Investing In Russia Bomber Planes: Costs, Valuation, Risks

Exploring investments in Russia Bomber Planes touches on sensitive geopolitics and complex asset classes. This article examines the costs, valuation, and risks tied to Russia Bomber Planes, with an emphasis on transparent, well-sourced information and practical implications for risk-aware readers.

Key Points

- Legal and regulatory constraints dominate any potential investment in Russia Bomber Planes, including sanctions, export controls, and local ownership rules.

- Secondary markets for military aircraft are opaque, tightly regulated, and prone to sudden policy shifts that can dramatically alter liquidity and value.

- Lifecycle costs—maintenance, upgrades, storage, insurance, and compliance—far exceed the headline price and can erode returns quickly.

- Valuation is highly uncertain because public data is scarce, technology obsolescence, and the strategic value of such platforms is tightly linked to geopolitical context.

- Ethical, national security, and reputational considerations should be central to any due diligence process, beyond purely financial metrics.

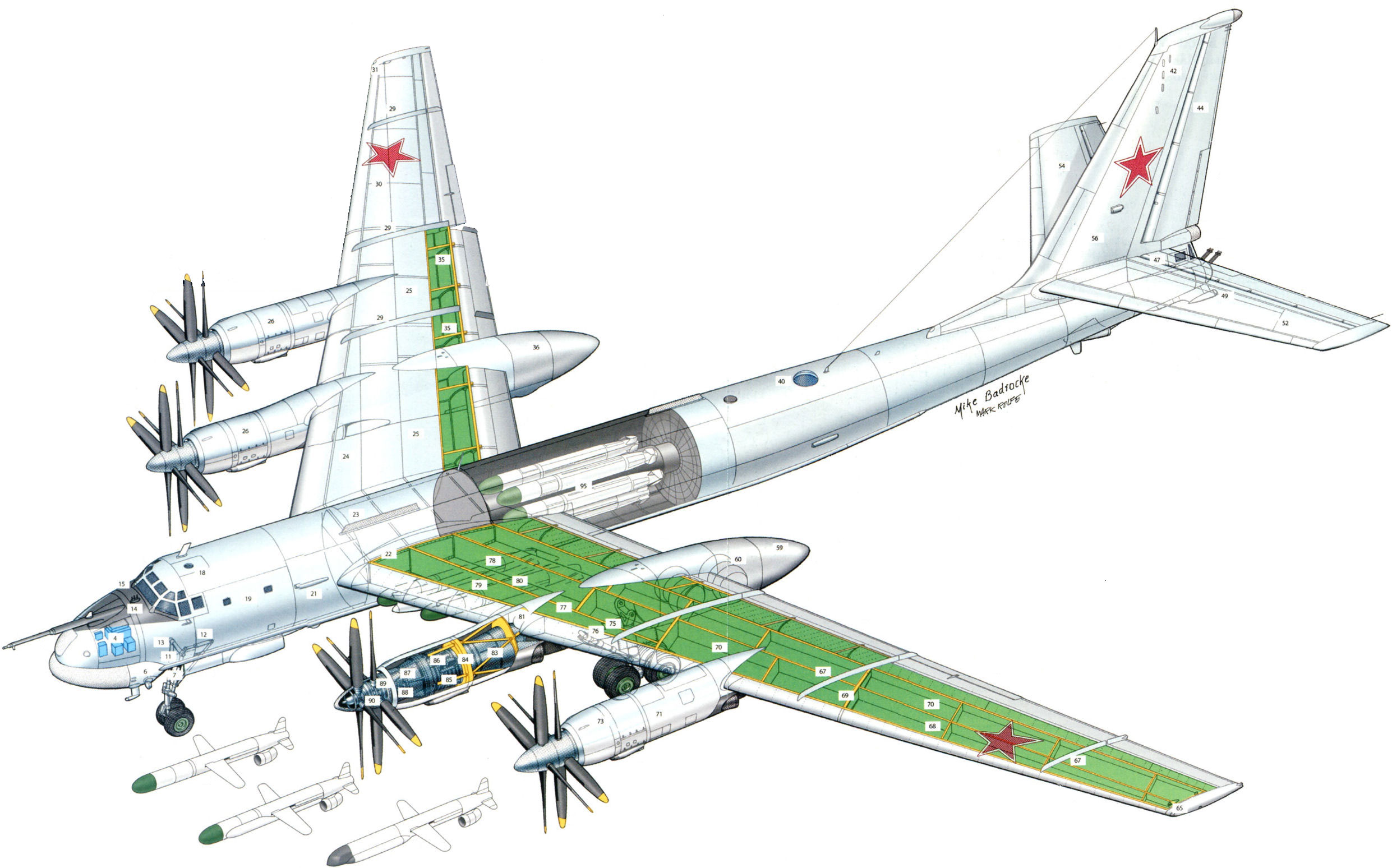

Costs of Russia Bomber Planes: What an Investor Should Expect

While an exact price tag for Russia Bomber Planes is not publicly disclosed, potential buyers should prepare for a cost structure that includes acquisition (or conversion), certification, and ongoing operating expenses. The acquisition approach matters—new production is rare for such platforms and most discussions involve surplus or decommissioned airframes, kits, and retrofits. Owning or leasing such equipment implies long-term capital commitments and specialized facilities.

Upfront and ongoing costs

Upfront costs include procurement, transport logistics, and regulatory compliance. Ongoing costs cover maintenance, spare parts, specialized skilled labor, insurance, storage, and potential upgrades to avionics and defensive systems. Because these aircraft are subject to export controls and sanctions regimes, the total cost of ownership can swing with policy changes.

Russia Bomber Planes Valuation: How Markets Perceive Worth

Valuing Russia Bomber Planes is not like valuing commercial aircraft. The secondary market for military platforms is limited and highly regulated. Factors influencing valuation include remaining service life, modernization requirements, regulatory risk, residual military utility, and potential resale restrictions. In many cases, valuation is more about risk-adjusted potential than about a transparent market price.

Key drivers of value

