Pay Uber Tax With Turbotax

Welcome to a comprehensive guide on an essential aspect of tax management for gig workers, freelancers, and ride-share drivers like yourself. In the ever-evolving gig economy, understanding how to navigate tax obligations is crucial. This article will focus on a specific and often confusing topic: paying Uber taxes using Turbotax, a popular tax preparation software. By the end of this article, you'll have a clear roadmap to tackle this task efficiently and confidently.

The Challenge: Uber Taxes

As an independent contractor or ride-share driver, you’re responsible for your own taxes, which can be a daunting task. Uber, one of the leading ride-sharing platforms, requires its drivers to handle their tax obligations independently. This means accurately tracking income, expenses, and deductions to ensure compliance with tax laws.

The process can be complex, especially when dealing with varying tax rates, different income sources, and the unique nature of gig work. That's where tools like Turbotax come in – to simplify the process and help you file your taxes accurately.

Why Turbotax for Uber Taxes?

Turbotax is a widely-used tax preparation software known for its user-friendly interface and comprehensive tax guidance. It’s designed to assist individuals, especially those with unique income streams like gig workers, in navigating the tax landscape. Here’s why Turbotax is an excellent choice for paying Uber taxes:

- Simplicity and Accessibility: Turbotax offers a straightforward process, guiding users through their tax returns step by step. This simplicity is especially beneficial for those who may not have extensive tax knowledge but need to file complex returns due to their gig work.

- Tailored to Gig Economy: The software is well-equipped to handle the specific needs of gig workers and ride-share drivers. It provides tools to track income, expenses, and deductions relevant to your work, making it easier to organize and file your taxes accurately.

- Accurate Calculations: Turbotax is renowned for its precision in tax calculations. It considers all relevant tax laws and regulations, ensuring you pay the correct amount of tax and receive the deductions and credits you're entitled to.

- Support and Guidance: The software provides extensive support, offering tips and suggestions tailored to your income and deductions. This helps you maximize your tax benefits and understand the implications of your financial decisions.

Step-by-Step Guide: Paying Uber Taxes with Turbotax

Now, let’s dive into the process of using Turbotax to pay your Uber taxes. This comprehensive guide will walk you through each step, ensuring a smooth and stress-free experience.

Step 1: Gather Your Documents

Before you begin, ensure you have all the necessary documents and information. This includes:

- Your Uber income statement or records of your earnings.

- Records of any expenses related to your Uber work, such as vehicle maintenance, fuel costs, and phone bills.

- Details of any other income sources you had during the tax year, such as other gig work or traditional employment.

- Receipts or records of any deductible expenses, including business-related travel, home office costs, and professional development.

- Your previous year's tax return (if applicable) to reference any carryover deductions or changes in tax status.

Step 2: Choose the Right Turbotax Product

Turbotax offers several products tailored to different tax situations. For Uber drivers and gig workers, the following products are recommended:

- Turbotax Deluxe: Ideal for those with investment income, rental property income, or other sources of unearned income. It's also suitable for those with various deductions and credits.

- Turbotax Premier: Designed for investors and rental property owners, this product is a great fit if you have capital gains or losses, rental income, or passive income from real estate.

- Turbotax Self-Employed: Specifically created for independent contractors, freelancers, and small business owners. It offers tools to maximize deductions and credits related to self-employment.

Choose the product that best suits your income and tax situation. If you're unsure, Turbotax's website provides detailed information to guide you in selecting the right product.

Step 3: Start Your Tax Return

Once you’ve chosen your Turbotax product, it’s time to begin your tax return. Follow these steps:

- Launch the Turbotax software or access it online through their website.

- Create an account or sign in if you already have one. This allows Turbotax to save your progress and provide personalized guidance.

- Select the option to "Start a New Tax Return" and follow the prompts to choose the appropriate tax year and filing status.

- Enter your personal information, including your name, address, and Social Security number. Ensure the information is accurate and up-to-date.

Step 4: Enter Your Uber Income and Expenses

Now, it’s time to input your Uber-related income and expenses. Here’s how:

- Locate the section for "Income" and select the option for "Self-Employment Income" or "Business Income."

- Enter your Uber income, either from your income statement or by manually entering the amount. Ensure you enter the correct amount, as this forms the basis for calculating your tax liability.

- Move on to the "Expenses" section. Here, you'll input all the expenses related to your Uber work. This includes vehicle expenses, fuel costs, phone bills, and any other business-related expenses.

- Turbotax will guide you through the process, providing tips and suggestions for deductions. Ensure you claim all eligible expenses to reduce your taxable income.

Step 5: Claim Deductions and Credits

Deductions and credits can significantly reduce your tax liability. Turbotax will prompt you to enter any applicable deductions and credits. Here’s what to consider:

- Standard Deduction: This is a set amount that reduces your taxable income. Turbotax will automatically calculate and apply the standard deduction unless you choose to itemize your deductions.

