1040X Tax Form

The 1040X Amended U.S. Individual Tax Return is a critical tool for taxpayers to rectify errors or make adjustments to previously filed federal income tax returns. This form is an essential part of the U.S. tax system, allowing individuals to amend their tax returns and ensure accurate reporting to the Internal Revenue Service (IRS). In this comprehensive guide, we will delve into the intricacies of the 1040X tax form, exploring its purpose, usage, and the steps involved in the amendment process.

Understanding the 1040X Tax Form

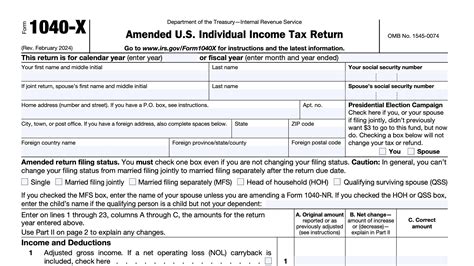

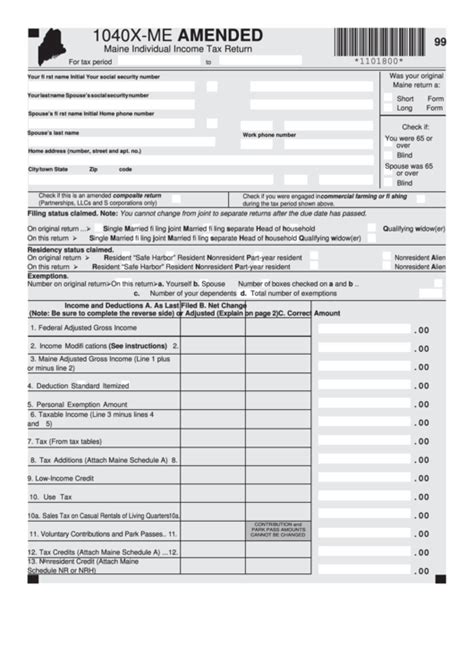

The 1040X tax form is designed to amend a previously filed Form 1040, which is the standard tax return form for individual taxpayers. It is used to correct mistakes or make necessary adjustments to income, deductions, credits, or any other information reported on the original tax return. The need for an amended return may arise due to various reasons, such as discovering an error, receiving additional income or deductions, or experiencing changes in tax filing status.

It's important to note that the 1040X form is not a substitute for refiling an entire tax return. Instead, it is a targeted tool to make specific changes to the original return. The form allows taxpayers to amend their tax returns for the current tax year or up to three previous tax years. This means individuals can address past mistakes or adjustments that were overlooked during the initial filing process.

Key Features and Specifications of the 1040X Form

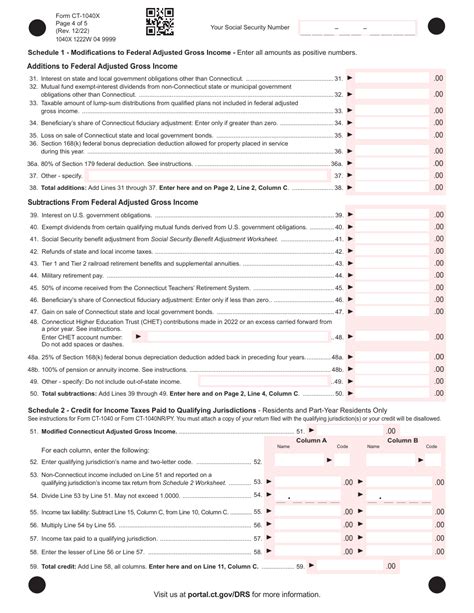

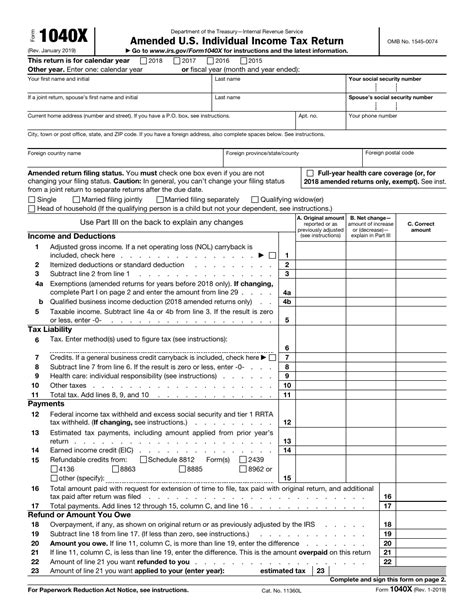

The 1040X form consists of three columns: Original Amount, Change, and Correct Amount. These columns are used to indicate the changes being made to the original tax return. Taxpayers must complete all applicable lines and provide supporting documentation to substantiate the amendments. The form also includes instructions and guidelines to ensure accurate completion.

