Richland County Sc Tax

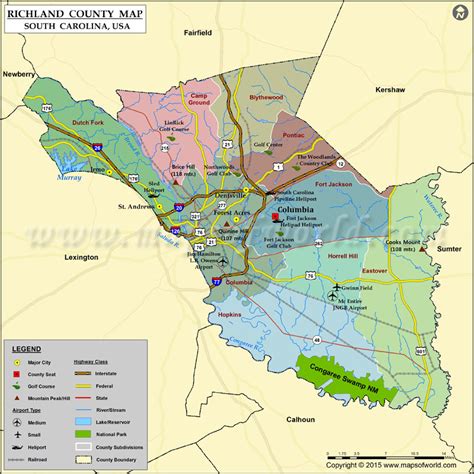

In the realm of property ownership and financial obligations, the topic of Richland County SC Tax is an important one for residents and business owners alike. Understanding the intricacies of property taxes, their assessment, and payment processes is essential for maintaining compliance and financial well-being. This comprehensive guide aims to shed light on the tax system in Richland County, South Carolina, offering an in-depth analysis and practical insights.

The Richland County Tax System: An Overview

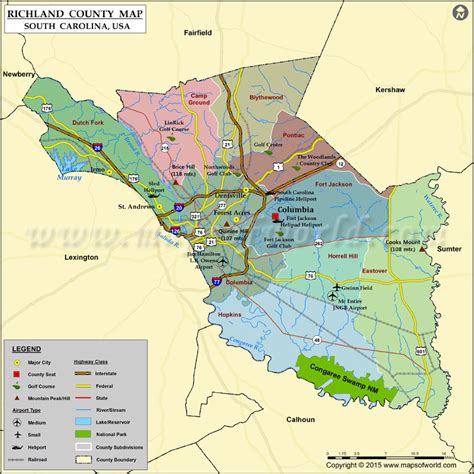

Richland County, nestled in the heart of South Carolina, operates a robust tax system designed to fund essential public services and infrastructure. The property tax forms a significant portion of the county’s revenue, contributing to the maintenance of roads, schools, emergency services, and other vital community amenities.

The tax system in Richland County is administered by the Richland County Treasurer's Office, which oversees the assessment, billing, and collection of property taxes. This office plays a crucial role in ensuring that property owners meet their financial obligations and that the county's services and projects are adequately funded.

Tax Assessment Process

The assessment process is a fundamental step in determining the tax liability for each property in Richland County. It involves the evaluation of the property’s value, taking into account various factors such as location, size, improvements, and market conditions.

The Richland County Assessor's Office is responsible for conducting these assessments. They employ a team of professionals who regularly review and update property records, ensuring that the assessed values are accurate and fair. This process is critical in maintaining a balanced and equitable tax system, where property owners pay their fair share based on the value of their holdings.

| Assessment Period | Frequency |

|---|---|

| Residential Properties | Every 5 years |

| Commercial Properties | Annually |

During the assessment period, property owners may receive a notice of value, which details the assessed value of their property. If an owner disagrees with the assessed value, they have the right to appeal the decision through a formal process outlined by the county.

Tax Rates and Calculations

The tax rate in Richland County is determined by the various taxing authorities, including the county government, school districts, and special purpose districts. These rates are expressed as mills, with one mill equating to one dollar of tax for every $1,000 of assessed property value.

To calculate the tax liability for a property, the assessed value is multiplied by the applicable tax rate(s). For instance, if a property has an assessed value of $200,000 and the tax rate is 10 mills, the tax liability would be $2,000 ($200,000 x 0.010). This calculation is applied to each taxing authority's rate, and the totals are summed to determine the final tax bill.

| Taxing Authority | Millage Rate |

|---|---|

| Richland County Government | 5.9 mills |

| Richland School District 1 | 12.8 mills |

| Special Purpose Districts (varies by location) | Up to 3 mills |

It's important to note that tax rates can vary across different areas of Richland County, depending on the services and infrastructure provided by each taxing authority. Property owners can refer to their tax bills or contact the Richland County Treasurer's Office for specific tax rate information applicable to their property.

Tax Payment Process

Property taxes in Richland County are typically due in two installments, with payment deadlines in June and December. The Richland County Treasurer’s Office sends out tax bills to property owners, detailing the amounts due, payment deadlines, and payment options.

Property owners have several payment methods available, including online payment through the county's website, payment by mail, or in-person payment at the Treasurer's Office. It's essential for property owners to stay informed about payment deadlines to avoid late fees and potential penalties.

The Richland County Treasurer's Office also offers a tax relief program for eligible homeowners, providing a reduction in property taxes based on income and other criteria. This program aims to assist senior citizens and low-income homeowners in maintaining their properties and remaining in their communities.

Tax Exemptions and Special Programs

Richland County recognizes the importance of supporting certain groups and organizations through tax exemptions and special programs. These initiatives not only provide financial relief to eligible individuals and entities but also contribute to the overall well-being and vitality of the community.

