Does Pennsylvania Tax Pensions

The taxation of pensions in Pennsylvania is a nuanced topic that varies based on several factors, including the type of pension, the source of income, and the residency status of the pension recipient. Understanding the tax implications for pensions is crucial for retirees and financial planners alike. This article aims to provide an in-depth analysis of Pennsylvania's pension tax laws, offering clarity and insights to those affected by these regulations.

Pennsylvania’s Pension Tax Landscape

Pennsylvania’s tax treatment of pensions is designed to balance the state’s revenue needs with the financial security of retirees. The Commonwealth of Pennsylvania employs a tiered approach to pension taxation, considering both the source of the pension and the residency status of the recipient.

Residency and Tax Status

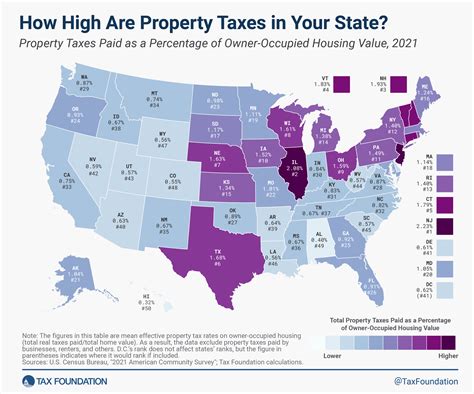

Pennsylvania residents are subject to state income tax on their pension income, regardless of the source. Non-residents, on the other hand, are taxed differently, with the state imposing a flat 3.07% tax on pension income derived from Pennsylvania-based sources.

| Residency Status | Tax Rate |

|---|---|

| Pennsylvania Resident | Varies based on income brackets |

| Non-Resident | Flat 3.07% |

Types of Pensions and Their Taxation

Pennsylvania distinguishes between various types of pensions, each with its own tax treatment. Here’s a breakdown:

- Public Pensions: Pensions from Pennsylvania's State Employees' Retirement System (SERS) and Public School Employees' Retirement System (PSERS) are taxed. However, a portion of these pensions may be excluded from taxable income based on specific criteria, such as age and years of service.

- Federal Pensions: Pensions from federal sources, like the Civil Service Retirement System (CSRS) and the Federal Employees Retirement System (FERS), are subject to Pennsylvania income tax for residents. For non-residents, these pensions are taxed at the flat 3.07% rate.

- Private Pensions: Pensions from private companies or private retirement plans are also taxable in Pennsylvania. The tax treatment depends on the residency status and the specific provisions of the pension plan.

- Military Pensions: Military retirement pay is taxed similarly to other pensions. However, certain combat-related disability pensions are exempt from taxation.

Strategies for Pension Tax Optimization

Given the complexity of Pennsylvania’s pension tax laws, retirees and financial advisors can employ several strategies to optimize their tax liabilities.

Tax-Efficient Withdrawals

Understanding the tax brackets and exclusions can help retirees plan their withdrawals strategically. By coordinating withdrawals with other income sources, retirees can potentially reduce their overall tax burden.

Maximizing Exclusions

Pennsylvania’s tax code allows for the exclusion of a portion of certain pensions. By understanding the criteria for these exclusions, retirees can structure their pension income to maximize these benefits.

Consideration of Residency

The distinction between resident and non-resident tax rates can be significant. Retirees who maintain multiple residences should carefully consider their residency status and the potential tax implications. Moving to a different state with more favorable pension tax laws could be a viable strategy.

Case Study: Tax Implications for a Pennsylvania Teacher’s Pension

Let’s consider the case of a retired teacher in Pennsylvania who receives a pension from the Public School Employees’ Retirement System (PSERS). This pension is subject to Pennsylvania’s income tax, but the retiree can benefit from the exclusion allowed for a portion of the pension income.

The exclusion amount depends on the retiree's age and years of service. For instance, a teacher who retired at age 62 with 30 years of service may be eligible for a higher exclusion amount compared to a retiree with fewer years of service. This exclusion can significantly reduce the taxable portion of the pension, leading to substantial tax savings.

The Future of Pension Taxation in Pennsylvania

Pennsylvania’s pension tax landscape is subject to change, influenced by economic conditions, legislative decisions, and the evolving needs of the state’s pension systems. Recent years have seen proposals to modify the tax treatment of pensions, including suggestions to extend the flat tax rate for non-residents to certain types of resident pensions.

Additionally, the ongoing debate surrounding the state's pension crisis could lead to further changes in tax laws. These changes may aim to alleviate the financial burden on the state's pension systems while ensuring fairness for retirees.

Conclusion

Understanding Pennsylvania’s pension tax laws is crucial for retirees and financial planners to make informed decisions. The state’s tax code provides a nuanced approach to pension taxation, offering benefits and exclusions while also imposing tax liabilities. By staying informed about these regulations and employing strategic tax planning, retirees can optimize their financial situations and ensure a more secure retirement.

Are all pensions taxed in Pennsylvania?

+No, the tax treatment of pensions depends on the source and residency status of the recipient. While Pennsylvania residents are taxed on most pension income, non-residents are subject to a flat tax rate for Pennsylvania-sourced pensions.

How can I maximize the tax benefits of my pension in Pennsylvania?

+You can maximize tax benefits by understanding the exclusions and tax brackets applicable to your specific pension. Consider working with a financial advisor to structure your withdrawals and pension income strategically.

Are there any proposals to change the pension tax laws in Pennsylvania?

+Yes, there have been proposals to modify the tax treatment of pensions, including extending the flat tax rate for non-residents to certain resident pensions. However, the specifics and timelines for these changes are not yet finalized.