How Are Ira Withdrawals Taxed

Understanding how IRA withdrawals are taxed is crucial for individuals who have invested in Individual Retirement Accounts (IRAs) to secure their financial future. The tax implications can vary depending on various factors, such as the type of IRA, the timing of withdrawals, and the taxpayer's specific circumstances. In this comprehensive guide, we will delve into the intricacies of IRA taxation, providing you with valuable insights to navigate this complex landscape.

The Basics of IRA Taxation

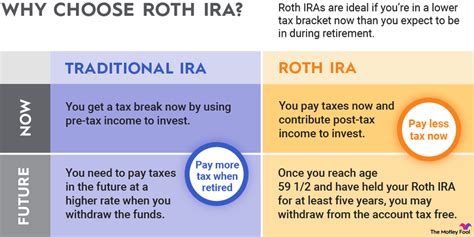

An IRA is a tax-advantaged investment account designed to help individuals save for retirement. There are two primary types of IRAs: traditional IRAs and Roth IRAs, each with its own unique tax treatment.

Traditional IRA Withdrawals

Traditional IRA contributions are often tax-deductible, reducing your taxable income in the year you make the contribution. However, when it comes to withdrawals, the rules change. Distributions from a traditional IRA are typically taxable as ordinary income. This means that when you withdraw funds during retirement, the amount you receive is added to your taxable income for that year.

The tax rate applied to these withdrawals depends on your overall income tax bracket. For instance, if you fall into the 22% tax bracket, any withdrawals from your traditional IRA will be taxed at that rate. It's important to note that there are certain circumstances where early withdrawals (before the age of 59½) may incur additional penalties, which we will explore further.

Roth IRA Withdrawals

Roth IRAs operate differently from traditional IRAs in terms of taxation. With a Roth IRA, you contribute after-tax dollars, meaning you have already paid taxes on the income used for contributions. This means that when you withdraw funds from a Roth IRA during retirement, the principal amount you contributed is typically tax-free.

However, the earnings on your Roth IRA contributions are subject to specific rules. In general, you must be at least 59½ years old and have held the Roth IRA for at least five years for your withdrawals to be considered qualified. Qualified distributions from a Roth IRA are tax-free, allowing you to enjoy the full benefits of your investments without any tax implications.

Tax Implications of Early Withdrawals

One common concern for IRA holders is the tax consequences of early withdrawals. If you need to access your IRA funds before reaching the age of 59½, you may face certain penalties and additional taxes.

Penalty for Early Withdrawals

The IRS imposes a 10% early withdrawal penalty on distributions from traditional and Roth IRAs if certain conditions are not met. This penalty is applied to the taxable amount of the distribution and is in addition to any regular income taxes owed.

There are, however, exceptions to this penalty. For instance, if you use the funds for qualifying expenses such as higher education costs, first-time home purchases, or certain medical expenses, the 10% penalty may be waived. It's crucial to consult with a tax professional to understand the specific rules and qualifications for penalty-free early withdrawals.

Taxable Amount of Early Withdrawals

The taxable amount of an early withdrawal from a traditional IRA includes both the contributions and earnings. Since contributions were likely made with pre-tax dollars, these distributions will be taxed as ordinary income. For Roth IRAs, only the earnings portion of an early withdrawal is subject to tax and the 10% penalty.

| IRA Type | Early Withdrawal Tax Treatment |

|---|---|

| Traditional IRA | Contributions and earnings taxed as ordinary income |

| Roth IRA | Earnings subject to tax and 10% penalty; contributions tax-free |

Strategic Withdrawals for Tax Efficiency

To maximize the tax benefits of your IRA withdrawals, it’s essential to develop a strategic plan. Here are some key considerations:

Coordination with Other Income Sources

When planning your IRA withdrawals, consider your overall income and tax bracket. By coordinating your withdrawals with other income sources, such as pensions or Social Security benefits, you can potentially reduce your taxable income and stay in a lower tax bracket.

Roth Conversions

Converting a portion of your traditional IRA to a Roth IRA can be a strategic move to reduce future tax liabilities. By doing so, you are essentially pre-paying taxes on the converted amount, allowing for tax-free growth and distributions in the future. This strategy is particularly beneficial if you expect to be in a higher tax bracket during retirement.

Required Minimum Distributions (RMDs)

Once you reach the age of 72, you are required to take minimum distributions from your traditional IRA each year. These RMDs are calculated based on your life expectancy and the value of your IRA. Failing to take the required distributions can result in a 50% penalty on the amount you should have withdrawn. Understanding and planning for RMDs is crucial to avoid unnecessary penalties.

Tax Advantages of IRAs

Despite the tax complexities, IRAs offer significant advantages that make them a popular choice for retirement savings.

Tax-Deferred Growth

Traditional IRAs provide tax-deferred growth, allowing your investments to compound over time without immediate tax implications. This means your money has the potential to grow faster, as you are not paying taxes on the earnings each year.

Tax-Free Growth with Roth IRAs

Roth IRAs offer the unique benefit of tax-free growth and distributions. By contributing after-tax dollars, you lock in your gains, ensuring that any future withdrawals are completely tax-free. This makes Roth IRAs an attractive option for those who expect to be in a higher tax bracket during retirement.

Tax Diversification

By having both traditional and Roth IRAs, you gain tax diversification. This allows you to strategically time your withdrawals to take advantage of different tax brackets and minimize your overall tax burden.

Conclusion

Navigating the tax landscape of IRA withdrawals requires careful planning and a thorough understanding of the rules. Whether you are considering early withdrawals, strategic planning for retirement, or simply wanting to maximize the benefits of your IRA, consulting with a financial advisor and tax professional is highly recommended. They can provide personalized guidance based on your unique circumstances, ensuring you make informed decisions about your retirement savings.

Can I withdraw from my IRA without paying taxes?

+Yes, you can make tax-free withdrawals from a Roth IRA under specific conditions. These conditions typically include being at least 59½ years old, having held the Roth IRA for at least five years, and using the funds for qualified expenses. Traditional IRA withdrawals, on the other hand, are generally taxable.

What happens if I don’t take my RMDs from my traditional IRA?

+Failing to take your Required Minimum Distributions (RMDs) from a traditional IRA can result in a steep penalty. The IRS imposes a 50% penalty on the amount you should have withdrawn. It’s crucial to understand and plan for your RMDs to avoid this penalty.

Are there any exceptions to the 10% early withdrawal penalty for IRAs?

+Yes, there are certain exceptions where the 10% early withdrawal penalty may be waived. These include using the funds for qualifying expenses such as higher education costs, first-time home purchases, or certain medical expenses. Consulting with a tax professional is essential to understand these exceptions.