Is Overtime Tax Free Now

The question of whether overtime pay is tax-free is an important one for many workers, especially those who frequently work beyond their regular hours. The concept of tax-free income is intriguing, but is it a reality for overtime earnings? Let's delve into the intricacies of the tax system and explore the current status of overtime pay.

Understanding Overtime Pay and Taxes

Overtime pay is a compensation for work performed beyond the standard workweek, which is typically 40 hours in many countries. It is a crucial aspect of labor laws, ensuring that employees receive fair remuneration for their extra efforts. The tax treatment of overtime pay, however, can vary depending on the jurisdiction and the specific employment arrangement.

In general, overtime pay is subject to income tax, just like regular wages. This means that when you receive additional compensation for working overtime, a portion of that income will be deducted for tax purposes. The tax rate applied to overtime pay may be the same as the rate for regular income or it might be calculated separately, depending on the tax system in your region.

Tax Exemptions and Benefits for Overtime

While overtime pay is usually taxable, there are certain scenarios where exemptions or benefits may apply. These situations can vary widely and are often subject to specific conditions and criteria. Here are some instances where overtime pay might be tax-exempt or eligible for special treatment:

Industry-Specific Exemptions

Some industries or professions may have specific tax exemptions for overtime pay. For example, certain agricultural workers or those in the oil and gas industry might be exempt from paying taxes on a portion of their overtime earnings. These exemptions are typically granted to support specific sectors or to address unique labor dynamics.

Shift Work and Night Premiums

In some cases, employees who work night shifts or irregular schedules might receive a premium or bonus for their work during these hours. These premiums can sometimes be tax-free, provided they meet certain criteria. For instance, the premium must be explicitly designated as a shift allowance or night differential and not considered part of the regular wage.

| Industry | Overtime Tax Exemption |

|---|---|

| Agriculture | Exemption for certain types of labor |

| Oil and Gas | Tax-free allowance for overtime in remote locations |

| Healthcare | Potential tax benefits for night shift workers |

Performance-Based Bonuses

Performance bonuses or incentives that are directly tied to specific achievements or targets can sometimes be tax-free or eligible for reduced taxation. If your overtime pay is structured as a performance bonus, it might fall under this category. However, the criteria for such bonuses can be complex, and they often require careful documentation to be eligible for tax benefits.

Tax Treatment of Overtime: A Global Perspective

The tax treatment of overtime pay can vary significantly from one country to another. Let’s take a look at how different regions approach this issue:

United States

In the United States, overtime pay is generally taxable. The Internal Revenue Service (IRS) treats overtime wages as part of an employee’s regular income and subjects them to the applicable federal, state, and local income taxes. However, certain industries or specific tax incentives might provide exemptions or reduced tax rates for overtime earnings.

United Kingdom

The UK’s tax system also considers overtime pay as taxable income. The rate at which overtime is taxed depends on the employee’s overall income and the applicable tax brackets. Like the US, there may be specific tax reliefs or exemptions available for certain industries or situations.

Canada

Canada’s tax rules for overtime pay are similar to those in the US and UK. Overtime earnings are taxable and are subject to income tax deductions. However, some provinces may offer specific tax credits or exemptions for overtime work, particularly in industries like construction or manufacturing.

Australia

Australia’s tax system also treats overtime pay as taxable income. The Australian Taxation Office (ATO) considers overtime earnings as part of an employee’s assessable income and applies the relevant tax rates accordingly. However, certain industries, such as mining or construction, might have specific tax arrangements for overtime work.

Maximizing Your Overtime Earnings

While overtime pay is generally taxable, there are strategies you can employ to optimize your financial situation:

- Understand your industry's tax landscape: Research the specific tax rules and exemptions applicable to your industry or profession. This can help you identify any potential benefits or tax-saving opportunities.

