Indiana Sales Tax Rate

In the world of retail and commerce, understanding sales tax regulations is crucial for both businesses and consumers alike. This comprehensive guide delves into the specifics of Indiana's sales tax rate, offering an in-depth analysis of its structure, application, and impact on various goods and services.

Understanding Indiana’s Sales Tax Rate

Indiana, like many states in the United States, imposes a sales tax on the sale of goods and some services. This tax is a vital source of revenue for the state, contributing to infrastructure development, education, and other public services.

The sales tax in Indiana operates on a progressive system, meaning the tax rate can vary depending on the type of goods or services being purchased. This system ensures that the tax burden is distributed fairly across different sectors of the economy.

The Basic Sales Tax Rate

At its core, Indiana has a general sales tax rate of 7%, which is applicable to most retail sales. This includes tangible personal property, such as clothing, electronics, and household items. The 7% rate is a standard across the state, providing a consistent tax environment for businesses and consumers.

| General Sales Tax Rate | 7% |

|---|---|

| Applies to | Tangible personal property |

Specific Sales Tax Rates

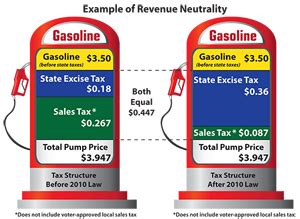

However, the sales tax landscape in Indiana becomes more nuanced when considering specific goods and services. The state has implemented selective sales tax rates for certain categories, which can either be higher or lower than the general rate.

- Food and Drugs: Certain food items and prescription drugs are subject to a reduced sales tax rate of 1%. This category includes non-prepared food, such as groceries, as well as medications purchased at pharmacies.

- Prepared Food and Beverages: Meals and beverages consumed on-site at restaurants, cafes, or other food establishments are taxed at a higher rate of 7% or even 8% in some counties. This distinction is made to encourage consumption of fresh, unprepared food over processed or prepared meals.

- Vehicle Sales: The purchase of motor vehicles, including cars, trucks, and motorcycles, is subject to a separate sales tax calculation. The tax rate varies based on the vehicle's purchase price and is calculated as a percentage of the sale price. This rate is typically higher than the general sales tax.

- Amusement and Entertainment: Admission fees for amusement parks, theaters, concerts, and other entertainment venues are subject to a specific sales tax rate, which can vary depending on the county. This rate is often higher than the general rate, with some counties imposing an additional amusement tax on top of the sales tax.

Local Sales Tax Rates

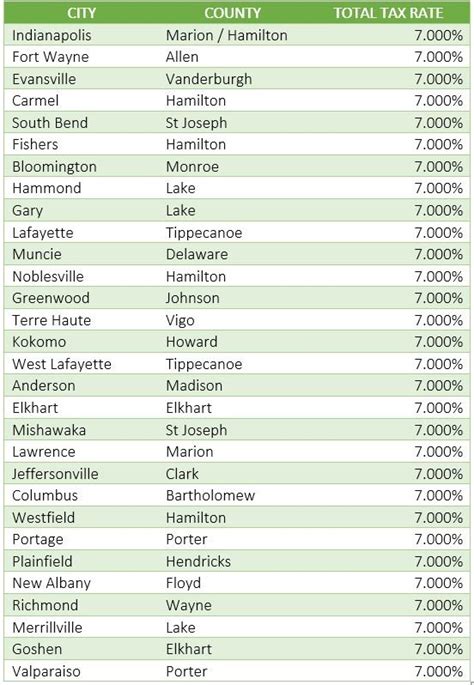

In addition to the state-level sales tax, Indiana allows local jurisdictions, such as counties and municipalities, to impose their own sales taxes. These local option sales taxes are added to the state’s general sales tax rate, creating a cumulative tax burden for consumers.

The local sales tax rates can vary significantly across the state, with some counties having no additional tax, while others may have rates as high as 2% or more. This local variation means that the total sales tax rate can differ considerably depending on where the purchase is made.

For instance, a consumer in Marion County, which includes the city of Indianapolis, would pay a total sales tax rate of 7% on most purchases. However, in Allen County, where Fort Wayne is located, the total sales tax rate could be as high as 8% due to the additional local option sales tax.

Sales Tax Exemptions and Special Cases

While the sales tax is a widespread mechanism for revenue generation, Indiana, like other states, provides exemptions and special cases to certain goods, services, and entities.

Sales Tax Exemptions

Indiana offers sales tax exemptions for a range of items, including:

- Non-Prepared Food: As mentioned earlier, most food items purchased for off-site consumption are exempt from the general sales tax, with a reduced rate of 1% applied instead.

- Prescription Drugs: The sale of prescription medications is exempt from the general sales tax, further reducing the tax burden for essential healthcare items.

- Agricultural Equipment: Farmers and agricultural businesses can purchase machinery, tools, and other equipment tax-free, promoting economic growth in the agricultural sector.

