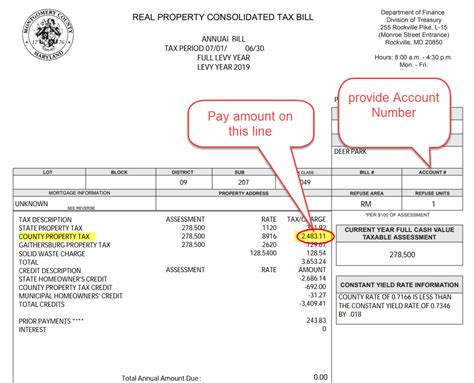

Property Tax Montgomery County Md

Welcome to this in-depth exploration of Property Tax in Montgomery County, Maryland. As a hub of economic activity and diverse communities, Montgomery County has a unique property tax system that impacts homeowners, businesses, and residents alike. This article will delve into the intricacies of this system, providing a comprehensive guide to understanding and managing property taxes in this vibrant county.

Understanding Property Taxes in Montgomery County

Property taxes are a significant source of revenue for local governments, including Montgomery County. These taxes contribute to funding essential services such as education, public safety, infrastructure, and more. The Montgomery County Department of Finance is responsible for assessing and collecting property taxes, ensuring a fair and efficient process for all property owners.

The property tax system in Montgomery County is based on the assessed value of real property. This value is determined by the Montgomery County Assessment Office, which conducts periodic assessments to ensure that property values are accurately reflected. The assessment process involves evaluating factors such as location, size, improvements, and recent sales of similar properties.

The assessed value of a property is then used to calculate the tax liability. Montgomery County utilizes a two-tiered tax rate structure, with different rates applicable to residential and commercial properties. This rate structure aims to distribute the tax burden fairly among property owners.

Residential Property Tax Rates

Residential properties in Montgomery County are assessed at a lower rate compared to commercial properties. The tax rate for residential properties is currently set at 0.96 per 100 of assessed value. This means that for every 100 of assessed value, homeowners pay 0.96 in property taxes. For example, a residential property with an assessed value of 300,000 would incur a property tax bill of 2,880 annually.

| Property Type | Tax Rate ($/100 of Assessed Value) |

|---|---|

| Residential | $0.96 |

| Commercial | $1.23 |

Commercial Property Tax Rates

Commercial properties, including businesses and investment properties, are assessed at a higher rate. The tax rate for commercial properties is currently 1.23 per 100 of assessed value. This rate is designed to account for the different usage and impact of commercial properties on the community. A commercial property with an assessed value of 500,000, for instance, would result in an annual property tax bill of 6,150.

Property Assessment and Appeals

Property assessments are conducted by the Montgomery County Assessment Office on a rolling basis, with some properties being reassessed more frequently than others. Property owners receive a Notice of Assessment, detailing the assessed value of their property and the corresponding tax liability. If a property owner believes that their assessment is inaccurate, they have the right to appeal.

The Appeals Process

Montgomery County provides a formal appeals process for property owners to challenge their assessments. The first step is to submit a written request for a review within a specified timeframe. The Assessment Office will then conduct a review and may schedule an informal hearing to discuss the assessment. If the property owner remains dissatisfied, they can request a formal appeal hearing before the Montgomery County Property Tax Assessment Appeal Board.

During the appeal process, property owners have the opportunity to present evidence, such as comparable sales data, appraisals, or other relevant information, to support their case. The Assessment Office will carefully consider all evidence and make a final determination on the assessed value. If the assessment is reduced, the property owner's tax liability will also be adjusted accordingly.

Managing Property Tax Payments

Montgomery County offers various options for property owners to manage their tax payments. The most common method is to pay in full by the due date, which is typically in late summer or early fall. Property owners can pay their taxes online, by mail, or in person at designated locations.

Payment Plans and Installments

For those who prefer a more flexible payment schedule, Montgomery County provides payment plans and installment options. Property owners can set up automatic payments or choose to pay in quarterly installments. This allows for better budgeting and can alleviate the financial burden of a large one-time payment.