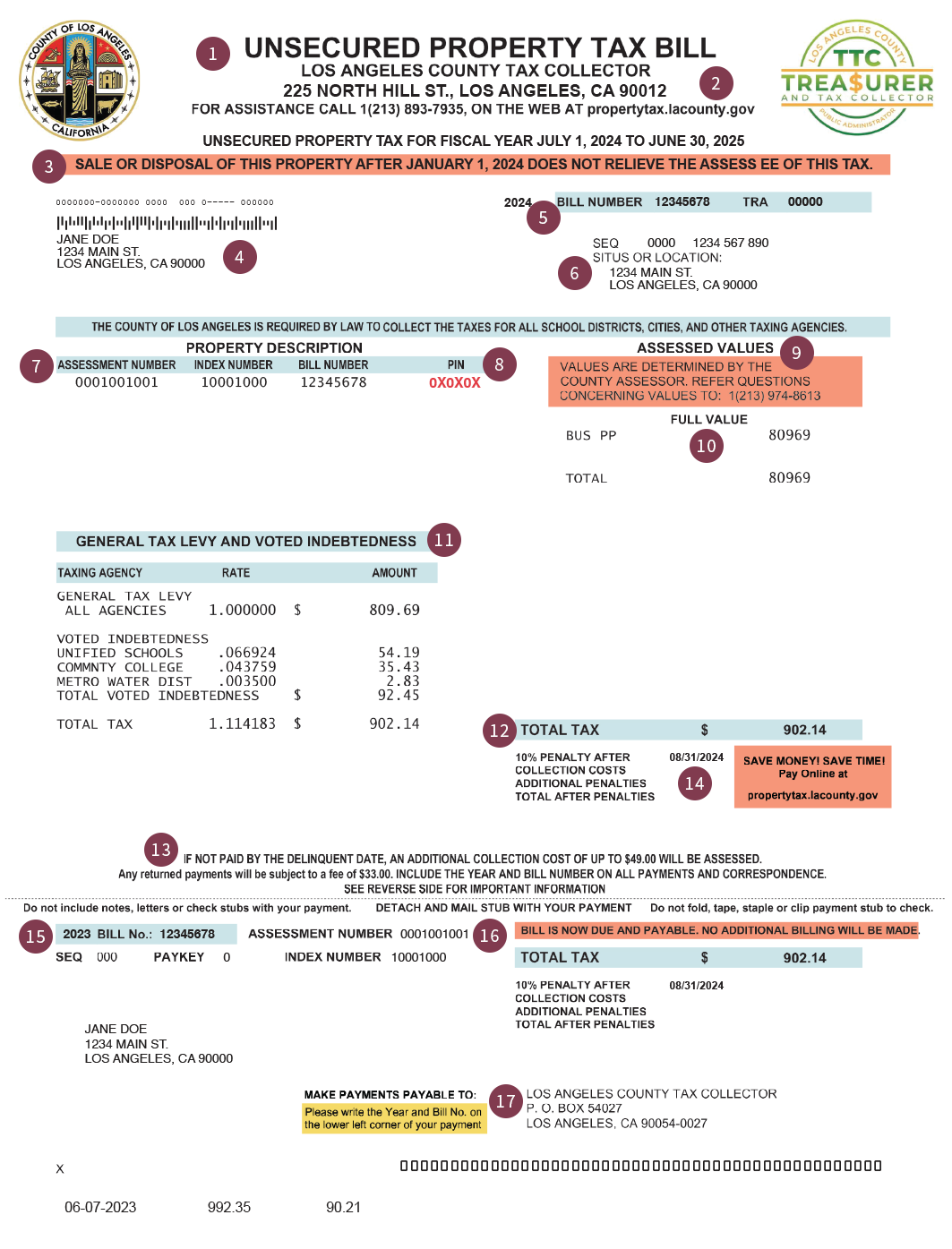

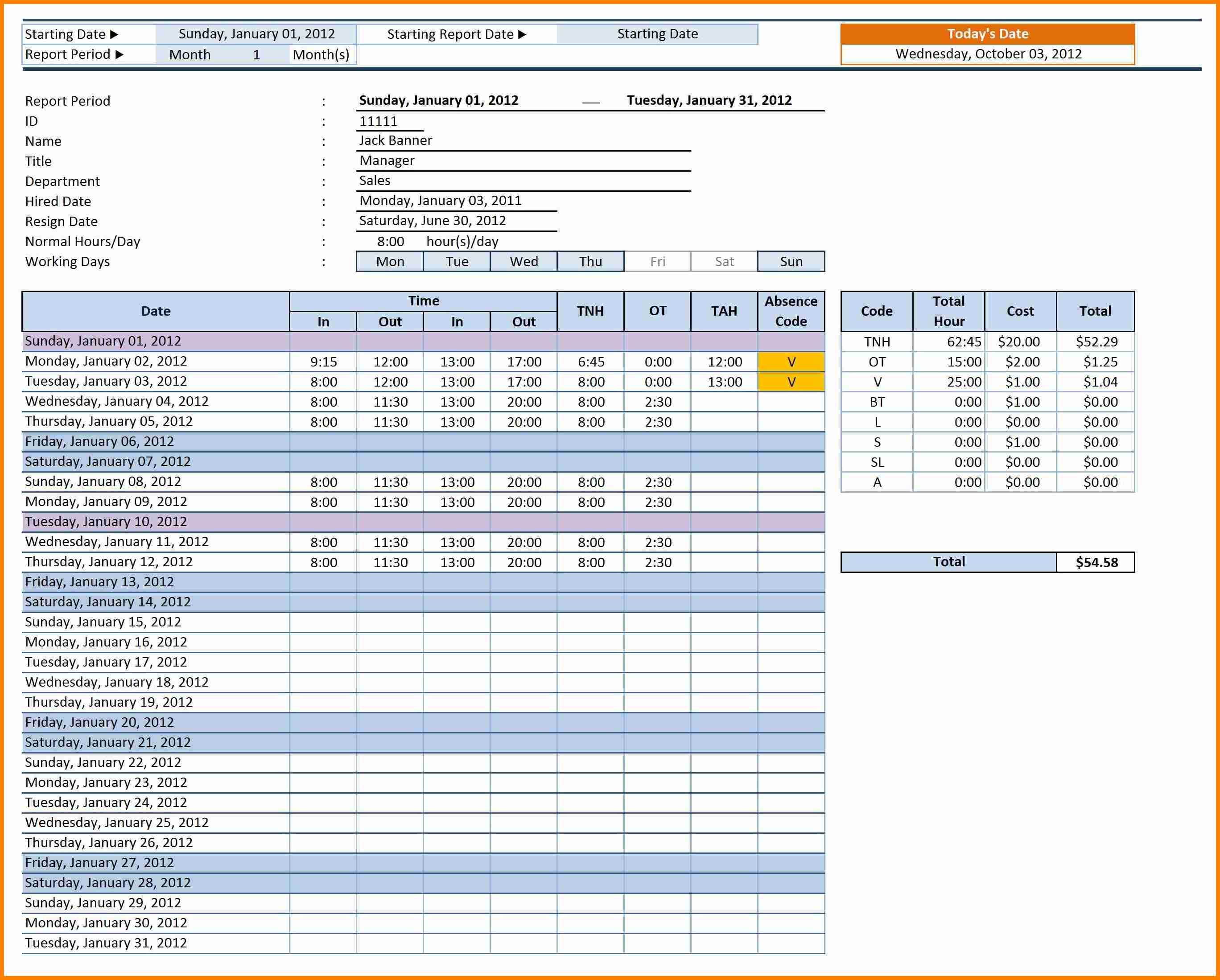

- Track your overtime accurately: Keep meticulous records of your overtime hours and earnings. This will not only help with tax compliance but can also provide valuable data for negotiating future compensation.

- Consider tax-efficient savings plans: Explore tax-advantaged savings accounts or retirement plans that can help you save a portion of your overtime earnings while reducing your tax burden.

Conclusion: Navigating the Tax Landscape

The tax treatment of overtime pay is a complex matter, and it’s essential to stay informed about the rules and regulations in your region. While overtime pay is generally taxable, there are situations where exemptions or benefits can apply. By staying aware of these opportunities and taking proactive measures, you can ensure that you’re making the most of your overtime earnings while remaining compliant with tax laws.

What happens if I don’t pay taxes on my overtime earnings?

+Failing to pay taxes on overtime earnings can lead to serious legal consequences. Tax evasion is a criminal offense in many countries, and it can result in significant fines, penalties, and even imprisonment. It’s crucial to declare all income, including overtime pay, to avoid legal issues and maintain compliance with tax laws.

Are there any tax benefits for working overtime in remote locations?

+Yes, some countries offer tax benefits for working overtime in remote or challenging locations. For example, certain oil and gas workers in remote regions may be eligible for tax-free allowances or reduced tax rates on their overtime earnings. These benefits are often industry-specific and subject to strict criteria.

Can I negotiate tax-free overtime pay with my employer?

+Negotiating tax-free overtime pay is a complex matter and largely depends on the tax laws and regulations in your country. While some employers might be open to discussing tax-efficient compensation packages, it’s essential to understand the legal and tax implications. It’s recommended to consult with a tax professional before engaging in such negotiations.