- Educational Resources: Books, school supplies, and certain educational materials are exempt from sales tax, encouraging investment in education.

- Manufacturing Machinery: Businesses engaged in manufacturing can purchase machinery and equipment without incurring sales tax, fostering industrial growth.

Special Cases

Indiana also has unique sales tax considerations for specific situations, such as:

- Internet Sales: Indiana has implemented a click-through nexus law, which requires out-of-state retailers with affiliate relationships in Indiana to collect and remit sales tax on purchases made by Indiana residents. This law aims to level the playing field for in-state retailers.

- Remote Sellers: Out-of-state sellers with no physical presence in Indiana but who sell to Indiana residents are required to register with the state and collect sales tax. This ensures that all online sales are taxed fairly.

- Use Tax: Indiana residents who make purchases from out-of-state sellers, either online or during travel, are required to pay a use tax to the state. This tax is self-reported and helps ensure that all purchases are taxed appropriately.

The Impact of Indiana’s Sales Tax

Indiana’s sales tax system has a significant impact on the state’s economy and its residents. While it provides a stable source of revenue for essential public services, it also influences consumer behavior and business operations.

Economic Impact

The sales tax plays a vital role in funding various public projects and initiatives. The revenue generated is allocated to infrastructure development, education, healthcare, and other social services. This investment in public goods helps stimulate economic growth and improve the overall quality of life for Indiana residents.

Additionally, the sales tax has an impact on the state's business environment. It encourages businesses to locate in Indiana by providing a stable tax system and a well-funded infrastructure. The selective sales tax rates also promote certain industries, such as agriculture and manufacturing, which are vital to the state's economy.

Consumer Behavior

Indiana’s sales tax can influence consumer purchasing decisions. The varying tax rates for different goods and services can encourage consumers to make more informed choices. For instance, the reduced tax rate on non-prepared food may encourage healthier eating habits, while the higher tax on entertainment can make consumers more conscious of their spending.

Moreover, the local variation in sales tax rates can lead to cross-border shopping, with consumers opting to make purchases in counties with lower tax rates. This behavior can impact local businesses and may require strategic planning to attract and retain customers.

Business Considerations

Businesses operating in Indiana need to navigate the state’s sales tax system carefully. They must understand the different tax rates, exemptions, and special cases to ensure compliance and avoid penalties. This includes accurately calculating and remitting sales tax on all applicable transactions.

For businesses selling to Indiana residents online or remotely, the click-through nexus law and remote seller registration requirements add complexity. They must stay informed about these regulations to ensure they are compliant with Indiana's sales tax laws.

Future Implications and Considerations

As the economy and consumer preferences evolve, Indiana’s sales tax system may need to adapt to remain effective and fair. Here are some considerations for the future:

- Online Sales Tax Collection: With the rise of e-commerce, ensuring fair tax collection from online sales is crucial. Indiana may need to enhance its remote seller registration and collection processes to keep up with the evolving digital landscape.

- Simplification of Tax Rates: While selective sales tax rates can promote certain industries, they can also create complexity. Simplifying the tax structure, while still promoting desired outcomes, could enhance compliance and reduce administrative burdens.

- Revenue Allocation: As the state's needs evolve, the allocation of sales tax revenue may need adjustment. Reevaluating how the tax revenue is distributed to support different sectors and initiatives could be beneficial.

- Cross-Border Shopping: With local sales tax variations, cross-border shopping may become more prevalent. Indiana may need to consider strategies to mitigate the impact on local businesses and encourage consumer spending within the state.

Conclusion

Indiana’s sales tax rate is a complex yet vital component of the state’s economy. It provides a stable revenue stream for public services while also influencing consumer choices and business operations. Understanding the nuances of Indiana’s sales tax system is essential for both consumers and businesses, ensuring compliance and promoting economic growth.

As the state continues to evolve, so too will its sales tax regulations. By staying informed and adapting to changing circumstances, Indiana can maintain a fair and effective tax system that benefits all its residents and businesses.

What is the sales tax rate in Indiana for online purchases?

+

Indiana requires online sellers with a significant economic presence in the state, such as through affiliate relationships, to collect and remit sales tax on purchases made by Indiana residents. The sales tax rate for online purchases is the same as for in-person sales, which is typically 7% at the state level, with additional local option sales taxes varying by county.

Are there any sales tax holidays in Indiana?

+

Indiana does not currently have any sales tax holidays. However, the state has considered implementing tax-free weekends in the past, focusing on back-to-school supplies and energy-efficient appliances. These proposals have not yet been enacted.

How often does Indiana’s sales tax rate change?

+

Indiana’s sales tax rate is relatively stable and has not seen significant changes in recent years. However, local option sales tax rates can vary, and counties may adjust these rates periodically. It’s essential to stay informed about local sales tax rates to ensure compliance.