Benton County Arkansas Property Tax

Benton County, located in the beautiful Ozark Mountains of Arkansas, is known for its stunning natural landscapes, thriving communities, and a vibrant real estate market. As property ownership is a significant aspect of many residents' lives, understanding the intricacies of Benton County property taxes is crucial. This comprehensive guide aims to provide an in-depth analysis of Benton County's property tax system, offering valuable insights for homeowners, prospective buyers, and investors.

Understanding Benton County’s Property Tax System

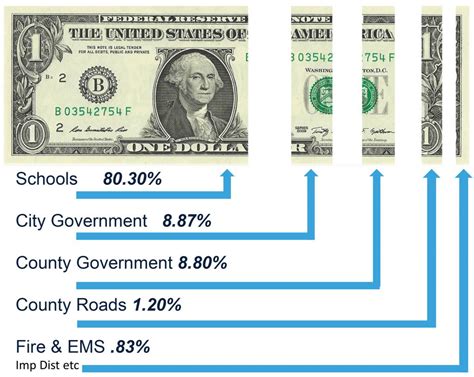

The property tax system in Benton County is a fundamental source of revenue for the county government, funding essential services such as education, infrastructure development, and public safety. The assessment and collection of property taxes are governed by the Arkansas Constitution and state statutes, providing a framework for a fair and equitable taxation process.

Property taxes in Benton County are calculated based on the assessed value of the property and the millage rate set by various taxing authorities. The assessed value is determined by the county assessor's office, which conducts regular property assessments to ensure accuracy and fairness. This value is then multiplied by the applicable millage rate to arrive at the property tax amount.

The millage rate, expressed in mills (where one mill equals one-tenth of a cent), is established by various taxing entities, including the county, school districts, cities, and special purpose districts. These entities have the authority to set their millage rates, which directly impact the property tax burden for residents and property owners.

Assessed Value Determination

The process of determining the assessed value of a property involves a thorough evaluation by the county assessor. This evaluation considers various factors, including the property’s location, size, age, condition, and recent sales data of comparable properties in the area. The assessor’s goal is to assign a fair market value to the property, ensuring that the tax burden is distributed equitably among property owners.

Benton County employs a mass appraisal system, where the assessor uses statistical techniques and market analysis to determine property values. This system ensures consistency and accuracy in assessments, minimizing the chances of arbitrary or unfair valuations.

Property owners have the right to appeal their assessed values if they believe the valuation is incorrect or unfair. The appeal process typically involves a review by the county's Board of Equalization, which considers the evidence presented by the property owner and the assessor's office before making a final determination.

Millage Rate and Tax Calculation

The millage rate is a critical factor in determining the property tax amount. It is set annually by the various taxing authorities and is typically approved through public hearings and budget processes. These authorities consider their revenue needs and the impact on taxpayers when setting the millage rate.

To calculate the property tax, the assessed value is multiplied by the applicable millage rate. For example, if a property has an assessed value of $200,000 and the total millage rate is 50 mills, the property tax would be calculated as follows:

| Assessed Value | Millage Rate | Property Tax |

|---|---|---|

| $200,000 | 50 mills | $1,000 |

It's important to note that the millage rate can vary significantly between different areas of Benton County, as it is set by individual taxing authorities. This means that properties in different school districts or municipalities may have different millage rates, resulting in varying property tax amounts.

Property Tax Rates and Comparisons

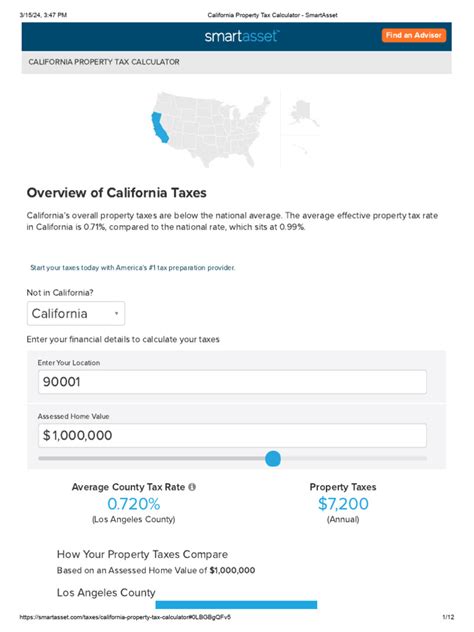

Benton County’s property tax rates are generally competitive when compared to other counties in Arkansas and across the United States. However, it’s essential to consider the specific characteristics of your property and the services provided by the taxing authorities to gain a comprehensive understanding of the tax burden.

According to recent data, the average effective property tax rate in Benton County is 0.63%, which is slightly below the national average of 1.08%. This rate is calculated by dividing the total property tax revenue by the total assessed value of all properties in the county.

When compared to neighboring counties, Benton County's property tax rates are relatively similar. For instance, neighboring Washington County has an average effective rate of 0.64%, while Madison County's rate is slightly higher at 0.71%. These comparisons provide a broader perspective on the tax landscape in the region.

Property Tax Rates by Municipality

Within Benton County, property tax rates can vary significantly depending on the municipality. Each city or town sets its own millage rate, which directly affects the property tax burden for residents.

For instance, the city of Bentonville has a total millage rate of 56.99, while the city of Rogers has a rate of 53.93. These rates include the millage for the county, school districts, and other special purpose districts. The difference in millage rates can result in varying tax amounts for properties located in different municipalities.

| Municipality | Total Millage Rate |

|---|---|

| Bentonville | 56.99 |

| Rogers | 53.93 |

| Bella Vista | 49.00 |

| Siloam Springs | 47.87 |

| Lowell | 54.57 |

Property Tax Rates by School District

School districts are a significant factor in property tax rates, as they typically have the highest millage rates among taxing authorities. In Benton County, school districts vary in their millage rates, with some districts having higher rates to support their educational programs and facilities.

