How Much Is California Sales Tax

California, the Golden State, is renowned for its diverse landscapes, thriving cities, and vibrant culture. From the iconic Hollywood sign to the breathtaking Yosemite National Park, it offers a unique blend of urban life and natural beauty. However, when it comes to managing finances, one aspect that cannot be overlooked is the sales tax system in California. This article aims to provide a comprehensive guide to understanding the sales tax rates, how they vary across the state, and their impact on both residents and businesses.

The Complexity of California Sales Tax

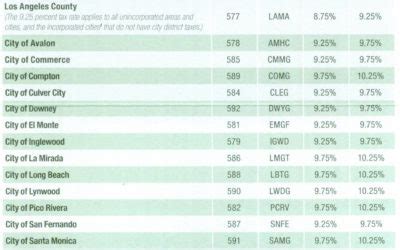

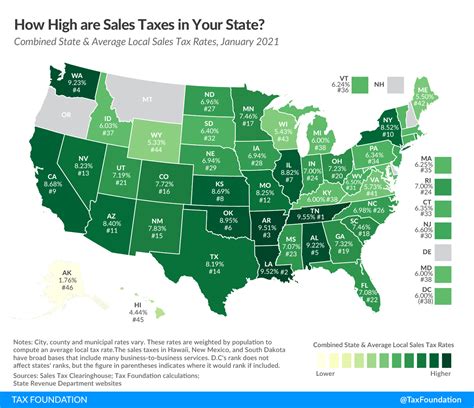

California’s sales tax system is notable for its complexity, primarily due to the combination of state, county, and city sales taxes. This layered structure results in varying tax rates across different regions within the state. As of my last update in January 2023, the statewide sales and use tax rate stands at 7.25%, which serves as the baseline for all taxable sales within California.

However, it is important to note that this is not the only tax applicable to purchases. Counties and cities have the authority to levy additional taxes, known as local taxes, on top of the state rate. These local taxes can significantly impact the total sales tax rate, creating variations across the state.

Understanding Local Sales Tax Rates

The local sales tax rates in California are determined by the county and city where the purchase is made. These rates can range from as low as 0% to as high as 12.125%, depending on the location. For instance, the city of Los Angeles has a local sales tax rate of 9.5%, while San Francisco imposes a 9.25% local tax.

To provide a clearer picture, let's consider an example. If you were to make a purchase in Los Angeles County, the total sales tax rate would be the sum of the state tax (7.25%) and the local tax (9.5%), resulting in a 16.75% sales tax rate. In contrast, a similar purchase in San Francisco would incur a total sales tax of 16.5% (state tax + local tax). These variations can significantly impact the cost of goods and services across the state.

Impact on Consumers and Businesses

The varying sales tax rates across California have implications for both consumers and businesses. For consumers, it means that the cost of goods can differ significantly depending on where they shop. This can influence purchasing decisions and potentially drive consumers to seek out lower-taxed areas for their purchases.

Businesses, on the other hand, face the challenge of managing sales tax compliance in a complex system. They must ensure that they are charging the correct tax rate based on the location of their customers and accurately remitting these taxes to the appropriate tax authorities. Failure to comply with sales tax regulations can result in penalties and legal issues.

To navigate this complexity, many businesses in California utilize sales tax automation software. These tools help businesses calculate the correct tax rate for each transaction, ensuring compliance and reducing the risk of errors. Additionally, some businesses choose to work with tax professionals who specialize in sales tax to ensure they are meeting their tax obligations accurately and efficiently.

Sales Tax Exemptions and Special Considerations

While sales tax is applicable to most goods and services in California, there are certain exemptions and special considerations to be aware of. Some items, such as prescription medications, groceries, and certain agricultural products, are exempt from sales tax. Additionally, certain types of transactions, like reselling goods or purchasing items for business use, may also be exempt from sales tax.