Remaining life and airworthiness: how much service life is left and what maintenance would be required to keep airframes airworthy. Regulatory status and export controls can significantly affect liquidity and resaleability.

Russia Bomber Planes Risks: Navigating Uncertainty

The main risks revolve around geopolitics, sanctions, and operational realities of maintaining and insuring specialized combat aircraft. Regulatory risk can appear with sudden sanctions expansions, while maintenance risk involves the availability of compatible parts and skilled technicians. Insurance costs may be higher, and there could be legal consequences for attempting to acquire or operate such assets in violation of international law or sanctions.

Mitigation considerations

Investors should prioritize governance, full disclosure, scenario analysis, and robust legal review. Diversification away from a single asset class, and reliance on reputable advisors with security clearances, can help manage risk. Consider whether access to public information and independent verification is feasible before pursuing any exposure to Russia Bomber Planes.

What are the major legal risks when considering investments related to Russia Bomber Planes?

+

Legal risk centers on compliance with sanctions, export controls, and ownership restrictions. In many jurisdictions, private acquisition or operation of military aircraft is tightly regulated or prohibited, and regulatory changes can rapidly affect the legality and value of such assets.

How do sanctions policy and regulatory shifts affect viability and resale of these assets?

+

Sanctions policy can freeze rights, restrict transfers, and complicate ownership, insurance, and maintenance. Sudden policy changes may dramatically reduce liquidity, increase compliance costs, or render resale impossible in certain markets.

What due diligence steps should a prudent investor take?

+

Engage legal counsel with sanctions expertise, verify provenance and export eligibility, assess maintenance and parts supply, model potential regulatory changes, and evaluate reputational and national-security implications. Consider alternative exposure via compliant defense-industry equities or risk analytics instead of direct asset ownership.

Are there compliant ways to study geopolitical risk exposure without purchasing aircraft?

+

Yes. Investors can seek exposure through publicly traded defense contractors, exchange-traded funds that focus on aerospace and defense, and risk-modeling services that quantify geopolitical exposure. These approaches offer risk assessment insights without the legal complexities of owning warfighting platforms.