| Column | Description |

|---|---|

| Original Amount | This column is used to enter the original amounts reported on the previous tax return. |

| Change | Here, taxpayers indicate the increase or decrease in the original amount due to the amendment. |

| Correct Amount | The correct amount column reflects the adjusted figure after the amendment. |

Additionally, the 1040X form requires taxpayers to provide a detailed explanation of the changes made. This explanation should be clear and concise, detailing the reason for the amendment and any supporting evidence. It is crucial to provide accurate and complete information to avoid further complications or delays in processing the amended return.

When to Use the 1040X Tax Form

The 1040X tax form is typically utilized in the following scenarios:

- Correcting Errors: If a taxpayer discovers a mistake in their original tax return, such as incorrect income reporting, missing deductions, or miscalculations, the 1040X form can be used to rectify these errors.

- Receiving Additional Income or Deductions: In cases where a taxpayer receives additional income or becomes eligible for new deductions after filing their initial return, the 1040X form allows them to claim these adjustments.

- Changes in Tax Status: Life events such as marriage, divorce, or the birth of a child can impact tax filing status. The 1040X form can be used to reflect these changes and adjust the tax return accordingly.

- Addressing IRS Adjustments: If the IRS makes adjustments to a taxpayer's return, the 1040X form can be used to agree or disagree with these changes and provide additional information.

Common Reasons for Amending a Tax Return

Here are some common scenarios that may warrant the use of the 1040X tax form:

- Forgotten Deductions: Taxpayers may realize they forgot to claim certain deductions, such as charitable contributions, medical expenses, or education credits, after filing their initial return.

- Income Adjustments: Additional income, such as unreported self-employment earnings or investment gains, may come to light after the original return is filed.

- Claiming Refundable Credits: Taxpayers may become eligible for refundable credits, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit, after their initial filing.

- Errors in Tax Calculations: Miscalculations in tax liability or refunds can occur, requiring the use of the 1040X form to correct these mistakes.

Steps to Amend Your Tax Return Using the 1040X Form

Amending your tax return using the 1040X form involves several important steps. Here's a comprehensive guide to help you through the process:

Step 1: Identify the Need for Amendment

The first step is to determine if an amendment is necessary. Carefully review your original tax return and any supporting documentation. Look for errors, missed deductions or credits, or changes in your tax situation that require adjustment.

Step 2: Gather Required Documentation

Before filing the 1040X form, gather all necessary documentation to support your amendments. This may include pay stubs, receipts, bank statements, or any other relevant records that validate the changes you are making to your tax return.

Step 3: Complete the 1040X Form

Carefully follow the instructions provided with the 1040X form. Fill out all applicable lines, providing the original amounts, changes, and correct amounts for each adjustment. Ensure that you complete the form accurately and provide a clear and concise explanation of your amendments.

Step 4: Calculate the Difference

Calculate the difference between the original tax liability or refund and the corrected amount. This will determine whether you owe additional taxes or are entitled to a larger refund.

Step 5: Prepare Supporting Documentation

Along with the 1040X form, you must submit supporting documentation to substantiate your amendments. Organize your records and ensure they are easily accessible for review by the IRS.

Step 6: File the 1040X Form

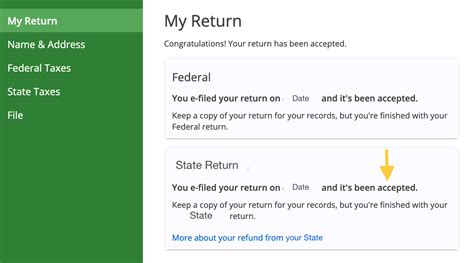

Submit your completed 1040X form and supporting documentation to the IRS. You can file the form electronically or by mail, depending on your preference and the complexity of your amendments.

Step 7: Await Processing

Once you have filed your amended return, the IRS will process your 1040X form. The processing time can vary, but it typically takes several weeks to several months. During this time, you may receive correspondence from the IRS regarding your amendment.

Step 8: Follow Up

If you have not received a response or refund after a reasonable period, consider contacting the IRS to inquire about the status of your amended return. Keep records of any communications with the IRS for future reference.

Best Practices and Considerations for Amending Your Tax Return

When using the 1040X tax form to amend your tax return, it's essential to follow best practices to ensure a smooth and accurate amendment process. Here are some key considerations:

Accuracy and Attention to Detail

Pay close attention to detail when completing the 1040X form. Double-check all calculations, amounts, and supporting documentation to avoid further errors or complications. Accuracy is crucial to maintain the integrity of your amended return.

