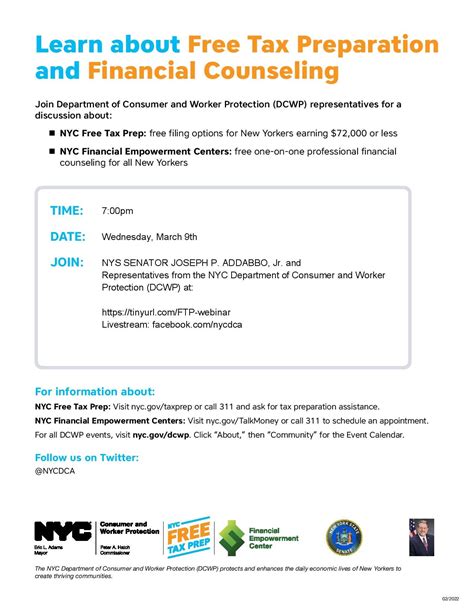

Free Tax Filing In New York

Navigating the complexities of tax filing can be a daunting task, especially for residents of bustling cities like New York. However, there's good news! New York offers various avenues for free tax filing, ensuring that its residents can fulfill their tax obligations without incurring additional costs. In this comprehensive guide, we'll explore the options available to New Yorkers, shedding light on the processes, eligibility criteria, and the benefits of utilizing these free services.

The Importance of Free Tax Filing

Taxes are an inevitable part of our financial lives, and understanding how to navigate the system efficiently is crucial. Free tax filing services provide an excellent opportunity for individuals, especially those with limited means, to access professional assistance without financial strain. In a city as diverse and economically varied as New York, such initiatives play a pivotal role in promoting financial inclusivity and ensuring that every resident has the tools to manage their tax responsibilities effectively.

Options for Free Tax Filing in New York

New York State and various community organizations offer multiple avenues for residents to file their taxes for free. These options cater to a wide range of income levels and circumstances, making it easier for New Yorkers to choose the most suitable path.

1. Volunteer Income Tax Assistance (VITA) Program

The VITA program is a federal initiative aimed at providing free tax help to individuals who earn $57,000 or less and need assistance during tax season. Trained volunteers offer face-to-face assistance at various community locations, ensuring that taxpayers receive personalized guidance and support. This program is particularly beneficial for those who may struggle with online tax filing or prefer in-person interactions.

To find a VITA site near you, you can use the IRS VITA Locator. Simply enter your zip code to discover nearby locations offering this service. It’s important to note that due to the COVID-19 pandemic, some VITA sites may have limited hours or offer services by appointment only. Therefore, it’s advisable to check the site’s status before planning your visit.

2. Free File Program

For taxpayers who are comfortable with online filing, the Free File program offers a simple and secure way to prepare and e-file their federal taxes for free. This program is a partnership between the IRS and various private-sector tax software companies. It is designed for individuals or families with an Adjusted Gross Income (AGI) of 73,000 or less, active-duty military personnel (with an AGI of 100,000 or less), and eligible taxpayers who need to file Form 1040 or 1040-SR.

To access the Free File program, you can visit the IRS Free File page. Here, you’ll find a list of tax software providers participating in the program. Each provider has their own eligibility criteria, so it’s important to review these before selecting a software. The IRS also provides a Free File Eligibility Worksheet to help you determine if you qualify.

3. Tax Counseling for the Elderly (TCE)

The TCE program offers free tax help for all taxpayers, particularly those who are 60 or older, specializing in questions about pensions and retirement-related issues. Trained volunteers, often in partnership with local community organizations, senior centers, and libraries, provide this service. The TCE program is funded by the IRS and grants are administered by the Tax Counseling for the Elderly (TCE) program, ensuring a high level of expertise and reliability.

To find a TCE site near you, you can use the IRS TCE Locator. This tool will provide you with a list of nearby locations offering TCE services. Similar to the VITA program, some TCE sites may have limited hours or operate by appointment only due to the ongoing pandemic. Therefore, it’s recommended to verify the site’s status before planning your visit.

4. MyFreeTaxes.org

MyFreeTaxes.org is a free, easy-to-use, and secure online tax preparation service provided by United Way and H&R Block. This platform is designed for individuals or families with an income of $66,000 or less. It offers a simple and straightforward way to file federal and state taxes online without any cost. Additionally, MyFreeTaxes.org provides resources and tools to help taxpayers understand their tax situation better and make informed decisions.

To use MyFreeTaxes.org, you can visit their website at https://www.myfreetaxes.org. The website provides a user-friendly interface, guiding you through the tax filing process step by step. It’s important to note that MyFreeTaxes.org is not affiliated with the IRS or any government agency, but it operates as a trusted partner in providing free tax services to the community.