- Itemized Deductions: If your itemized deductions exceed the standard deduction, you may choose to itemize. This includes expenses like medical costs, state and local taxes, charitable contributions, and mortgage interest. Turbotax will guide you through the process of itemizing these deductions.

- Tax Credits: Tax credits are even more beneficial than deductions as they directly reduce your tax liability dollar-for-dollar. Turbotax will prompt you to enter any applicable credits, such as the Earned Income Tax Credit (EITC) or Child Tax Credit. These credits can significantly reduce the amount of tax you owe or even result in a refund.

Step 6: Review and File Your Return

Once you’ve entered all your income, expenses, deductions, and credits, it’s time to review your tax return. Turbotax will provide a summary of your return, including your total income, taxable income, and tax liability. Take the time to review this summary carefully, ensuring all the information is accurate.

If you're satisfied, you can proceed to file your return. Turbotax will guide you through the e-filing process, ensuring your return is submitted securely and accurately. You'll receive a confirmation once your return has been accepted by the IRS.

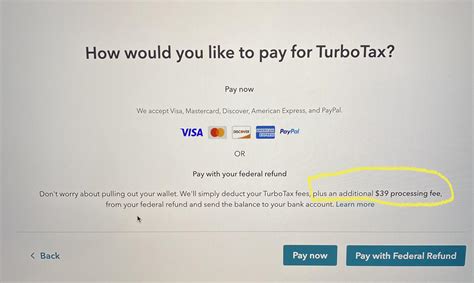

Step 7: Pay Your Uber Taxes

After filing your return, you may owe taxes based on your Uber income and other sources of income. Turbotax will calculate the amount you owe and provide options for payment. You can choose to pay by credit or debit card, electronic funds transfer, or by mailing a check.

If you're unable to pay the full amount, Turbotax can help you set up a payment plan with the IRS. This allows you to pay your taxes over time, reducing the financial burden.

Maximizing Your Tax Benefits with Turbotax

Turbotax offers several features to help you maximize your tax benefits. Here are some tips to get the most out of the software:

- Deduction Maximizer: This tool helps you identify and claim all eligible deductions. It analyzes your financial situation and provides suggestions for deductions you may have overlooked.

- Credit Finder: Turbotax's Credit Finder tool searches for credits you may be eligible for, including education credits, child-related credits, and energy-efficient home improvements.

- Audit Defense: Turbotax offers Audit Defense as an add-on service. If you're audited by the IRS, this service provides tax professionals to represent you and help resolve the issue.

- Tax Tips and Insights: Turbotax provides a wealth of tax tips and insights tailored to your income and deductions. These can help you understand tax laws and strategies to reduce your tax burden in future years.

Future Implications and Tax Planning

Paying your Uber taxes accurately is just the first step. It’s important to view tax management as an ongoing process, especially in the dynamic world of gig work. Here are some considerations for the future:

- Tax Planning: Use your experience with Turbotax to plan for future tax years. Review your deductions and credits to see where you can maximize savings. Consider setting aside a portion of your income specifically for taxes to avoid a large tax bill at the end of the year.

- Record Keeping: Maintain good record-keeping practices. Keep track of your income, expenses, and deductions throughout the year. This simplifies the tax preparation process and ensures you don't miss out on any deductions.

- Stay Informed: Tax laws and regulations can change frequently. Stay updated on any changes that may impact your tax situation. Turbotax provides updates and guidance on tax law changes, ensuring you're always informed.

Conclusion: A Smooth Uber Tax Experience

Paying your Uber taxes doesn’t have to be a daunting task. With Turbotax, you have a powerful tool to simplify the process and ensure accuracy. By following this comprehensive guide, you can confidently navigate the world of Uber taxes and maximize your tax benefits.

Remember, tax management is an essential aspect of your financial well-being, especially in the gig economy. Stay organized, keep good records, and utilize tools like Turbotax to make tax time a breeze. With a little preparation and the right tools, you can focus on your work and let Turbotax handle the rest.

How accurate is Turbotax in calculating my Uber taxes?

+Turbotax is highly accurate in calculating taxes. It considers all relevant tax laws and regulations, ensuring you pay the correct amount of tax and receive the deductions and credits you’re entitled to. The software is regularly updated to reflect any changes in tax laws, providing you with the most up-to-date information.

Can I file my Uber taxes manually instead of using Turbotax?

+While it’s possible to file your Uber taxes manually, using Turbotax offers several advantages. The software simplifies the process, reducing the risk of errors and ensuring you don’t miss out on any deductions or credits. It also provides guidance and support, making tax preparation less daunting and more efficient.

What if I need help with my Uber taxes beyond what Turbotax offers?

+Turbotax provides a range of support options, including live support from tax experts. If you need additional assistance, you can consider hiring a tax professional or enrolling in the Audit Defense service, which provides representation in case of an IRS audit.