Homestead Exemptions

The homestead exemption is a significant tax relief program offered by Richland County, benefiting homeowners who use their property as their primary residence. This exemption reduces the assessed value of the property for tax purposes, resulting in a lower tax liability. It’s designed to ease the financial burden on homeowners and encourage homeownership.

To qualify for the homestead exemption, homeowners must meet specific criteria, including being the legal owner of the property and using it as their primary residence. The exemption amount can vary, and property owners should consult the Richland County Treasurer's Office for the most up-to-date information on eligibility and exemption amounts.

Veteran’s Exemptions

Richland County extends its appreciation to veterans by offering a veteran’s exemption, which provides a reduction in property taxes for eligible veterans. This exemption is a way for the county to honor the service and sacrifices made by those who have served in the armed forces.

Veterans who meet the criteria, such as having a service-connected disability or meeting certain income thresholds, can apply for this exemption. The Richland County Assessor's Office handles the application process, and eligible veterans can receive a significant reduction in their property tax liability.

Nonprofit and Religious Organization Exemptions

Richland County recognizes the valuable contributions of nonprofit organizations and religious institutions to the community by offering tax exemptions for their properties. These exemptions ensure that these organizations can dedicate more resources to their missions and services without the burden of high property taxes.

To qualify for these exemptions, organizations must meet specific criteria, such as being a bona fide nonprofit entity or a religious institution. The Richland County Treasurer's Office handles the application process, and eligible organizations can enjoy a complete exemption from property taxes, allowing them to allocate more funds towards their charitable activities.

The Future of Richland County’s Tax System

As Richland County continues to evolve and grow, its tax system will play a pivotal role in shaping the future of the community. The revenue generated from property taxes is essential for funding critical services, infrastructure development, and economic initiatives.

Economic Impact and Development

The tax revenue collected in Richland County contributes significantly to the local economy. It supports the development and maintenance of vital infrastructure, such as roads, bridges, and public transportation systems. These improvements enhance the quality of life for residents and create a more attractive environment for businesses, fostering economic growth and job creation.

Additionally, the tax system supports the county's efforts in attracting new businesses and industries. By providing a stable and efficient tax structure, Richland County can offer a competitive business environment, encouraging investment and innovation. This, in turn, leads to increased tax revenue, further benefiting the community.

Community Engagement and Transparency

Richland County is committed to maintaining transparency and engagement with its residents and taxpayers. The county actively communicates tax-related information, including assessment processes, tax rates, and payment options, to ensure that property owners are well-informed and can participate effectively in the tax system.

The Richland County Treasurer's Office and Assessor's Office host regular public meetings and provide online resources to keep residents updated on tax-related matters. This transparency fosters trust and understanding, allowing property owners to actively contribute to the financial health of their community.

Technological Advancements and Online Services

Richland County recognizes the importance of leveraging technology to enhance the efficiency and accessibility of its tax system. The county has invested in online platforms and digital tools to streamline the tax assessment, billing, and payment processes.

Property owners can now access their tax information, assessment details, and payment history online. They can also receive electronic notices and reminders, making it easier to stay on top of their tax obligations. This digital transformation not only improves convenience but also reduces administrative costs and environmental impact.

Community Development Initiatives

Beyond the collection and distribution of tax revenue, Richland County is dedicated to using its resources to enhance the overall well-being of its residents. The tax system plays a crucial role in funding community development initiatives, such as affordable housing programs, small business support, and initiatives aimed at improving social and economic equity.

By strategically allocating tax revenue, Richland County can address pressing community needs, promote sustainable development, and foster a sense of belonging and opportunity for all residents.

How can I appeal my property’s assessed value if I disagree with it?

+If you believe your property’s assessed value is inaccurate, you have the right to appeal. The process typically involves submitting an appeal to the Richland County Assessor’s Office within a specified timeframe. You’ll need to provide evidence and supporting documentation to support your claim. It’s recommended to consult the county’s guidelines or seek professional advice for a successful appeal.

What are the payment options for property taxes in Richland County?

+Richland County offers a variety of payment options for property taxes. You can pay online through the county’s website, by mail, or in person at the Treasurer’s Office. The county also accepts payments by phone and through electronic funds transfer. Be sure to check the payment deadlines to avoid late fees.

Are there any tax relief programs for senior citizens in Richland County?

+Yes, Richland County provides tax relief programs for senior citizens. The homestead exemption, for instance, offers a reduction in property taxes for homeowners aged 65 and older. Additionally, the county offers a tax relief program specifically designed for low-income senior citizens. You can contact the Richland County Treasurer’s Office for more details and eligibility criteria.

How often are property values reassessed in Richland County?

+Property values in Richland County are reassessed periodically. Residential properties are typically reassessed every five years, while commercial properties are reassessed annually. These reassessments ensure that property values remain accurate and up-to-date, allowing for fair and equitable taxation.