Nyc Property Tax Rate

The New York City property tax system is a crucial aspect of the city's finances and plays a significant role in shaping the real estate market. With one of the highest property tax rates in the country, understanding this system is essential for both property owners and prospective buyers. In this comprehensive guide, we delve into the intricacies of NYC's property tax rate, exploring its components, calculation methods, and the impact it has on various property types.

Understanding NYC’s Property Tax Structure

The property tax system in New York City is complex, designed to generate revenue for the city’s operations while ensuring fairness among property owners. It is governed by the Department of Finance (DOF), which assesses properties, determines their taxable value, and calculates the taxes owed.

Tax Classes and Assessment Rates

One of the unique features of NYC’s property tax system is the classification of properties into different tax classes. These classes are determined based on the property’s use and ownership, and each class has a specific assessment rate, which is the percentage of a property’s value that is subject to taxation.

| Tax Class | Description | Assessment Rate |

|---|---|---|

| Class 1 | One-, two-, and three-family homes | 6% |

| Class 2 | Apartment buildings and cooperatives | 45% |

| Class 3 | Condominiums and commercial properties | 45% |

| Class 4 | Utilities and railroad properties | 55% |

| Class 5 | Special purpose properties like schools and hospitals | Varies |

The assessment rates are a key factor in determining the property tax rate. For instance, a property in Class 1 with a $500,000 assessed value would have a taxable value of $30,000 ($500,000 x 0.06), while a property in Class 3 with the same assessed value would have a taxable value of $225,000 ($500,000 x 0.45). This differential treatment is designed to encourage certain types of development and maintain affordability for homeowners.

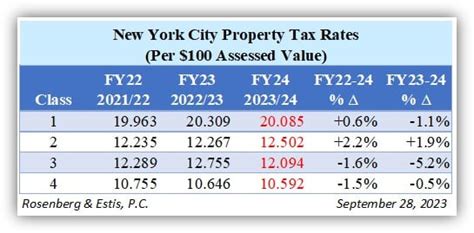

Tax Rates and Levies

Once the taxable value of a property is determined, the actual tax rate is applied. This rate is set annually by the city and is expressed as a percentage of the taxable value. For the fiscal year 2023-2024, the tax rates for each class are as follows:

| Tax Class | Tax Rate |

|---|---|

| Class 1 | 0.00922% |

| Class 2 | 0.00922% |

| Class 3 | 0.00922% |

| Class 4 | 0.00922% |

| Class 5 | Varies based on property type |

Using the previous example, a Class 1 property with a taxable value of $30,000 would have an annual tax bill of $276.60 ($30,000 x 0.00922), while a Class 3 property with a taxable value of $225,000 would owe $2,079 ($225,000 x 0.00922). These rates are uniform across the city, ensuring fairness among properties of the same class.

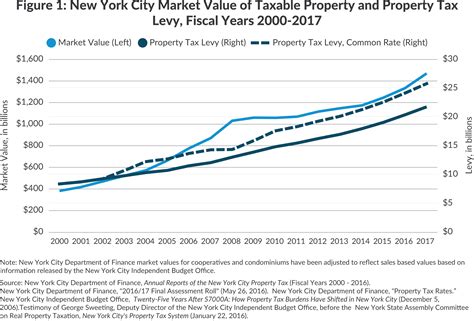

Tax Levies and Budget Allocation

The tax levies collected from property owners are a vital source of revenue for the city’s budget. These funds are allocated to various city services and departments, including education, public safety, infrastructure maintenance, and social services. The distribution of tax levies is a complex process, determined by the city’s budget priorities and the needs of different communities.

Impact on Property Owners

The NYC property tax system has a significant impact on property owners, influencing their financial decisions and the overall real estate market.

Residential Property Owners

For homeowners, the property tax is a major expense. The tax rate, combined with the assessment rate, can significantly impact the affordability of owning a home in NYC. However, the city offers several exemptions and abatements to alleviate the burden on homeowners. These include the STAR exemption for primary residences and the J-51 abatement program, which offers tax benefits for properties undergoing certain types of improvements.

Commercial Property Owners

Commercial property owners, including businesses and investors, face higher tax rates due to the higher assessment rates for commercial properties. This can impact the profitability of these investments and influence decisions about property acquisition and development. However, the city also offers incentives for certain types of commercial development, such as the Industrial and Commercial Abatement Program (ICAP), which provides tax benefits for new construction or substantial renovations of commercial properties.

Impact on the Real Estate Market

The property tax rate can influence the dynamics of the real estate market. High tax rates can discourage investment and development, especially in areas where the tax burden is significant. On the other hand, tax incentives and abatements can stimulate development and attract investors. The city’s tax policies thus play a crucial role in shaping the real estate landscape, influencing property values, rental rates, and the overall health of the market.

Challenges and Future Prospects

The NYC property tax system faces several challenges, including the need to balance revenue generation with the financial well-being of property owners. As the city’s needs and the real estate market evolve, the tax system must adapt to ensure fairness and stability.

Fairness and Equity

One of the key challenges is ensuring that the tax system remains fair and equitable. This involves regularly reviewing and adjusting assessment rates and tax levies to reflect the changing values of properties and the city’s budgetary requirements. The city also aims to address any disparities that may arise, such as the potential for higher tax burdens on certain communities due to property values or the availability of tax incentives.

Economic Impact

The property tax system has a significant economic impact, influencing investment decisions and the overall health of the city’s economy. High tax rates can deter investment, while tax incentives can stimulate growth. Balancing these factors is crucial to maintaining a vibrant real estate market and a robust economy.

Future Developments

Looking ahead, the NYC property tax system is likely to see several changes and developments. The city is continually exploring ways to improve the system, including the potential for a land value tax, which would tax the value of the land separately from the value of the improvements made to it. This could encourage more efficient use of land and promote affordability.

Additionally, the city is investing in technology to improve the efficiency and accuracy of property assessments. This includes the use of advanced data analytics and machine learning to ensure that property values are assessed fairly and consistently. These technological advancements are expected to streamline the tax assessment process and reduce potential disputes.

Conclusion

The NYC property tax rate is a complex and dynamic system, designed to meet the city’s financial needs while maintaining fairness among property owners. With its unique classification system and assessment rates, the city aims to balance the interests of various stakeholders, from homeowners to commercial investors. As the city continues to evolve, so too will its property tax system, ensuring it remains a vital and responsive component of the city’s financial framework.

How often are property taxes assessed in NYC?

+Property taxes are assessed annually in NYC. The Department of Finance determines the taxable value of each property based on its assessed value and the applicable assessment rate.

Are there any exemptions or abatements available for property owners in NYC?

+Yes, NYC offers several exemptions and abatements to reduce the property tax burden for homeowners and certain types of commercial properties. These include the STAR exemption, J-51 abatement program, and the Industrial and Commercial Abatement Program (ICAP), among others.

How are property tax rates determined in NYC?

+Property tax rates are set annually by the city and are based on the city’s budget needs and real estate market conditions. The rates are uniform for each tax class, ensuring fairness among properties of the same type.