Tax Return Transcript Online

Filing taxes can be a complex and often daunting task, but with the advancement of technology, accessing essential tax-related documents has become more convenient. One such document that plays a crucial role in various financial and legal matters is the tax return transcript. In recent years, the Internal Revenue Service (IRS) has made significant strides in providing taxpayers with online access to their tax information, including the tax return transcript. This article will delve into the process of obtaining a tax return transcript online, exploring its importance, the steps involved, and the benefits it offers to individuals and businesses.

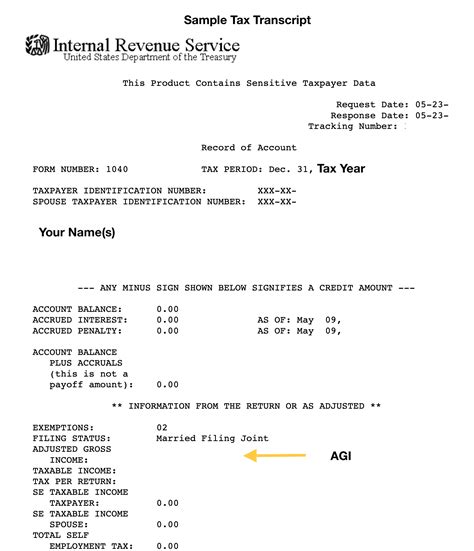

Understanding the Tax Return Transcript

A tax return transcript is an official summary of your federal tax return as processed by the IRS. It contains valuable information about your tax filing, including your filing status, income details, adjustments, and any tax payments or refunds. This document serves as a comprehensive record of your tax-related activities and is often required for various purposes, such as:

- Verifying income for loan applications, scholarships, or government benefits.

- Correcting errors or resolving issues with previous tax returns.

- Providing documentation for legal proceedings or financial audits.

- Supporting tax-related appeals or disputes.

- Obtaining copies of lost or missing tax returns.

The tax return transcript offers a detailed and secure way to access and share tax information, ensuring accuracy and privacy. By making this transcript available online, the IRS has streamlined the process, making it more accessible and efficient for taxpayers.

The Process of Obtaining a Tax Return Transcript Online

The IRS provides several methods to obtain a tax return transcript, and the online option is a convenient and secure way to access this document. Here is a step-by-step guide to retrieving your tax return transcript online:

Step 1: Visit the IRS Website

Begin by navigating to the official IRS website, www.irs.gov. This is the trusted source for all IRS-related services and information.

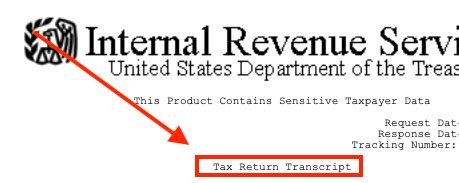

Step 2: Access the “Get Transcript” Service

On the IRS website, locate and click on the “Get Transcript” service. This service allows you to access and download various IRS transcripts, including the tax return transcript.

Step 3: Choose Your Delivery Method

The IRS offers two delivery methods for tax return transcripts: online view and mail delivery. For immediate access, select the online view option, which allows you to view and print your transcript directly from the IRS website.

Step 4: Create an Account (if required)

To access your tax return transcript online, you may need to create an IRS online account. This secure account requires personal identification information and allows you to manage various tax-related tasks online.

Step 5: Request Your Transcript

Once you have logged into your IRS account or selected the online view option, follow the prompts to request your tax return transcript. You will need to provide specific details, such as your tax filing status, Social Security Number (SSN), and the tax year for which you need the transcript.

Step 6: Verify Your Identity

For security purposes, the IRS may require you to verify your identity through a series of challenges. This process ensures that only authorized individuals can access your tax information.

Step 7: View and Download Your Transcript

After successfully verifying your identity, you will be granted access to your tax return transcript. You can view it online and have the option to download it as a PDF file for future reference.

Benefits of Obtaining a Tax Return Transcript Online

The online process of obtaining a tax return transcript offers several advantages over traditional methods, such as mailing or visiting an IRS office. Here are some key benefits:

Convenience and Speed

By accessing your tax return transcript online, you can retrieve it quickly and conveniently from the comfort of your home or office. This eliminates the need for postal delays or in-person visits, saving you valuable time.

Security and Privacy

The IRS takes security seriously, and the online transcript service is designed with robust security measures. Your personal information and tax data are protected through encryption and multi-factor authentication, ensuring a secure transaction.

Accessibility and Flexibility

The online transcript service is accessible 24⁄7, allowing you to retrieve your tax return transcript at your convenience. This flexibility is especially beneficial for individuals with busy schedules or those located in remote areas.

Reduced Paperwork

By obtaining your tax return transcript online, you eliminate the need for physical copies, reducing paperwork and the associated storage and organizational challenges.

Data Accuracy

The tax return transcript retrieved online is an exact copy of the IRS’s processed return, ensuring accuracy and consistency. This minimizes the risk of errors or discrepancies that may arise with manual transcription.

Tips for a Smooth Online Experience

To ensure a smooth and successful experience when obtaining your tax return transcript online, consider the following tips:

- Gather the necessary information beforehand, including your SSN, filing status, and the tax year for which you need the transcript.

- Ensure you have a stable internet connection and access to a compatible web browser.

- Create your IRS online account in advance, if required, to streamline the process.

- Familiarize yourself with the IRS website and the "Get Transcript" service to navigate it efficiently.

- Keep your personal identification information and tax records organized for quick reference.

- If you encounter any issues, refer to the IRS website for detailed help and support resources.

Future Implications and Innovations

The IRS’s online tax return transcript service is a testament to the agency’s commitment to modernizing its services and adapting to the digital age. As technology continues to advance, we can expect further enhancements and improvements to the online tax filing and transcript retrieval processes.

In the future, we may see more interactive and user-friendly interfaces, enhanced security measures, and potentially even real-time access to tax information. The IRS is continuously working to make tax-related tasks more accessible and efficient for taxpayers, ensuring a smoother and less stressful experience.

Additionally, the IRS is exploring partnerships with private sector companies to offer additional tax services and tools. These collaborations aim to provide taxpayers with even more options and flexibility when managing their tax obligations and accessing critical tax documents.

Conclusion

Obtaining a tax return transcript online is a convenient, secure, and efficient way to access crucial tax information. The IRS’s online transcript service has revolutionized the way taxpayers manage their tax-related affairs, offering a fast and accessible solution. By following the steps outlined in this article and taking advantage of the IRS’s online resources, individuals and businesses can seamlessly retrieve their tax return transcripts, empowering them to handle various financial and legal matters with confidence.

How long does it take to receive a tax return transcript online?

+With the online option, you can access your tax return transcript immediately after verifying your identity. This provides a quick and efficient way to retrieve your tax information.

Can I obtain multiple tax return transcripts for different years online?

+Yes, you can request tax return transcripts for multiple tax years online. Simply follow the same process and select the desired tax year when requesting your transcript.

Are there any fees associated with obtaining a tax return transcript online?

+No, there are no fees charged by the IRS for obtaining a tax return transcript online. This service is provided free of cost to taxpayers.

Can I use the tax return transcript for tax preparation or filing?

+While the tax return transcript provides valuable information, it is not a substitute for your original tax return. It is primarily used for verification and reference purposes. For tax preparation and filing, you should use your original tax return documents.

What if I need a transcript for a tax year that is not available online?

+The IRS generally provides online access to tax return transcripts for the current year and the three prior years. If you need a transcript for an older tax year, you can request it by mail or by contacting the IRS directly.