Boston City Tax

Boston, the vibrant capital of Massachusetts, is renowned for its rich history, diverse culture, and thriving economy. As a thriving metropolis, it boasts a robust tax system that plays a pivotal role in funding essential public services and infrastructure projects. Understanding the intricacies of Boston's tax landscape is crucial for both residents and businesses operating within the city limits.

The Complex Landscape of Boston City Tax

Boston’s tax structure is multifaceted, encompassing a range of levies and assessments that contribute to the city’s overall revenue. This intricate system is designed to support the diverse needs of its residents, from maintaining the iconic Boston Common to investing in cutting-edge initiatives that propel the city forward.

Residential Property Taxes: A Vital Revenue Stream

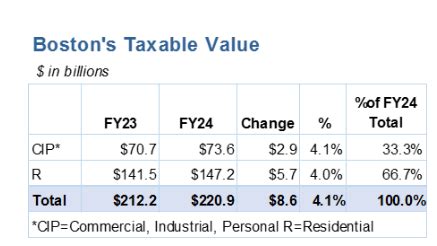

One of the cornerstone taxes in Boston is the residential property tax. This levy is imposed on homeowners and is determined based on the assessed value of their property. The revenue generated from property taxes forms a significant portion of Boston’s annual budget, enabling the city to provide essential services such as education, public safety, and healthcare.

The assessment process for residential properties is rigorous, taking into account various factors such as the property's location, size, and recent sales data in the vicinity. This ensures that the tax burden is distributed fairly among homeowners, reflecting the true market value of their properties.

| Residential Property Tax Rates | 2023 Rates |

|---|---|

| Citywide Average Tax Rate | 1.06% |

| Median Residential Property Tax | $4,500 |

| Highest Taxed Neighborhood | Back Bay |

| Lowest Taxed Neighborhood | Roxbury |

Business Taxes: Supporting Economic Growth

Boston’s thriving business community also contributes significantly to the city’s tax revenue through various business-related taxes. These taxes are instrumental in fostering economic development, creating jobs, and enhancing the overall business environment.

- Commercial Property Tax: Similar to residential properties, commercial properties are subject to a tax based on their assessed value. This tax supports the maintenance and improvement of commercial infrastructure and public spaces.

- Business Income Tax: Boston levies a tax on the income generated by businesses operating within the city limits. This tax rate varies depending on the business entity type and income level.

- Meals and Entertainment Tax: A unique feature of Boston's tax system is the meals and entertainment tax, which applies to meals and entertainment services provided within the city. This tax contributes to funding cultural and recreational initiatives.

- Hotel Room Occupancy Tax: Boston also imposes a tax on hotel stays, which helps support tourism-related initiatives and infrastructure improvements.

Special Taxes and Exemptions

In addition to the aforementioned taxes, Boston has implemented several special taxes and exemptions to address specific needs and promote social equity.

- Community Preservation Act (CPA) Tax: Some cities in Massachusetts, including Boston, have adopted the CPA tax, which funds community preservation projects such as open space acquisition, historic resource preservation, and affordable housing initiatives.

- Senior Tax Exemption: To support Boston's senior citizens, the city offers a tax exemption for homeowners aged 65 and above who meet certain income and residency requirements.

- Veterans' Exemption: Boston also provides a tax exemption for honorably discharged veterans who meet specific criteria, recognizing their service to the nation.

The Impact of Boston City Taxes

The revenue generated through Boston’s tax system has a profound impact on the city’s development and quality of life. It funds critical infrastructure projects, including road and bridge repairs, public transportation upgrades, and the expansion of recreational facilities.

Moreover, tax revenue supports Boston's renowned education system, ensuring that students have access to high-quality schools and resources. It also plays a pivotal role in maintaining public safety, with funds allocated to police and fire departments, ensuring the city's residents and visitors remain protected.

Balancing Act: Tax Equity and City Development

Boston’s tax system strives to achieve a delicate balance between generating sufficient revenue and maintaining tax equity. The city’s tax policies aim to ensure that the tax burden is distributed fairly across different income levels and property owners.

To promote social equity, Boston offers various tax relief programs and incentives. For instance, the Abatement Program provides temporary tax relief to homeowners facing financial hardships due to unforeseen circumstances. Additionally, the Low-Income Senior Tax Deferral Program allows eligible seniors to defer a portion of their property taxes, providing much-needed financial relief.

Conclusion: A Dynamic Tax Landscape

Boston’s tax system is a complex yet essential component of the city’s economic framework. It supports the city’s growth, development, and the well-being of its residents. As Boston continues to evolve, its tax policies will play a crucial role in shaping the city’s future, ensuring it remains a vibrant, prosperous, and inclusive metropolis.

How can I estimate my property tax in Boston?

+You can estimate your property tax by multiplying the assessed value of your property by the applicable tax rate for your neighborhood. You can find the assessed value on your property tax bill or by contacting the Boston Assessing Department. Remember, this is an estimate, and the actual tax amount may vary based on factors like exemptions or abatement programs.

Are there any tax incentives for renewable energy installations in Boston?

+Yes, Boston offers tax incentives for renewable energy installations through the Net Metering Program. This program allows homeowners and businesses to generate their own renewable energy and receive credits on their utility bills. Additionally, the city provides tax exemptions for solar equipment, encouraging the adoption of clean energy technologies.

How does Boston support small businesses in terms of taxes?

+Boston offers various tax incentives and programs to support small businesses. The Small Business Technical Assistance Program provides tax credits to businesses that create jobs and invest in certain neighborhoods. Additionally, the city offers tax exemptions for certain business equipment and machinery, reducing the tax burden for small enterprises.