Ms State Tax Refund Status Login

Welcome to this comprehensive guide on understanding and navigating the Ms State Tax Refund Status Login process. This article aims to provide an in-depth analysis, step-by-step instructions, and valuable insights into managing your tax refund status efficiently. Whether you're a first-time user or a seasoned taxpayer, this guide will ensure you have a seamless experience when checking the status of your Mississippi state tax refunds.

Understanding the Ms State Tax Refund Status Login

The Ms State Tax Refund Status Login is a secure online portal provided by the Mississippi Department of Revenue to enable taxpayers to track the progress of their state tax refunds. This user-friendly platform offers a convenient way to monitor the status of your refund, from the moment your tax return is processed to the final refund payment.

By logging into the portal, you gain access to real-time information about your refund, including its current stage in the processing pipeline, estimated payment date, and any updates or messages from the Department of Revenue. This transparency ensures you can stay informed and make informed decisions regarding your financial planning.

Key Benefits of Using the Ms State Tax Refund Status Login

- Real-Time Updates: The login portal provides up-to-date information, ensuring you’re always aware of the latest status of your refund.

- Convenience: Accessible from anywhere with an internet connection, the portal eliminates the need for lengthy phone calls or visits to tax offices.

- Security: With robust security measures in place, your personal and financial information remains protected throughout the login process.

- Self-Service: You have control over your tax refund journey, allowing you to check the status at your convenience without relying on external assistance.

Step-by-Step Guide to Accessing Your Ms State Tax Refund Status

Follow these simple steps to log in and view the status of your Mississippi state tax refund:

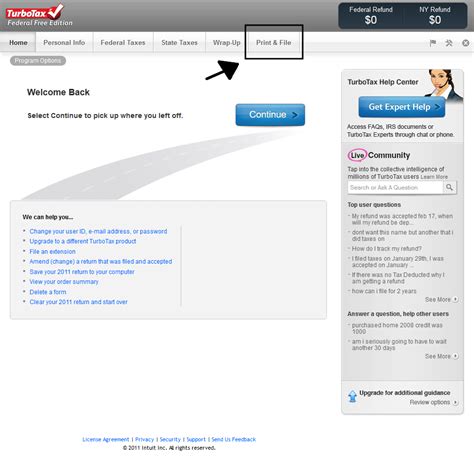

Step 1: Navigate to the Official Portal

Begin by opening your preferred web browser and visiting the official Mississippi Department of Revenue website. This is the trusted source for accessing your tax refund information, ensuring the security and accuracy of your data.

Step 2: Locate the Login Section

Once on the website, look for the “Taxpayer Login” or “My Account” section. This is typically located in a prominent position on the homepage, making it easy to find and access.

Step 3: Enter Your Credentials

To access your account, you’ll need to provide your User ID and Password. These credentials were created when you initially registered for the online portal. If you’ve forgotten your login details, the website provides a “Forgot User ID/Password” link to assist you in retrieving or resetting your information securely.

Step 4: Log In and View Your Refund Status

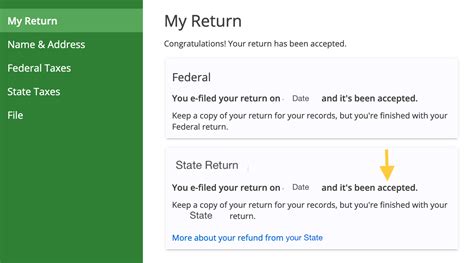

After entering your credentials, click the “Log In” button to access your personalized account dashboard. Here, you’ll find a dedicated section for tracking your tax refund status. The dashboard provides a clear overview of your refund, including its current stage, estimated payment date, and any recent updates or messages from the Department of Revenue.

Step 5: Monitor Your Refund Progress

Regularly check your account to stay updated on the progress of your refund. The portal will provide real-time updates, ensuring you’re always informed. If there are any delays or additional requirements, you’ll receive notifications through the portal, allowing you to take prompt action if needed.

Frequently Asked Questions (FAQ)

Q: How long does it typically take for my Mississippi state tax refund to be processed?

+The processing time for Mississippi state tax refunds can vary depending on several factors, including the complexity of your tax return and the volume of returns being processed. Generally, it takes approximately 4 to 6 weeks from the date you file your return for it to be processed and the refund to be issued. However, in some cases, it may take longer, especially during peak tax season.

Q: Can I check my refund status without logging in to the portal?

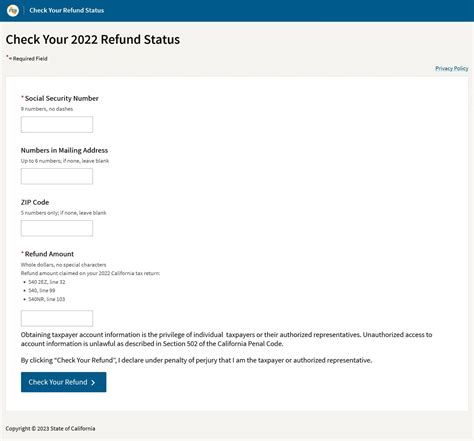

+While logging in to the Ms State Tax Refund Status Login portal provides the most comprehensive and up-to-date information, you can also check your refund status using the Where’s My Refund tool on the Mississippi Department of Revenue website. This tool allows you to enter your Social Security Number, filing status, and exact refund amount to obtain a status update. However, the portal offers a more detailed and personalized experience.

Q: What should I do if my refund status shows as “Processing” for an extended period?

+If your refund status remains in the “Processing” stage for an unusually long time, it may indicate a potential issue with your tax return. In such cases, it’s advisable to contact the Mississippi Department of Revenue directly. They can provide specific guidance and assist you in resolving any problems that may be delaying your refund. Their contact information is available on their official website.

Q: Can I receive my tax refund via direct deposit if I use the Ms State Tax Refund Status Login portal?

+Yes, when filing your Mississippi state tax return, you have the option to choose direct deposit as your preferred refund method. This allows the Department of Revenue to deposit your refund directly into your bank account, typically within a shorter timeframe compared to a paper check. To set up direct deposit, ensure you provide accurate banking information during the tax filing process.

Q: Is it possible to receive status updates via email or text message?

+At present, the Ms State Tax Refund Status Login portal does not offer automatic email or text message notifications for refund status updates. However, you can regularly log in to the portal to check for any changes or updates manually. Alternatively, you can bookmark the “Where’s My Refund” tool for quick access to check your status without logging in.

Conclusion: Empowering Taxpayers with Transparency and Control

The Ms State Tax Refund Status Login portal is a powerful tool that empowers Mississippi taxpayers with transparency and control over their tax refund journey. By following the simple steps outlined in this guide, you can efficiently access and monitor the progress of your state tax refunds. The portal’s user-friendly interface and real-time updates ensure a seamless experience, allowing you to make informed decisions and plan your finances effectively.

Remember, staying informed is key to a smooth tax refund process. Regularly check your account, keep your contact information updated, and reach out to the Department of Revenue if you have any concerns. With the convenience and security of the Ms State Tax Refund Status Login, managing your tax refunds has never been easier.