For example, the Bentonville School District has a millage rate of 33.95, while the Rogers School District has a rate of 30.90. These rates are in addition to the county and municipal millage rates, contributing to the overall property tax burden for residents within these school districts.

| School District | Millage Rate |

|---|---|

| Bentonville School District | 33.95 |

| Rogers School District | 30.90 |

| Siloam Springs School District | 30.95 |

| Gentry School District | 31.70 |

| Elkins School District | 31.95 |

Property Tax Exemptions and Relief Programs

Benton County offers various property tax exemptions and relief programs to eligible property owners, providing financial assistance and reducing the tax burden for certain individuals and organizations.

Homestead Exemption

The homestead exemption is a widely utilized property tax relief program in Arkansas. This exemption reduces the assessed value of a property owner’s primary residence, resulting in lower property taxes. To qualify for the homestead exemption, the property must be the owner’s primary residence, and the owner must apply for the exemption with the county assessor’s office.

In Benton County, the homestead exemption reduces the assessed value of a primary residence by $3,500. This reduction directly lowers the property tax amount, providing significant savings for homeowners. It's important to note that the homestead exemption is not automatic and requires annual renewal.

Senior Citizen and Disabled Exemption

Benton County also offers property tax exemptions for senior citizens and disabled individuals. These exemptions provide partial or total relief from property taxes, depending on the applicant’s income and disability status. To qualify, applicants must meet specific income and disability criteria and provide the necessary documentation to the county assessor’s office.

The senior citizen exemption applies to homeowners aged 65 or older with an annual household income below a certain threshold. The disabled exemption is available to individuals with a permanent disability that affects their ability to work or earn an income. Both exemptions can provide substantial savings for eligible individuals.

Veteran Exemption

Benton County recognizes the service and sacrifice of its veterans by offering a property tax exemption for eligible veterans. This exemption reduces the assessed value of a veteran’s primary residence, resulting in lower property taxes. To qualify, veterans must have served in the armed forces during a period of war or national emergency and meet specific service and disability criteria.

The veteran exemption is particularly beneficial for those with disabilities or who have served multiple tours of duty. The county assessor's office works closely with veterans to ensure they receive the exemption they are entitled to, providing a valuable support system for those who have served our country.

Property Tax Payment and Deadlines

Property tax payments in Benton County are due twice a year, typically in October and March. The county assessor’s office sends property tax statements to all property owners, detailing the assessed value, millage rate, and the total amount due. It’s crucial for property owners to review these statements carefully and ensure timely payment to avoid penalties and interest charges.

Property owners have the option to pay their taxes in full or choose to pay in installments. The county offers various payment methods, including online payment portals, mail-in payments, and in-person payments at the county treasurer's office. It's recommended to explore the payment options available and choose the most convenient and secure method.

Penalty and Interest Charges

Late payment of property taxes in Benton County can result in penalty and interest charges. These charges are designed to encourage timely payment and ensure a steady revenue stream for the county and its taxing authorities. The penalty and interest rates are set by the county and can vary depending on the timing of the late payment.

It's essential for property owners to be aware of the payment deadlines and make every effort to pay their taxes on time. Late payments can not only result in additional charges but may also affect the property owner's credit score and financial stability.

Payment Assistance Programs

Benton County understands that financial hardships can impact property owners’ ability to pay their taxes on time. To provide assistance, the county offers payment plans and hardship exemptions for eligible individuals. These programs aim to support property owners facing temporary financial difficulties, allowing them to manage their tax obligations more flexibly.

Payment plans allow property owners to spread their tax payments over a specified period, reducing the financial burden of a lump-sum payment. Hardship exemptions provide temporary relief from property taxes for individuals facing financial hardships due to circumstances such as job loss, medical emergencies, or natural disasters.

Conclusion: Navigating Benton County’s Property Tax Landscape

Understanding the intricacies of Benton County’s property tax system is essential for property owners, prospective buyers, and investors. The county’s property tax rates, while competitive, can vary significantly depending on the specific characteristics of your property and its location within the county.

By familiarizing yourself with the assessment process, millage rates, and available exemptions, you can make more informed decisions about your property ownership and tax obligations. Additionally, staying up-to-date with payment deadlines and exploring available assistance programs can help ensure a smooth and stress-free property tax experience.

Benton County's commitment to transparency, fairness, and support for its residents is evident in its property tax system. As a property owner, you have the right to understand the process and seek assistance when needed. With the right knowledge and resources, navigating Benton County's property tax landscape can be a straightforward and manageable aspect of your property ownership journey.

Frequently Asked Questions

How often are property assessments conducted in Benton County?

+

Property assessments in Benton County are conducted annually. The county assessor’s office reviews and updates property values to ensure accuracy and fairness in the taxation process.

Can I appeal my property’s assessed value if I believe it is incorrect?

+

Yes, property owners have the right to appeal their assessed values. The appeal process involves submitting evidence to the county’s Board of Equalization, which reviews the case and makes a final determination.

What is the deadline for paying property taxes in Benton County?

+

Property taxes in Benton County are due twice a year, typically in October and March. It’s important to review your tax statements and make timely payments to avoid penalties and interest charges.

Are there any payment plans available for property taxes in Benton County?

+

Yes, Benton County offers payment plans for property taxes. These plans allow property owners to spread their tax payments over a specified period, providing flexibility for those facing financial challenges.

What exemptions are available for senior citizens in Benton County?

+

Benton County offers a senior citizen exemption for homeowners aged 65 or older with an annual household income below a certain threshold. This exemption provides partial or total relief from property taxes, depending on eligibility.