California Capital Gains Tax Rate

California, the Golden State, is renowned for its diverse landscapes, vibrant cities, and thriving economy. It is a state that boasts not only natural beauty and cultural attractions but also a robust business environment, making it a hub for entrepreneurs and investors alike. One crucial aspect of doing business in California is understanding the state's tax structure, particularly when it comes to capital gains. In this comprehensive guide, we will delve into the intricacies of California's capital gains tax rate, exploring its implications, variations, and potential strategies to navigate this essential financial aspect.

Understanding California’s Capital Gains Tax

Capital gains tax is a critical consideration for any investor or business owner, and California, with its thriving economy, presents a unique set of rules and rates. This section will provide an in-depth understanding of what capital gains tax entails in the context of California’s tax landscape.

Capital gains tax is levied on the profits made from the sale of investments or assets. In California, this tax is applied to a wide range of investments, including stocks, bonds, real estate, and business interests. The state's tax structure distinguishes between short-term and long-term capital gains, with different rates and considerations for each.

Short-Term vs. Long-Term Capital Gains

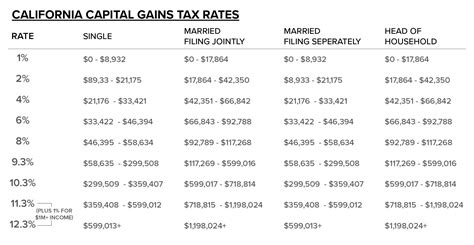

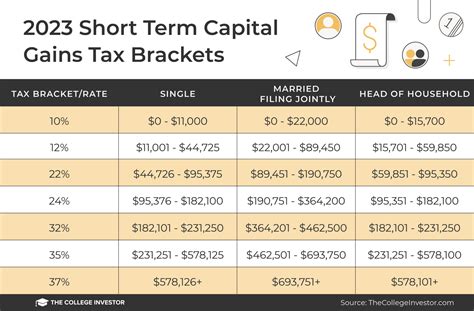

Short-term capital gains refer to profits made from assets held for a year or less. These gains are taxed at the investor’s ordinary income tax rate, which can range from 1% to 13.3% in California, depending on their income bracket. The tax rate for short-term capital gains is often higher than that for long-term gains, as it is considered a more immediate profit and thus subject to a higher tax burden.

Long-term capital gains, on the other hand, are profits derived from assets held for more than a year. These gains are taxed at a lower rate, currently set at 3.9% in California. The state offers this reduced rate to encourage long-term investment and stable economic growth. Understanding the distinction between short-term and long-term capital gains is crucial for investors and business owners to optimize their tax strategies.

| Capital Gains Type | Tax Rate | Holding Period |

|---|---|---|

| Short-Term | 1% - 13.3% | Held for a year or less |

| Long-Term | 3.9% | Held for more than a year |

California’s Tax Structure: A Comprehensive Overview

California’s tax system is complex, and understanding its nuances is essential for businesses and investors operating within the state. This section will provide a detailed analysis of California’s tax structure, including the various taxes and rates that apply to individuals and businesses.

Personal Income Tax Rates

California has a progressive personal income tax system, which means that higher income levels are taxed at higher rates. The state’s income tax rates range from 1% to 13.3%, with seven tax brackets in total. The specific tax rate an individual pays depends on their taxable income, which is calculated after deductions and exemptions.

| Tax Bracket | Tax Rate | Taxable Income Range |

|---|---|---|

| 1 | 1% | Up to $10,658 |

| 2 | 2% | $10,659 - $21,317 |

| 3 | 4% | $21,318 - $37,298 |

| 4 | 6% | $37,299 - $55,948 |

| 5 | 8% | $55,949 - $91,975 |

| 6 | 9.3% | $91,976 - $261,137 |

| 7 | 13.3% | Over $261,137 |

It's important to note that these tax rates are subject to change, and individuals should consult the latest tax guidelines for the most accurate information.

Business Tax Rates and Incentives

California offers a range of business tax rates and incentives to attract and support businesses operating within the state. The primary business tax is the Corporation Tax, which is levied on the net income of corporations doing business in California. The tax rate for this is currently set at 8.84%.

Additionally, California offers various tax incentives and credits to encourage specific business activities. These incentives can significantly reduce a business's tax liability and include credits for research and development, hiring veterans, and investing in renewable energy projects. Understanding these incentives can be crucial for businesses looking to optimize their tax strategies and contribute to the state's economic growth.

Strategies for Optimizing Capital Gains Tax in California

Navigating California’s capital gains tax landscape can be complex, but with the right strategies, investors and business owners can minimize their tax burden while still contributing to the state’s economy. This section will explore some expert strategies for optimizing capital gains tax in California.

Long-Term Investment Strategies

One of the most effective strategies for minimizing capital gains tax is to hold investments for the long term. As mentioned earlier, long-term capital gains are taxed at a significantly lower rate than short-term gains. By adopting a long-term investment mindset, investors can take advantage of this reduced tax rate and potentially save a substantial amount on their tax liability.

