Georgia Tax Center Log In

Welcome to an in-depth exploration of the Georgia Tax Center, a vital online platform that simplifies tax management for residents and businesses in the state of Georgia. This platform is a one-stop solution for various tax-related services, ensuring convenience and efficiency for taxpayers. In this article, we will delve into the features, benefits, and step-by-step process of logging into the Georgia Tax Center, empowering you to navigate this essential resource with confidence.

Understanding the Georgia Tax Center

The Georgia Tax Center is an innovative web-based platform developed and maintained by the Georgia Department of Revenue (DOR). It serves as a comprehensive digital hub, offering a wide range of tax-related services and resources. From individual taxpayers to businesses, the center provides a user-friendly interface, ensuring a seamless experience for all.

The center's primary objective is to streamline tax processes, making them more accessible and less daunting. It accomplishes this by consolidating various tax-related tasks, such as filing returns, making payments, accessing tax forms, and staying updated with the latest tax news and guidelines. This centralized approach saves time and effort, eliminating the need to navigate multiple websites or visit physical offices.

Key Features and Benefits

The Georgia Tax Center boasts an array of features designed to enhance the taxpayer experience. Let’s explore some of the key benefits it offers:

Efficient Tax Filing

The center provides a secure and user-friendly platform for filing individual and business tax returns. It guides users through the process, ensuring accuracy and completeness. With its intuitive design, even complex tax scenarios can be navigated with ease.

Secure Payment Options

Taxpayers can make payments directly through the center, offering a secure and convenient method. It supports various payment options, including credit/debit cards, electronic checks, and even payment plans for those who need more flexibility.

Real-Time Account Management

Registered users can access their account information in real-time. This feature allows them to view past filings, track refund status, update personal information, and stay informed about their tax obligations.

Comprehensive Resource Library

The center houses a wealth of resources, including tax forms, publications, and helpful guides. This library ensures that taxpayers have the information they need to understand and comply with Georgia’s tax laws.

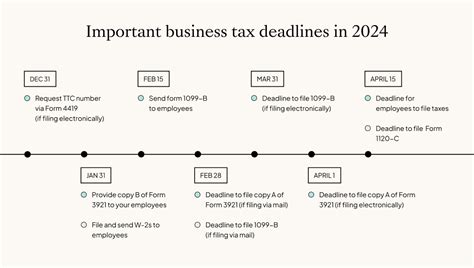

Tax Calendar and Alerts

A built-in tax calendar keeps users informed about important deadlines. Additionally, the center offers alert systems, sending notifications about upcoming tax events or changes in regulations.

Business Registration and Licensing

Businesses can utilize the center to register and obtain the necessary licenses and permits. This streamlines the process, making it quicker and more efficient for new and existing businesses.

Logging into the Georgia Tax Center

Logging into the Georgia Tax Center is a straightforward process. Here’s a step-by-step guide to ensure a smooth experience:

- Visit the Official Website: Begin by opening your preferred web browser and navigating to the official Georgia Tax Center website. You can find the link on the Georgia Department of Revenue homepage or by searching for "Georgia Tax Center Login" in a search engine.

- Locate the Login Section: Once on the website, look for the login section, usually located at the top right corner of the homepage. It may be labeled as "Login," "Sign In," or "My Account."

- Enter Your Credentials: Click on the login button, and you will be directed to a secure login page. Here, you will need to enter your username and password. Ensure that you are using the correct credentials associated with your tax account.

- Secure Login: After entering your details, click the "Log In" or "Sign In" button. The system will verify your credentials, and if valid, you will be granted access to your account.

- Two-Factor Authentication (Optional): For added security, the Georgia Tax Center may offer two-factor authentication. If enabled, you will receive a verification code via email, text message, or a mobile app. Enter this code to complete the login process.

- Access Your Account: Once logged in, you will be directed to your personalized dashboard. From here, you can access various tax-related services, manage your account, and perform any necessary actions.

It's important to note that the login process may vary slightly based on your user type (individual or business) and the specific services you require. The Georgia Tax Center website provides detailed instructions and support resources to guide you through the process.

Security and Privacy

The Georgia Tax Center prioritizes the security and privacy of its users. The platform employs advanced encryption technologies to protect sensitive information during transmission and storage. Additionally, it adheres to strict data protection regulations, ensuring that your personal and financial data remains confidential.

Additional Resources and Support

The Georgia Department of Revenue understands that tax matters can be complex, and they offer a range of support resources to assist taxpayers. These include:

- Help Center: A comprehensive online help center provides answers to frequently asked questions and step-by-step guides for various tax-related tasks.

- Contact Options: Taxpayers can reach out to the DOR through various channels, including phone, email, and live chat. The department provides dedicated support teams to assist with specific inquiries.

- Training and Webinars: Regular training sessions and webinars are conducted to educate taxpayers about new tax laws, changes in regulations, and best practices for using the Georgia Tax Center.

Future Enhancements and Updates

The Georgia Department of Revenue is committed to continuous improvement and innovation. The Georgia Tax Center is regularly updated to incorporate new features, enhance existing functionalities, and improve the overall user experience. Stay tuned for upcoming enhancements, which may include improved mobile accessibility, expanded payment options, and more personalized tax guidance.

Conclusion

The Georgia Tax Center is a powerful tool that revolutionizes the way taxpayers interact with the state’s tax system. By consolidating various tax-related services into a single platform, it simplifies the tax management process, making it more accessible and efficient. Logging into the center is a straightforward process, and with its user-friendly interface and comprehensive resources, taxpayers can confidently navigate their tax obligations.

As you embark on your tax journey with the Georgia Tax Center, remember that staying informed and utilizing the available resources can make tax compliance a seamless and stress-free experience. Embrace the digital transformation of tax management, and let the center guide you toward a brighter financial future.

What if I forget my username or password for the Georgia Tax Center?

+

If you encounter issues with your login credentials, the Georgia Tax Center provides a “Forgot Username” and “Forgot Password” feature. Simply click on the respective link during the login process, and you will be guided through a secure process to retrieve or reset your information. Ensure you have access to the email address associated with your account for verification purposes.

Can I access the Georgia Tax Center on my mobile device?

+

Yes, the Georgia Tax Center is designed to be mobile-friendly. You can access the platform using your smartphone or tablet’s web browser. The responsive design ensures a seamless experience, allowing you to manage your tax affairs on the go.

How secure is my personal information on the Georgia Tax Center?

+

The Georgia Tax Center employs robust security measures to protect your personal and financial data. All information transmitted and stored on the platform is encrypted, and the center adheres to strict data privacy regulations. Your data is secure, and only authorized users with valid credentials can access your account.

What if I need further assistance with my tax matters beyond the online resources?

+

The Georgia Department of Revenue offers various support channels to assist taxpayers. You can reach out to their dedicated support teams via phone, email, or live chat. They provide expert guidance and can help resolve complex tax-related issues. Additionally, the DOR conducts regular taxpayer workshops and webinars to provide in-depth assistance.

Are there any upcoming changes or updates to the Georgia Tax Center that I should be aware of?

+

The Georgia Tax Center is continuously evolving to meet the changing needs of taxpayers. Stay tuned for future updates, which may include enhanced mobile functionality, expanded payment options, and more personalized tax guidance. The DOR actively engages with taxpayers to gather feedback and improve the platform’s user experience.