Tax Brackets 2018

Tax brackets play a crucial role in determining how much income tax individuals and families owe to the government each year. These brackets, which are updated annually, define the rates at which different income levels are taxed. For the tax year 2018, the Internal Revenue Service (IRS) set specific tax brackets for each filing status, offering a nuanced approach to tax liability. Understanding these tax brackets is essential for taxpayers to plan their finances effectively and ensure compliance with tax regulations.

Understanding the 2018 Tax Brackets

In 2018, the IRS implemented a progressive tax system, meaning that as taxable income increases, so does the applicable tax rate. This system is designed to ensure fairness and to balance the tax burden across different income levels. The tax brackets for the 2018 tax year were set based on the Tax Cuts and Jobs Act, which brought significant changes to the U.S. tax code.

The 2018 tax brackets were structured based on filing status, with separate brackets for single filers, married filing jointly or qualifying widow(er), married filing separately, and head of household. Each filing status had a unique set of tax rates and income thresholds, reflecting the diverse financial situations of American taxpayers.

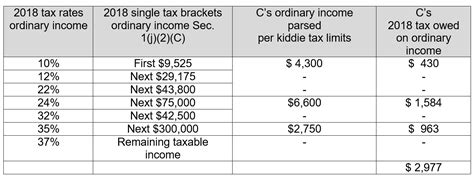

Single Filers

For single filers, the 2018 tax brackets were as follows:

| Tax Rate | Taxable Income Range |

|---|---|

| 10% | 0 - 9,525 |

| 12% | 9,526 - 38,700 |

| 22% | 38,701 - 82,500 |

| 24% | 82,501 - 157,500 |

| 32% | 157,501 - 200,000 |

| 35% | 200,001 - 500,000 |

| 37% | $500,001 and above |

Single filers with taxable income falling within these brackets were subject to the corresponding tax rates. For example, an individual with a taxable income of $40,000 would fall into the 22% tax bracket, while someone earning $250,000 would be in the 35% tax bracket.

Married Filing Jointly and Qualifying Widow(er)

For married couples filing jointly or qualifying widow(er)s, the 2018 tax brackets were more favorable due to the combined income. Here are the tax brackets for this filing status:

| Tax Rate | Taxable Income Range |

|---|---|

| 10% | 0 - 19,050 |

| 12% | 19,051 - 77,400 |

| 22% | 77,401 - 165,000 |

| 24% | 165,001 - 315,000 |

| 32% | 315,001 - 400,000 |

| 35% | 400,001 - 600,000 |

| 37% | $600,001 and above |

These tax brackets demonstrate the benefit of filing jointly, as the thresholds for each bracket are higher compared to single filers. For instance, a married couple with a combined taxable income of $200,000 would be in the 24% tax bracket, which is a significant difference from the 35% bracket for single filers earning the same amount.

Married Filing Separately

Individuals who are married but choose to file separately have different tax brackets than those who file jointly. The 2018 tax brackets for married filing separately were as follows:

| Tax Rate | Taxable Income Range |

|---|---|

| 10% | 0 - 9,525 |

| 12% | 9,526 - 38,700 |

| 22% | 38,701 - 82,500 |

| 24% | 82,501 - 157,500 |

| 32% | 157,501 - 199,500 |

| 35% | 199,501 - 200,000 |

| 37% | $200,001 and above |

The tax brackets for married filing separately are similar to those for single filers, but with some adjustments in the income thresholds. This filing status is often less advantageous in terms of tax liability, as it may result in higher taxes compared to filing jointly.

Head of Household

The tax brackets for head of household filers in 2018 were designed to provide support for individuals who are the primary caregivers for their households. These tax brackets were as follows:

| Tax Rate | Taxable Income Range |

|---|---|

| 10% | 0 - 13,600 |

| 12% | 13,601 - 51,800 |

| 22% | 51,801 - 84,200 |

| 24% | 84,201 - 160,700 |

| 32% | 160,701 - 200,000 |

| 35% | 200,001 - 500,000 |

| 37% | $500,001 and above |

The head of household filing status offers certain tax benefits, especially for individuals who are single parents or have dependents living with them. The income thresholds and tax rates are designed to provide some relief for these taxpayers.

Impact of Tax Brackets on Taxpayers

The 2018 tax brackets had a significant impact on taxpayers, influencing their financial planning and tax strategies. Here are some key aspects to consider:

Tax Liability and Withholding

Understanding the tax brackets helped taxpayers estimate their tax liability for the year. By comparing their taxable income to the bracket thresholds, individuals could anticipate their tax obligations and adjust their withholding accordingly. This ensured that they were neither overpaying nor underpaying their taxes throughout the year.

Tax Planning Strategies

Taxpayers often employ various strategies to optimize their tax situation within the confines of the tax brackets. For instance, individuals with incomes near the threshold of a higher tax bracket may explore tax-efficient investments or contributions to retirement accounts to reduce their taxable income and stay within a lower bracket. Additionally, understanding the brackets can guide taxpayers in making informed decisions about when to claim deductions or credits, as these can impact their taxable income and, consequently, their tax bracket.

Income Distribution and Economic Impact

The progressive nature of the tax system, as reflected in the tax brackets, has broader economic implications. By taxing higher incomes at higher rates, the government aims to distribute the tax burden more equitably. This approach can influence income distribution and impact economic growth, as higher-income earners may adjust their spending and investment behaviors in response to the tax rates.

Looking Ahead: Tax Bracket Adjustments

Tax brackets are not static; they are subject to annual adjustments to account for inflation and economic changes. The IRS typically announces these adjustments before the start of each tax year. For taxpayers, staying informed about these changes is crucial for effective tax planning. Adjustments to tax brackets can impact tax liability, especially for individuals with incomes near the threshold of a new bracket.

It's worth noting that the 2018 tax brackets were part of a larger tax reform package, and subsequent years have seen further adjustments and potential changes to the tax code. Taxpayers and tax professionals must stay abreast of these changes to ensure compliance and take advantage of any beneficial adjustments.

Conclusion

The 2018 tax brackets served as a vital framework for taxpayers to understand their tax obligations and plan their finances accordingly. The progressive tax system, as reflected in these brackets, aims to create a fair and balanced tax structure. Understanding the intricacies of tax brackets is an essential part of financial literacy, empowering individuals to make informed decisions about their earnings, investments, and tax strategies.

What is the difference between tax brackets and marginal tax rates?

+Tax brackets define the income ranges at which specific tax rates apply, while marginal tax rates refer to the tax rate that applies to the last dollar of income earned. For example, if you’re in the 22% tax bracket, that’s your marginal tax rate, but you’ll also pay the rates in the lower brackets on the income falling within those ranges.

How often are tax brackets updated, and why?

+Tax brackets are typically updated annually to account for inflation. This adjustment ensures that taxpayers are not pushed into higher tax brackets solely due to rising costs of living, maintaining the fairness of the tax system.

Can tax brackets impact my decision to file taxes jointly or separately with my spouse?

+Yes, tax brackets can influence the decision to file jointly or separately. Married couples often benefit from filing jointly due to the more favorable tax brackets for this status. However, in certain situations, such as when one spouse has significantly higher income than the other, filing separately may be more advantageous.

Are there any tax strategies to reduce my tax liability within the 2018 tax brackets?

+Absolutely! Taxpayers can employ various strategies to reduce their tax liability within the 2018 tax brackets. These include maximizing deductions and credits, contributing to tax-advantaged retirement accounts, and exploring tax-efficient investment options. Consulting a tax professional can provide tailored advice based on your specific circumstances.