Sales Tax In Arkansas For Used Car

Understanding sales tax for used car purchases in Arkansas is essential for both buyers and sellers. The state's tax regulations can impact the overall cost of buying a pre-owned vehicle, so it's important to be well-informed about the process and potential expenses.

The Arkansas Sales Tax System

Arkansas, like many other states, imposes a sales and use tax on the sale of tangible personal property, including vehicles. This tax is a percentage of the purchase price and is collected by the seller, who then remits it to the state government. The revenue generated from sales tax is a significant source of income for the state, funding various public services and infrastructure projects.

The sales tax rate in Arkansas varies depending on the location of the sale. The state has a base sales tax rate, but counties and cities can add their own local taxes, resulting in a combined rate that may differ from one region to another. As of [most recent year with available data], the statewide sales tax rate was [statewide tax rate]%, with an average combined rate of approximately [average combined rate]% across the state.

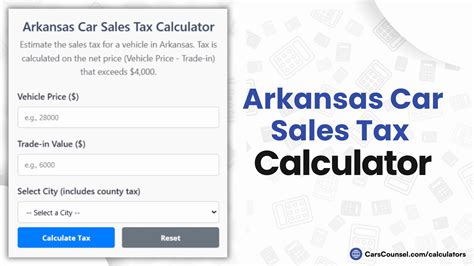

Calculating Sales Tax for Used Cars

When purchasing a used car in Arkansas, the sales tax is calculated based on the purchase price of the vehicle. This price includes any fees, dealer preparation charges, and documentation fees, but it excludes trade-in allowances and down payments. Here’s a breakdown of the process:

- Determine the purchase price of the used car. This is typically the agreed-upon amount between the buyer and the seller, including any additional fees.

- Apply the appropriate sales tax rate. As mentioned earlier, this rate can vary based on the location of the sale. You can use the Arkansas Department of Finance and Administration's website to find the specific tax rate for your county or city.

- Calculate the sales tax amount by multiplying the purchase price by the tax rate. For example, if the purchase price is $15,000 and the tax rate is 7%, the sales tax would be $1,050.

- Add the sales tax to the purchase price to arrive at the total cost of the vehicle. In our example, the total cost would be $16,050.

It's important to note that Arkansas also has a use tax, which applies when a vehicle is purchased out-of-state and brought into Arkansas. This tax ensures that regardless of where the purchase takes place, the state still receives its share of tax revenue. The use tax is calculated in the same way as sales tax, using the vehicle's purchase price and the applicable tax rate.

| Vehicle Type | Tax Rate |

|---|---|

| Used Cars | [Used car tax rate]% |

| Trucks and Trailers | [Trucks and trailers tax rate]% |

| Motorcycles | [Motorcycle tax rate]% |

| Boats and Watercraft | [Boat tax rate]% |

Exemptions and Special Considerations

While the general rule is that sales tax applies to most vehicle purchases, Arkansas does offer certain exemptions and special considerations under specific circumstances. These include:

- Trade-Ins: When trading in a vehicle as part of the purchase, the trade-in allowance is typically subtracted from the purchase price before calculating sales tax. This means that you are only taxed on the net price after the trade-in value is deducted.

- Disabled Individuals: Arkansas provides a sales tax exemption for certain vehicles purchased by individuals with disabilities. This exemption applies to vehicles specifically modified to accommodate the disability and is subject to certain eligibility criteria and documentation.

- Military Personnel: Active-duty military personnel stationed in Arkansas may be eligible for a sales tax exemption when purchasing a vehicle. This exemption is part of the state's support for military members and is designed to ease their transition into Arkansas.

- Special Vehicle Types: Certain types of vehicles, such as recreational vehicles (RVs) and off-road vehicles, may have different tax rates or requirements. It's essential to understand the specific regulations for the type of vehicle you're purchasing.

Registration and Titling

In addition to sales tax, purchasing a used car in Arkansas will also involve registration and titling fees. These fees are separate from the sales tax and are used to register the vehicle with the state and issue a title in the buyer’s name. The specific fees can vary based on the vehicle’s age, weight, and other factors.

| Fee Type | Amount |

|---|---|

| Registration Fee | $[registration fee] |

| Title Fee | $[title fee] |

| License Plate Fee | $[license plate fee] |

Tips for Buyers and Sellers

Navigating the sales tax process for used car purchases in Arkansas can be simplified with the right approach. Here are some tips for both buyers and sellers:

Tips for Buyers

- Research Local Tax Rates: Before finalizing a purchase, research the specific sales tax rate for the location where you’ll be buying the vehicle. This information is readily available online through the Arkansas Department of Finance and Administration.

- Negotiate Trade-Ins: If you’re trading in a vehicle, negotiate the trade-in value to ensure it’s fair and accurately reflected in the purchase price. This can help reduce the overall sales tax you’ll pay.

- Understand Exemptions: Familiarize yourself with any applicable exemptions or special considerations. This can help you maximize any tax savings you may be eligible for.

Tips for Sellers

- Provide Clear Documentation: When selling a used car, ensure that all necessary documentation is provided to the buyer, including the title and any relevant maintenance records. This helps streamline the sales tax and registration process.

- Calculate Sales Tax Accurately: As a seller, it’s your responsibility to calculate the sales tax accurately based on the purchase price. Be transparent about the tax amount with the buyer to avoid any misunderstandings.

- Offer Financing Options: Consider offering financing options to potential buyers. This can make your vehicle more accessible to a wider range of buyers and potentially speed up the sales process.

How often do sales tax rates change in Arkansas?

+Sales tax rates in Arkansas can change periodically, usually as part of legislative actions or local government decisions. It’s a good practice to check the official state websites or consult a tax professional before making a significant purchase to ensure you have the most up-to-date information.

Are there any online tools to calculate sales tax for used cars in Arkansas?

+Yes, there are several online calculators and resources available that can help estimate the sales tax for a used car purchase in Arkansas. These tools often consider factors like the purchase price, vehicle type, and location to provide an accurate estimate. It’s always a good idea to cross-reference with official state sources.

What happens if I fail to pay sales tax on a used car purchase in Arkansas?

+Failing to pay sales tax on a used car purchase in Arkansas can result in penalties and interest. It’s important to ensure that sales tax is paid accurately and on time to avoid any legal complications. If you have questions or concerns about sales tax payment, it’s best to consult a tax professional or reach out to the Arkansas Department of Finance and Administration.