Tax Lien Investing For Beginners

Tax lien investing is an attractive opportunity for investors seeking an alternative asset class with the potential for high returns and a unique approach to real estate. It offers a way to participate in the real estate market without the traditional burdens of property ownership. This article will guide beginners through the process, explaining the ins and outs of tax lien investing and providing insights into this fascinating investment niche.

Understanding Tax Liens

A tax lien is a legal claim placed on a property by a governmental entity, usually a county or state, when the property owner fails to pay their property taxes. The lien essentially gives the government a legal right to the property as security for the unpaid taxes. This is where tax lien investing comes into play, offering investors the opportunity to purchase these liens and, in some cases, potentially acquire the property.

The Process of Tax Lien Sales

Each year, local governments hold tax lien sales to recover unpaid property taxes. These sales are open to the public, allowing investors to bid on the right to collect the unpaid taxes and any penalties associated with the lien. The investor who offers the lowest interest rate for the debt is typically awarded the lien.

Here's a simplified breakdown of the process:

- Identification of Delinquent Properties: Governments identify properties with overdue taxes and prepare them for sale.

- Lien Sale: A public auction is held where investors bid on the right to collect the taxes. The lowest interest rate bid wins.

- Lien Redemption Period: The property owner has a specified time to redeem the lien by paying the taxes, penalties, and any associated fees. If they don't, the investor's rights to the property become stronger.

- Property Acquisition (in some cases): If the lien is not redeemed, the investor may be able to initiate a process to acquire the property, although this varies by jurisdiction.

| Key Term | Description |

|---|---|

| Tax Lien | A legal claim on a property for unpaid taxes. |

| Tax Lien Sale | Public auction of liens for delinquent properties. |

| Lien Redemption Period | Timeframe given to property owners to pay their taxes and penalties. |

| Property Acquisition | Potential outcome where the investor can acquire the property if the lien isn't redeemed. |

The Appeal of Tax Lien Investing

For beginners, tax lien investing offers several advantages that make it an appealing entry point into alternative investments.

Low Entry Barrier

Tax lien investing often has a lower financial barrier to entry compared to traditional real estate investing. You can often start with a relatively small amount of capital, especially when compared to the cost of purchasing a property outright.

Diversification

By investing in tax liens, you’re adding a unique asset class to your portfolio. This can help diversify your investments and potentially reduce overall risk, especially if you’re already heavily invested in stocks or other traditional assets.

Potential for High Returns

While returns can vary, tax lien investing can offer substantial rewards. Investors can earn interest on the amount owed, and in some cases, they can acquire properties at a significant discount.

Minimal Management

Unlike traditional real estate investing, where you might need to manage tenants and property maintenance, tax lien investing generally requires less ongoing management. Your primary focus is on the lien itself and any potential redemption or acquisition processes.

Getting Started: A Step-by-Step Guide

Starting in tax lien investing involves several key steps. Here’s a comprehensive guide to help you navigate the process.

Research Local Markets

Not all areas have the same tax lien opportunities. Research different counties and states to understand their tax lien sale processes, redemption periods, and potential for property acquisition. Some areas may be more favorable for investors.

Understand Legal Requirements

Each jurisdiction has its own set of laws governing tax liens. You’ll need to familiarize yourself with these to ensure you’re compliant. This includes understanding the auction process, redemption periods, and any requirements for property acquisition.

Find a Broker or Attend Sales

You can either attend tax lien sales in person or work with a broker who specializes in this field. Brokers can provide valuable insights and assist with the bidding process.

Choose Your Investment Strategy

Determine whether you’re primarily interested in earning interest on the liens or acquiring properties. This will influence your bidding strategy and the types of liens you pursue.

Bid Strategically

Bidding on tax liens requires a strategic approach. Consider the property’s value, the amount of taxes owed, and the potential for redemption or acquisition. Remember, the lowest interest bid wins, so you’ll need to balance your return expectations with the risk involved.

Monitor and Manage Your Liens

Once you’ve acquired liens, it’s essential to monitor them. Keep track of redemption periods and any legal requirements. If a lien isn’t redeemed, you may need to initiate the process for property acquisition, which can be complex and varies by jurisdiction.

Risks and Considerations

While tax lien investing can be lucrative, it’s not without risks. Here are some key considerations for beginners.

