Wayne County Property Tax

Wayne County, home to Detroit and a host of other vibrant communities, is a dynamic region in Michigan with a rich history and a diverse range of properties. The county's property tax system plays a crucial role in funding essential services and infrastructure, making it a topic of interest for both residents and investors alike. This comprehensive guide delves into the intricacies of Wayne County property tax, shedding light on its assessment process, rates, exemptions, and more.

Understanding Wayne County Property Tax

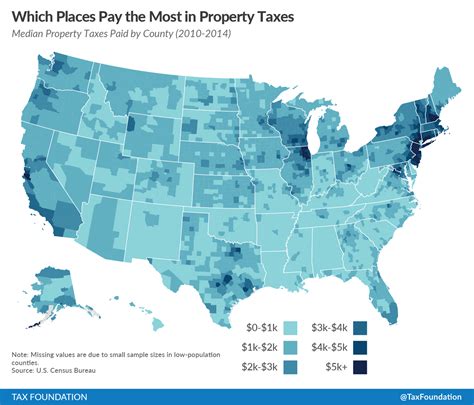

Property taxes are a significant source of revenue for local governments in the United States, and Wayne County is no exception. These taxes are levied on both real estate and personal property, with the primary purpose of funding vital public services such as education, public safety, healthcare, and infrastructure development.

In Wayne County, the property tax system is administered by the Wayne County Treasurer's Office, which is responsible for assessing, collecting, and distributing property taxes to various governmental entities within the county. The tax revenue collected helps support local schools, police and fire departments, libraries, parks, and other essential services.

The Assessment Process

The foundation of Wayne County’s property tax system lies in the assessment process. Assessors from the Wayne County Equalization Department are tasked with determining the taxable value of each property within the county. This value is based on a combination of factors, including:

- Market Value: The market value of a property is an important consideration. It represents the price that a willing buyer and seller would agree upon in an open and competitive market.

- Comparable Sales: Assessors analyze recent sales of similar properties in the area to ensure fairness and accuracy in their assessments.

- Property Characteristics: Factors such as size, age, condition, and improvements made to the property are taken into account.

- Economic Factors: The local economy and real estate market trends influence property values and, consequently, tax assessments.

Once the taxable value is determined, it serves as the basis for calculating the property tax bill. This value can change over time due to factors like market fluctuations, property improvements, or changes in local regulations.

Tax Rates and Calculations

The property tax rate in Wayne County is expressed as a millage rate, which is the number of dollars in tax per thousand dollars of taxable value. This rate is determined by the taxing authorities, including the county, cities, townships, school districts, and special assessment districts, and it can vary across different areas within the county.

To calculate the property tax, the taxable value of the property is multiplied by the applicable millage rate. For example, if a property has a taxable value of $100,000 and the total millage rate is 50 mills, the property tax would be calculated as follows:

$100,000 (taxable value) x 0.050 (50 mills) = $5,000 (property tax)

It's important to note that the millage rate is subject to change annually, and property owners can find the current rate on the Wayne County Treasurer's website or by contacting their local taxing authorities.

Tax Exemptions and Credits

Wayne County offers various tax exemptions and credits to eligible property owners, which can significantly reduce their tax burden. Some of the key exemptions and credits include:

- Homestead Exemption: This exemption is available to primary homeowners who occupy their property as their principal residence. It provides a reduction in the taxable value of the property, effectively lowering the property tax.

- Poverty Exemption: Low-income homeowners may qualify for a poverty exemption, which reduces the taxable value of their property based on income criteria.

- Veterans' Exemption: Veterans and their surviving spouses may be eligible for a property tax exemption based on their military service.

- Senior Citizen Exemption: Senior citizens aged 65 and older may qualify for an exemption, which provides a reduction in their taxable value.

- Agricultural Property Tax Credit: Property owners who use their land for agricultural purposes may be eligible for a credit, reducing their tax liability.

It's crucial for property owners to understand their eligibility for these exemptions and credits and to ensure they are applied correctly to their tax assessments.

The Impact of Property Taxes

Property taxes in Wayne County play a vital role in the financial health and sustainability of the community. The revenue generated through property taxes directly impacts the quality of life for residents by funding essential services and infrastructure projects. Here are some key areas where property taxes make a difference:

Education

A significant portion of property tax revenue in Wayne County goes towards funding public education. This includes supporting local schools, providing resources for teachers and students, and maintaining school facilities. Investing in education is crucial for fostering a skilled workforce and promoting economic growth in the county.

Public Safety

Property taxes are essential for funding police and fire departments, ensuring the safety and security of residents and businesses. Adequate funding allows for the recruitment and training of personnel, the purchase of necessary equipment, and the maintenance of emergency response capabilities.

Infrastructure Development

Property taxes contribute to the development and maintenance of critical infrastructure in Wayne County. This includes roads, bridges, public transportation systems, and utilities. Well-maintained infrastructure not only improves the quality of life for residents but also attracts businesses and investment, driving economic growth.