Late Payments and Penalties

It’s important to note that late payments of property taxes can result in penalties and interest. Montgomery County imposes a late fee of 10% of the unpaid balance if taxes are not paid by the due date. Additionally, interest accrues at a rate of 1.5% per month on the unpaid balance. To avoid these penalties, it’s crucial to stay informed about payment deadlines and take advantage of the available payment options.

Property Tax Relief Programs

Montgomery County recognizes the financial impact of property taxes on its residents and offers several tax relief programs to assist eligible property owners. These programs aim to provide support to homeowners, seniors, and individuals with limited means.

Homeowner Tax Credit

The Homeowner Tax Credit is a valuable program that provides a credit against the property tax bill for eligible homeowners. To qualify, homeowners must meet certain income requirements and own and occupy the property as their primary residence. The credit amount is determined based on the homeowner’s income and can significantly reduce their tax liability.

Senior Citizen Tax Credit

The Senior Citizen Tax Credit is designed to assist senior citizens who own and occupy their primary residence in Montgomery County. Eligible seniors can receive a credit against their property taxes, reducing the financial burden. The credit amount is based on the senior’s income and age, with higher credits available for older individuals.

Property Tax Relief Programs for Low-Income Residents

Montgomery County also offers various property tax relief programs for low-income residents. These programs aim to ensure that property taxes do not become a barrier to homeownership for those with limited financial means. Eligibility for these programs is typically based on income and asset limits, and they can provide significant relief to qualifying individuals.

Impact of Property Taxes on the Community

Property taxes play a crucial role in funding essential services and initiatives in Montgomery County. The revenue generated from property taxes supports a wide range of programs and infrastructure projects, benefiting the entire community.

Education

A significant portion of property tax revenue is allocated to education. This funding supports public schools, providing resources for teachers, classroom materials, and infrastructure improvements. It ensures that students in Montgomery County receive a quality education and have access to the tools they need to succeed.

Public Safety

Property taxes also contribute to maintaining a safe and secure community. The revenue funds police and fire departments, ensuring that residents have access to emergency services and law enforcement. It helps to keep neighborhoods safe and promotes a high quality of life.

Infrastructure and Community Development

Property taxes are instrumental in funding infrastructure projects and community development initiatives. This includes the maintenance and improvement of roads, bridges, and public transportation systems. Additionally, property tax revenue supports community centers, parks, and recreational facilities, enhancing the overall well-being and enjoyment of residents.

Conclusion: A Fair and Comprehensive Property Tax System

Montgomery County’s property tax system is designed to be fair, efficient, and supportive of the community. By understanding the assessment process, tax rates, and available relief programs, property owners can navigate the system with confidence. The revenue generated from property taxes directly benefits the community, contributing to a high quality of life and a vibrant local economy.

Stay informed, utilize the available resources, and take advantage of the opportunities provided by Montgomery County's property tax system. By doing so, property owners can ensure they are paying their fair share while also supporting the growth and development of this thriving county.

How often are property assessments conducted in Montgomery County?

+Property assessments are conducted on a rolling basis, with some properties being reassessed every year, while others are reassessed every three years. The Montgomery County Assessment Office determines the reassessment schedule based on various factors, including property type and recent sales data.

What happens if I miss the property tax payment deadline?

+If you miss the property tax payment deadline, you will incur a late fee of 10% of the unpaid balance, and interest will accrue at a rate of 1.5% per month. It’s important to stay informed about payment deadlines and consider setting up automatic payments or payment plans to avoid late fees and penalties.

Are there any property tax exemptions or discounts available in Montgomery County?

+Yes, Montgomery County offers various property tax exemptions and discounts. These include the Homeowner Tax Credit, Senior Citizen Tax Credit, and other relief programs for low-income residents. Eligibility and application processes vary, so it’s recommended to check with the Montgomery County Department of Finance for specific details.