Redemption Risk

The primary risk in tax lien investing is that the property owner redeems the lien, meaning you’ll receive the amount owed but may not be able to acquire the property. This is a common outcome, so it’s important to factor this into your investment strategy.

Property Acquisition Challenges

If you’re interested in acquiring properties, the process can be complex and time-consuming. There are often legal hurdles to overcome, and you may need to work with legal professionals to navigate these.

Interest Rate Competition

In more popular tax lien markets, you may face competition from other investors, driving down the interest rates you can bid. This can impact your potential returns.

Research and Due Diligence

It’s crucial to conduct thorough research on each lien you’re interested in. This includes understanding the property’s value, the owner’s financial situation, and any potential liens or encumbrances on the property.

Future Outlook and Strategies

The world of tax lien investing is evolving, and there are several strategies and trends that investors can leverage to maximize their returns.

Online Tax Lien Platforms

With the rise of technology, many tax lien sales are now conducted online. This offers investors the convenience of participating from anywhere and can provide access to a wider range of liens.

Specialized Tax Lien Funds

For those who prefer a more hands-off approach, specialized tax lien funds offer an option. These funds pool investors’ capital to purchase liens, providing a diversified portfolio and professional management.

Data-Driven Strategies

With the availability of real estate data and analytics, investors can now make more informed decisions. By analyzing property values, tax delinquency rates, and other factors, investors can identify more profitable liens.

Networking and Education

The tax lien investing community is growing, and there are numerous resources available for beginners. Attending workshops, joining online forums, and networking with experienced investors can provide valuable insights and strategies.

Conclusion

Tax lien investing offers beginners a unique opportunity to participate in the real estate market with a lower barrier to entry and the potential for high returns. While it requires a thorough understanding of the legal and financial aspects, the rewards can be substantial. By following a strategic approach and staying informed, beginners can navigate this niche investment successfully.

What happens if the property owner doesn’t redeem the lien?

+If the property owner doesn’t redeem the lien within the specified redemption period, the investor may have the right to initiate a process to acquire the property. This process can vary by jurisdiction and often involves legal procedures to obtain clear title to the property.

Can tax lien investing be a full-time business?

+Yes, tax lien investing can be a full-time business for experienced investors. It requires a deep understanding of the market, strategic bidding, and effective management of acquired liens or properties. However, it’s essential to build a solid foundation of knowledge and experience before attempting to make it a primary income source.

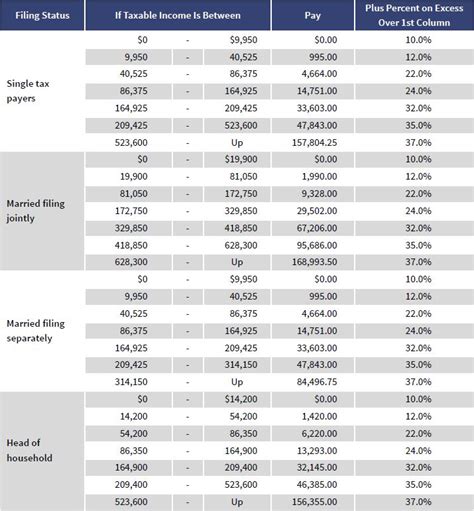

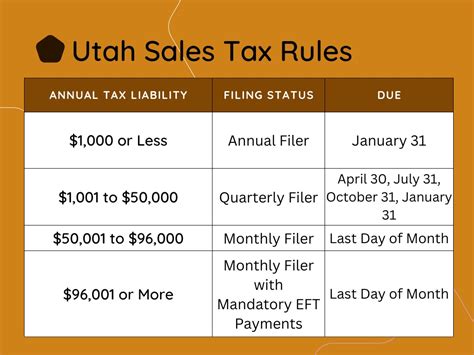

Are there tax implications for tax lien investors?

+Yes, tax lien investing has tax implications. The interest earned on the liens is typically taxable income, and there may be other tax considerations depending on the jurisdiction and the outcome of the investment (e.g., property acquisition). It’s advisable to consult with a tax professional to understand your specific tax obligations.

What’s the typical timeline for a tax lien investment?

+The timeline can vary significantly. It starts with the tax lien sale, followed by the redemption period, which can last several months. If the lien isn’t redeemed, the process for property acquisition can take additional time due to legal procedures. On average, a tax lien investment can take anywhere from several months to a few years to reach resolution.