Community Services

Property taxes support a wide range of community services, such as libraries, parks, recreational facilities, and cultural institutions. These services enhance the overall well-being and social fabric of the community, providing opportunities for education, leisure, and cultural enrichment.

Navigating the Property Tax System

Understanding and navigating the property tax system in Wayne County can be complex, but there are resources available to assist property owners. Here are some key steps and considerations:

Assessing Your Property

If you believe your property assessment is inaccurate, you have the right to appeal. The Wayne County Equalization Department provides guidelines and a formal process for appealing assessments. It’s essential to gather evidence and supporting documentation to strengthen your case.

Exemptions and Credits

Stay informed about the various exemptions and credits available in Wayne County. Ensure you meet the eligibility criteria and take advantage of these opportunities to reduce your tax burden. The Wayne County Treasurer’s Office provides detailed information on these programs.

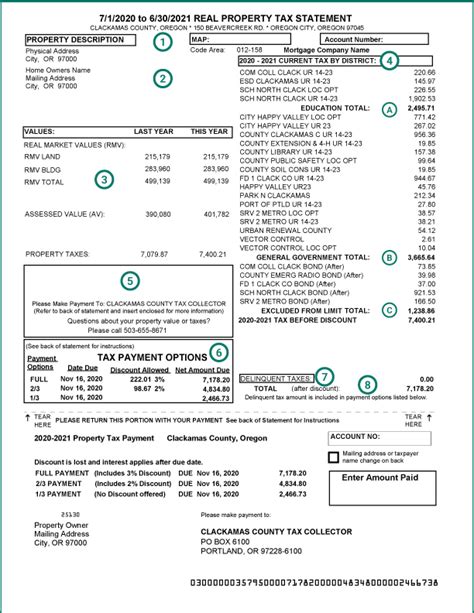

Tax Payment Options

Wayne County offers several payment options for property taxes, including online payments, payment plans, and in-person payments at designated locations. It’s important to stay informed about deadlines and to explore any available payment assistance programs.

Understanding Tax Bills

Review your tax bills carefully to ensure accuracy. Pay attention to the breakdown of the tax amount, the applicable millage rate, and any exemptions or credits applied. If you have questions or concerns, contact the Wayne County Treasurer’s Office for clarification.

Future Outlook and Considerations

As Wayne County continues to evolve and adapt to changing economic and social dynamics, the property tax system will play a pivotal role in shaping its future. Here are some key considerations for the future:

Economic Development

A vibrant and competitive business environment is essential for attracting investment and creating jobs. Property taxes, when managed effectively, can support economic development initiatives, such as infrastructure improvements and business incentives, fostering growth and prosperity in the county.

Equitable Tax Distribution

Ensuring an equitable distribution of tax burden is crucial for maintaining social cohesion and fairness. Wayne County should continue to explore ways to distribute tax responsibilities fairly across different types of properties and income levels, considering the unique needs and circumstances of its diverse communities.

Community Engagement

Engaging with residents and stakeholders is vital for building trust and understanding in the property tax system. Transparent communication, public forums, and educational initiatives can help demystify the process, address concerns, and foster a sense of ownership and responsibility among taxpayers.

Technological Innovations

Embracing technological advancements can streamline the property tax system, making it more efficient and accessible. Online portals, mobile apps, and digital payment options can enhance convenience and transparency for taxpayers.

| Key Statistic | Value |

|---|---|

| Median Property Value in Wayne County | $120,000 |

| Average Annual Property Tax Rate | 2.5% |

| Homestead Exemption Savings (Average) | $1,200 |

| Total Property Tax Revenue (FY 2022) | $450 million |

How often are property assessments conducted in Wayne County?

+Property assessments in Wayne County are conducted annually. Assessors review and update property values based on market conditions and other factors to ensure fairness and accuracy in tax assessments.

Can I appeal my property assessment if I believe it is incorrect?

+Yes, you have the right to appeal your property assessment if you believe it is inaccurate. The Wayne County Equalization Department provides a formal appeals process. You will need to provide evidence and supporting documentation to support your case.

What are the deadlines for paying property taxes in Wayne County?

+Property taxes in Wayne County are due twice a year, with specific deadlines set by the Wayne County Treasurer’s Office. It’s important to stay informed about these deadlines to avoid penalties and interest charges.

Are there any assistance programs for property tax payments in Wayne County?

+Yes, Wayne County offers various assistance programs to help property owners with their tax payments. These programs include payment plans, deferred payment options, and exemptions for low-income homeowners. Contact the Wayne County Treasurer’s Office for more information.

How can I stay informed about changes in property tax rates and regulations in Wayne County?

+Stay updated by regularly visiting the Wayne County Treasurer’s website, which provides the latest information on tax rates, regulations, and any changes or updates. You can also subscribe to their newsletter or follow their social media channels for timely notifications.