It's important for both consumers and businesses to understand these exemptions and their eligibility criteria. Businesses should ensure they are aware of the applicable sales tax laws and regulations to avoid inadvertently overcharging or undercharging customers.

| Sales Tax Rate Range | Localities |

|---|---|

| 7.25% - 8.25% | Most Counties |

| 8.75% - 9.75% | Major Cities (e.g., Los Angeles, San Francisco) |

| 10.25% - 12.125% | Special Districts (e.g., Transportation Taxes) |

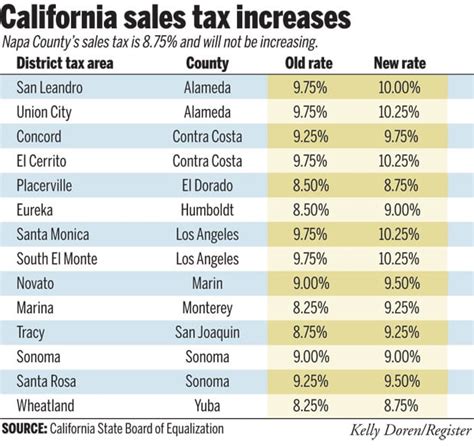

Staying Updated with Sales Tax Changes

The sales tax landscape in California is subject to change, with new tax laws and regulations being introduced periodically. It is crucial for both consumers and businesses to stay informed about these changes to ensure they are compliant with the latest tax requirements.

The California Department of Tax and Fee Administration (CDTFA) is the primary source for information on sales tax rates and regulations. They provide regular updates on their website, including any changes to tax rates, new laws, and important deadlines. It is advisable for individuals and businesses to regularly check this source to stay updated.

Additionally, subscribing to tax newsletters or following tax-related blogs can be a helpful way to receive timely updates on sales tax changes in California. Staying informed not only helps businesses avoid potential penalties but also ensures consumers are aware of any shifts in the tax landscape that may impact their purchasing decisions.

Conclusion: Navigating California’s Sales Tax Landscape

Understanding California’s sales tax system is crucial for both consumers and businesses operating within the state. The combination of state, county, and city sales taxes creates a complex but manageable landscape. By staying informed about the varying tax rates, exemptions, and compliance requirements, individuals and businesses can navigate this system effectively.

For consumers, being aware of the local sales tax rates can help them make cost-effective purchasing decisions. Businesses, on the other hand, need to ensure they are compliant with the applicable sales tax laws to avoid legal issues and maintain a positive relationship with their customers. Utilizing sales tax automation tools and seeking professional tax advice can greatly assist businesses in managing their sales tax obligations.

As California continues to thrive and evolve, its sales tax system will undoubtedly remain a significant aspect of its economic landscape. By staying informed and adaptable, both consumers and businesses can successfully navigate this complex but necessary component of doing business in the Golden State.

How often do sales tax rates change in California?

+Sales tax rates in California can change annually, typically as a result of new legislation or local ballot measures. It is important to stay updated with the California Department of Tax and Fee Administration for any changes.

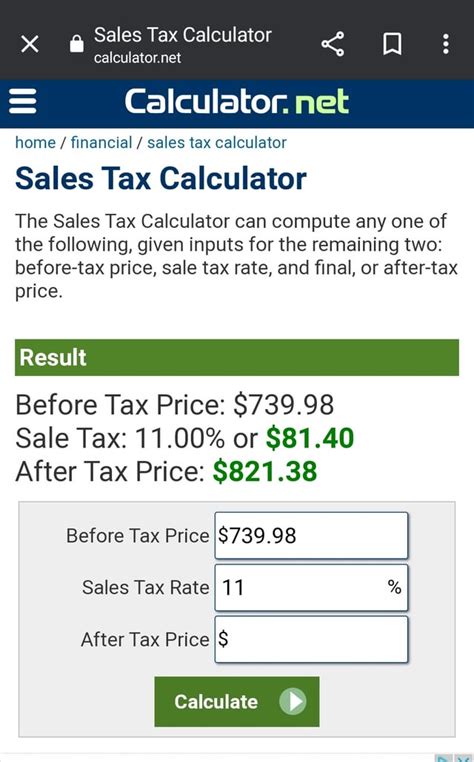

Are there any online resources to help calculate sales tax in California?

+Yes, there are several online sales tax calculators available, such as the Avalara Sales Tax Calculator, which can help estimate the total sales tax based on the location of the purchase.

What happens if a business fails to remit sales tax accurately?

+Businesses that fail to accurately remit sales tax may face penalties, interest charges, and legal consequences. It is crucial for businesses to maintain proper sales tax records and comply with tax regulations to avoid such issues.

Are there any sales tax holidays in California?

+Yes, California occasionally observes sales tax holidays, typically for back-to-school shopping or disaster preparedness. During these periods, certain items may be exempt from sales tax, providing a temporary relief for consumers.

How can I stay informed about sales tax changes in my specific county or city?

+You can contact your local tax office or subscribe to their newsletters to receive updates on sales tax changes specific to your county or city. Additionally, local newspapers and community websites often provide information on tax-related matters.