes beyond basic property information by offering a detailed analysis of tax bills. Property owners can review their current and past tax bills, understanding the breakdown of taxes, including the distribution across different taxing jurisdictions.

In cases where property owners believe their assessment is inaccurate or unfair, the lookup tool provides guidance on the appeal process. It outlines the steps to initiate an appeal, including the necessary documentation and timelines. This feature empowers property owners to protect their interests and ensure fair taxation.

Exploring Historical Tax Data and Market Trends

For investors and analysts, the Wake County Property Tax Lookup offers a historical perspective on property tax data. By analyzing trends over time, users can identify patterns, assess market stability, and make informed decisions about real estate investments.

The lookup tool's historical data can reveal insights into property value appreciation, tax rate fluctuations, and the overall health of the local real estate market. This information is invaluable for strategic planning, whether it's for personal investment or commercial development.

Conclusion: A Powerful Resource for Property Owners and Investors

The Wake County Property Tax Lookup is a powerful tool that empowers property owners, buyers, and investors with detailed and transparent information. By providing easy access to property assessments, tax rates, and payment options, it simplifies the often complex world of property taxation.

Whether you're a resident seeking clarity on your tax obligations or an investor researching the local market, the Wake County Property Tax Lookup offers a wealth of insights. Its user-friendly interface, comprehensive data, and integration with payment systems make it an essential resource for anyone with an interest in Wake County's vibrant real estate landscape.

How often are property assessments updated in Wake County?

+Property assessments in Wake County are typically updated annually. The assessment process takes into account factors such as market value, property improvements, and any changes to the property’s characteristics.

Can I appeal my property assessment if I believe it is incorrect?

+Yes, property owners have the right to appeal their assessments if they believe the assessed value is inaccurate. The Wake County Property Tax Lookup provides information on the appeal process, including deadlines and the necessary steps to initiate an appeal.

Are there any discounts or exemptions available for property taxes in Wake County?

+Wake County offers various tax discounts and exemptions, including the Homestead Exemption for primary residences and discounts for early tax payments. The Property Tax Lookup provides details on these incentives and how to qualify.

How can I stay updated on changes to my property’s tax information?

+To stay informed about changes to your property’s tax information, you can sign up for email notifications through the Wake County Property Tax Lookup. This ensures you receive updates on assessments, tax rates, and any relevant changes.

Can I access the Wake County Property Tax Lookup on mobile devices?

+Absolutely! The Wake County Property Tax Lookup is designed to be mobile-friendly, allowing you to access property information and manage your tax obligations conveniently on your smartphone or tablet.