Eligibility and Documentation

While these programs are designed to be inclusive, there are certain eligibility criteria to consider. For instance, the VITA and TCE programs often cater to specific income levels or age groups. Additionally, you may need to bring certain documents to your tax preparation session, such as:

- Photo ID

- Social Security cards for you, your spouse, and any dependents

- Birth dates for you, your spouse, and any dependents

- Income records (W-2, 1099, etc.)

- Interest and dividend statements

- A copy of last year’s federal and state tax returns, if available

- Bank routing numbers and account information for direct deposit

- An estimate of child care expenses paid, if applicable

- Any other relevant tax documents

It’s important to check the specific requirements for each program to ensure you have all the necessary documents before your appointment or online filing.

The Benefits of Free Tax Filing

Utilizing free tax filing services offers numerous advantages to New Yorkers. Firstly, it provides an opportunity to have your taxes prepared by trained professionals, ensuring accuracy and reducing the risk of errors. This can be especially beneficial for those with complex tax situations or who are filing for the first time.

Secondly, these services often provide additional financial support and resources. For instance, the VITA program can help you claim various credits, such as the Earned Income Tax Credit (EITC) or Child Tax Credit, which can significantly boost your refund. The TCE program, on the other hand, specializes in retirement-related tax issues, ensuring that older adults receive the most suitable guidance.

Lastly, free tax filing services promote financial literacy and empowerment. By offering personalized guidance and resources, these programs help individuals understand their financial situations better, make informed decisions, and take control of their financial future.

Tips for a Smooth Tax Filing Experience

To ensure a seamless tax filing process, here are some additional tips to keep in mind:

- Plan Ahead: Start gathering your tax documents early. This will help you organize your information and ensure you have everything ready when it’s time to file.

- Review Your Documents: Carefully review all your tax forms and documents for accuracy. This includes checking names, Social Security numbers, and income figures.

- Choose the Right Program: Evaluate your eligibility and needs to select the most suitable free tax filing program. Consider factors like income, age, and the complexity of your tax situation.

- Make an Appointment: If you’re using a program like VITA or TCE, make an appointment to ensure you get the attention and time you need. This can help reduce wait times and provide a more personalized experience.

- Ask for Help: Don’t hesitate to seek assistance if you have questions or encounter difficulties. The volunteers and professionals at these programs are there to guide you through the process.

Future Outlook and Resources

As technology advances and the tax landscape evolves, we can expect further improvements and innovations in free tax filing services. The ongoing COVID-19 pandemic has accelerated the shift towards digital solutions, and we may see more online platforms and mobile apps tailored to different user needs. Additionally, continued collaboration between government agencies, community organizations, and private sectors will likely enhance the accessibility and efficiency of these services.

For the latest updates and resources on free tax filing in New York, consider visiting the following websites:

- New York State Department of Taxation and Finance

- IRS - Earned Income Tax Credit

- New York City Department of Finance - Tax Resources

Conclusion

Free tax filing services in New York are a testament to the city’s commitment to financial inclusivity and empowerment. By offering a range of options, from in-person assistance to online platforms, New Yorkers can choose the method that best suits their needs and circumstances. These services not only provide a cost-effective way to file taxes but also offer valuable financial guidance and support, helping individuals navigate the complexities of the tax system with confidence.

What if I don’t qualify for any of these free tax filing programs?

+If you don’t meet the eligibility criteria for the free programs mentioned above, you can still explore other options. Many tax software providers offer affordable pricing plans for simple tax returns. Additionally, you can consider seeking the services of a professional tax preparer, who can guide you through the process and ensure accurate filing. Remember to shop around and compare prices to find the best fit for your budget and needs.

Are these free tax filing services secure and reliable?

+Absolutely! The free tax filing programs mentioned are backed by reputable organizations, including the IRS and trusted community partners. They prioritize security and privacy, employing robust measures to protect your personal and financial information. Rest assured that your data will be handled with the utmost care and confidentiality.

Can I file my taxes for free if I’m self-employed or have a small business?

+Yes, you can! Many of the free tax filing programs cater to a wide range of tax situations, including self-employment and small business ownership. However, it’s important to note that the level of complexity may impact your eligibility. For instance, the Free File program mentioned earlier is designed for simple tax returns, so if your business has complex transactions, you may need to consider other options. Always review the specific eligibility criteria for each program to determine if it suits your needs.

Are there any penalties for missing the tax filing deadline if I use these free services?

+While these free tax filing services aim to make the process easier and more accessible, it’s still important to meet the tax filing deadline. Missing the deadline can result in penalties and interest charges. Therefore, it’s crucial to plan and file your taxes on time, even if you’re utilizing free services. Remember, the earlier you start, the more time you have to gather your documents and ensure a smooth filing process.