Additionally, long-term investments can benefit from the power of compounding. Over time, investments can grow exponentially, and the tax savings on these long-term gains can further enhance an investor's portfolio. It's important to note that long-term investment strategies should be aligned with an individual's risk tolerance and financial goals.

Tax-Efficient Investment Vehicles

California offers a range of tax-efficient investment vehicles that can help investors minimize their capital gains tax liability. These include tax-exempt municipal bonds, which are free from federal and state taxes, making them an attractive option for investors looking to reduce their tax burden. Additionally, retirement accounts like 401(k)s and IRAs offer tax advantages, allowing investors to defer taxes on their investments until retirement.

Other tax-efficient investment options include real estate investment trusts (REITs) and master limited partnerships (MLPs). These vehicles offer the potential for steady income and capital appreciation while providing tax benefits, making them an attractive option for investors looking to optimize their tax strategies.

Utilizing Tax Credits and Deductions

California provides a range of tax credits and deductions that can help individuals and businesses reduce their overall tax liability. For businesses, this can include research and development tax credits, which incentivize innovation and technological advancement. Additionally, businesses can take advantage of deductions for business expenses, employee benefits, and contributions to pension plans.

For individuals, tax credits and deductions can also significantly reduce their tax burden. This includes deductions for mortgage interest, charitable contributions, and state and local taxes. Furthermore, California offers tax credits for various activities, such as adopting energy-efficient practices and investing in renewable energy projects.

Future Implications and Considerations

As with any aspect of tax law, California’s capital gains tax structure is subject to change and evolution. This section will explore potential future implications and considerations for investors and businesses operating in the state.

Potential Tax Law Changes

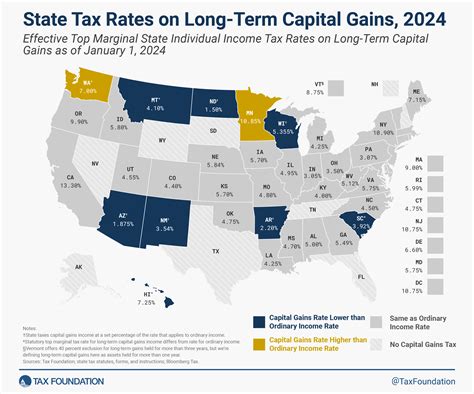

California’s tax laws are constantly evolving, and it’s essential for investors and businesses to stay informed about potential changes. One of the key considerations is the possibility of tax rate adjustments. While the state’s tax rates are currently stable, there is always a chance that they could be modified, either to increase revenue or to encourage specific economic behaviors.

Additionally, California's tax structure may undergo changes to align with federal tax reforms. Any significant federal tax law changes can have a ripple effect on state tax laws, potentially impacting capital gains tax rates and incentives. Staying informed about federal and state tax reforms is crucial for businesses and investors to adapt their strategies accordingly.

Economic Impact and Growth Strategies

California’s capital gains tax structure plays a significant role in the state’s economic growth and development. The reduced rate for long-term capital gains, for instance, encourages investors to hold onto their assets, fostering stability in the market. Additionally, the state’s tax incentives for businesses can attract new investments and encourage the growth of existing enterprises.

However, the impact of capital gains tax on the economy is a delicate balance. While a reduced tax rate can encourage investment, it can also lead to a reduction in tax revenue for the state. As such, California's tax policymakers must carefully consider the economic implications of any changes to the capital gains tax structure to ensure sustainable economic growth.

How often do California's capital gains tax rates change?

+California's capital gains tax rates are relatively stable, but they can change periodically, often in response to economic conditions or legislative decisions. It's essential to stay updated with the latest tax guidelines to ensure compliance.

Are there any tax breaks for small businesses in California?

+Yes, California offers various tax incentives and credits for small businesses, including tax breaks for hiring veterans, investing in renewable energy, and conducting research and development activities.

What is the difference between state and federal capital gains tax rates?

+State and federal capital gains tax rates can vary significantly. California, for example, has a separate capital gains tax rate from the federal rate, which is currently 20% for long-term capital gains. It's crucial to understand both state and federal tax rates to optimize your tax strategy.

In conclusion, California's capital gains tax structure is a critical aspect of doing business and investing within the state. By understanding the nuances of this tax, including the distinction between short-term and long-term capital gains, investors and business owners can make informed decisions to optimize their tax strategies. From long-term investment strategies to tax-efficient investment vehicles and utilizing tax credits, there are numerous ways to navigate California's capital gains tax landscape effectively.

As the Golden State continues to evolve its tax policies, staying informed about potential changes and their economic implications is essential. California’s tax structure plays a vital role in the state’s economic growth and stability, and by understanding its intricacies, investors and businesses can contribute to the state’s prosperity while minimizing their tax burden.