Timely Filing

It's important to file your amended return within the designated time frame. The IRS allows taxpayers to amend their returns for up to three previous tax years. However, it's best to file the 1040X form as soon as you become aware of the need for an amendment to avoid potential penalties or interest charges.

Seek Professional Assistance

If you are unsure about the amendment process or have complex tax situations, consider seeking the assistance of a tax professional or a certified public accountant (CPA). They can provide guidance and ensure that your amended return is completed accurately and in compliance with IRS regulations.

Keep Records and Documentation

Maintain organized records and documentation to support your amended return. This includes keeping copies of your original tax return, the 1040X form, supporting documents, and any correspondence with the IRS. These records can be valuable for future reference and may be required during an IRS audit.

Understand the Impact of Amendments

Before filing an amended return, understand the potential impact on your tax liability or refund. Amendments can result in additional tax owed or a larger refund, depending on the nature of the changes. Be prepared for any financial implications and plan accordingly.

Stay Informed about Tax Laws and Updates

Stay updated on tax laws and regulations, as they may impact your amended return. The IRS regularly publishes updates and guidance on its website. Staying informed can help you navigate any changes and ensure compliance with the latest tax requirements.

The Importance of Accurate Tax Reporting and Compliance

Accurate tax reporting is fundamental to maintaining a fair and efficient tax system. The 1040X tax form plays a crucial role in ensuring that taxpayers can correct mistakes and maintain compliance with tax laws. By utilizing the 1040X form when necessary, individuals can uphold their tax obligations and avoid potential penalties or legal consequences.

Potential Consequences of Inaccurate Tax Reporting

Inaccurate tax reporting can lead to various consequences, including:

- Audits: The IRS may select your return for an audit if it identifies inconsistencies or discrepancies. Audits can be time-consuming and require extensive documentation.

- Penalties and Interest: Failing to report income accurately or claiming incorrect deductions can result in penalties and interest charges. These can significantly increase your tax liability.

- Legal Consequences: Deliberate attempts to falsify tax returns or engage in tax fraud can lead to criminal charges and severe penalties, including fines and imprisonment.

Benefits of Accurate Tax Reporting

On the other hand, accurate tax reporting offers several benefits, such as:

- Peace of Mind: Knowing that your tax returns are accurate and compliant provides peace of mind and reduces the risk of IRS scrutiny.

- Eligibility for Credits and Refunds: Accurate reporting ensures that you receive all the credits and refunds you are entitled to, maximizing your tax savings.

- Efficient Tax Planning: Accurate tax reporting allows for better tax planning, helping you optimize your tax strategy and make informed financial decisions.

Conclusion

The 1040X tax form is a vital tool for taxpayers to amend their federal income tax returns and ensure accurate reporting to the IRS. By understanding the purpose, usage, and steps involved in the amendment process, individuals can effectively rectify errors or make necessary adjustments to their tax returns. Accurate tax reporting is essential for maintaining compliance, avoiding penalties, and optimizing tax benefits. Remember to approach the amendment process with caution, accuracy, and professional guidance when needed.

Frequently Asked Questions

How long does it take for the IRS to process an amended return using the 1040X form?

+

The processing time for an amended return can vary. On average, it takes the IRS several weeks to several months to process a 1040X form. Factors such as the complexity of the amendments and the volume of amended returns received by the IRS can impact the processing time.

Can I amend my tax return if I filed it electronically (e-filed)?

+

Yes, you can amend an electronically filed tax return. To do so, you will need to prepare and submit a paper 1040X form along with any supporting documentation. Ensure that you include your prior-year Adjusted Gross Income (AGI) to validate your identity.

Are there any penalties for filing an amended return using the 1040X form?

+

Generally, there are no penalties for filing an amended return using the 1040X form. However, if you owe additional taxes as a result of the amendments and fail to pay them within the required timeframe, you may be subject to interest and penalty charges. It’s important to pay any additional taxes owed promptly to avoid further complications.

Can I amend multiple tax years on a single 1040X form?

+

No, you cannot amend multiple tax years on a single 1040X form. Each tax year must be amended separately using a separate 1040X form. This ensures that the IRS can properly process and review each amendment individually.

What happens if I discover additional errors after filing an amended return using the 1040X form?

+

If you discover additional errors after filing an amended return, you can file another 1040X form to correct those errors. It’s important to accurately identify and address all errors to ensure an accurate tax return. Keep in mind that the IRS allows taxpayers to amend their returns for up to three previous tax years.