Tax On Food Nyc

In New York City, taxes play a significant role in shaping the economic landscape and impacting the daily lives of residents and businesses alike. One area where taxes have a notable influence is the food and beverage industry. The tax on food in NYC is a complex topic that involves various regulations, rates, and exemptions. Understanding the intricacies of these taxes is essential for both consumers and businesses operating in the city.

This comprehensive guide aims to delve into the world of food taxes in NYC, exploring the different types of taxes, their implications, and how they affect the culinary scene. By shedding light on these tax mechanisms, we can gain insights into the economic dynamics of the city's vibrant food culture.

Unraveling the Food Tax Landscape in NYC

New York City’s tax structure for food and beverages is multifaceted, comprising several taxes that apply at different stages of the supply chain and consumption. These taxes can significantly impact the prices consumers pay for their favorite meals and drinks.

The NYC Sales Tax: A Fundamental Component

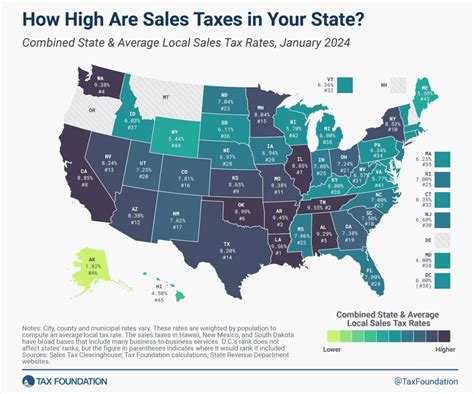

At the core of the food tax system in NYC is the sales tax, a consumption tax imposed on the sale of goods and services. This tax is administered by the New York State Department of Taxation and Finance and applies to most retail sales, including food items. The sales tax rate in NYC is currently 4.5%, which is in addition to the state sales tax rate of 4%.

However, it's important to note that not all food items are subject to the full sales tax. Certain food categories, such as unprepared foods and non-alcoholic beverages, are considered tax-exempt under NYC's sales tax laws. This means that when you purchase a loaf of bread or a bottle of water, you won't incur the full sales tax rate.

| Food Category | Sales Tax Rate |

|---|---|

| Prepared Foods | 8.875% |

| Unprepared Foods | 0% |

| Non-Alcoholic Beverages | 0% |

Prepared foods, on the other hand, are subject to a higher tax rate of 8.875%, which includes both the state and city sales tax components. This rate applies to meals served in restaurants, catering services, and other prepared food items.

The Prepared Food Surcharge: A Unique NYC Tax

In 2021, NYC introduced the Prepared Food Surcharge, a tax specifically targeted at prepared food items. This surcharge is applied on top of the existing sales tax and aims to generate revenue for the city’s budget. The surcharge rate varies depending on the type of food establishment and the transaction amount.

| Transaction Amount | Surcharge Rate |

|---|---|

| Up to $10 | 5% |

| $10.01 - $20 | 7.5% |

| Over $20 | 10% |

For example, if you purchase a meal at a restaurant for $25, the Prepared Food Surcharge would be $2.50 (10% of the transaction amount). This surcharge is in addition to the regular sales tax, so it can significantly impact the final bill.

Environmental Impact Fee: Promoting Sustainability

NYC has also implemented an Environmental Impact Fee on certain disposable food containers and utensils. This fee is designed to encourage the use of sustainable and environmentally friendly packaging. The fee applies to establishments that provide single-use items, such as plastic utensils or paper cups.

| Disposable Item | Environmental Impact Fee |

|---|---|

| Paper Cups | $0.10 per cup |

| Plastic Utensils | $0.10 per utensil |

| Other Disposable Containers | $0.25 per container |

Businesses that offer these disposable items must collect the Environmental Impact Fee from their customers and remit it to the city. This fee aims to reduce waste and promote the use of reusable or compostable alternatives.

Exemptions and Discounts: Navigating the Tax Landscape

While the tax system in NYC may seem complex, there are exemptions and discounts available to certain food establishments and consumers. For instance, nonprofit organizations and religious institutions can apply for tax-exempt status, allowing them to avoid certain taxes on food sales.

Additionally, NYC offers a Senior Citizen Restaurant Discount Program, which provides a 50% discount on meals at participating restaurants for residents aged 60 and above. This program aims to support older adults and make dining out more affordable. To qualify, seniors must meet certain income requirements and register for the program.

Impact on the Culinary Scene: Affordability and Accessibility

The taxes on food in NYC have a direct impact on the city’s culinary scene, influencing the affordability and accessibility of dining options. While taxes are necessary for funding public services, they can also create barriers for consumers and businesses.

The Cost of Dining Out: A Balancing Act

For many New Yorkers, dining out is an integral part of their lifestyle. However, the combination of sales tax, Prepared Food Surcharge, and other fees can make eating at restaurants and cafes more expensive. This can lead to a shift in consumer behavior, with some opting for more affordable dining options or cooking at home more frequently.

Businesses, especially small restaurants and food establishments, face the challenge of managing their pricing strategies while staying competitive. The tax burden can affect their profitability and, in some cases, impact their ability to offer discounts or promotions.

Promoting Sustainable and Healthy Choices

The Environmental Impact Fee on disposable items is a unique approach by NYC to encourage sustainable practices. By making single-use items more expensive, the city aims to promote the use of reusable or eco-friendly alternatives. This tax has the potential to influence consumer behavior and drive a shift towards more environmentally conscious choices.

The Future of Food Taxes: A Dynamic Landscape

The tax landscape in NYC is subject to change and evolution. As the city’s needs and priorities shift, so too may the tax system. For instance, in recent years, there have been discussions about implementing a soda tax to reduce consumption of sugary drinks and generate revenue for health initiatives.

Additionally, with the rise of online food delivery services, there may be future considerations for taxing these transactions. The impact of the COVID-19 pandemic on the food industry has also highlighted the need for flexible and adaptive tax policies.

Conclusion: Navigating NYC’s Culinary Tax Journey

Understanding the tax on food in NYC is crucial for both consumers and businesses operating within the city. The complex web of sales tax, Prepared Food Surcharge, and Environmental Impact Fees influences the pricing and affordability of food items. While taxes play a vital role in funding public services, they also shape the culinary landscape and consumer behavior.

As NYC continues to evolve, so too will its tax system. Staying informed about these tax mechanisms and their implications is essential for navigating the city's vibrant food scene. Whether you're a resident, a visitor, or a business owner, being aware of the tax landscape can help you make informed choices and contribute to the dynamic culinary culture of New York City.

Are all food items subject to the same sales tax rate in NYC?

+No, the sales tax rate in NYC varies depending on the type of food item. Unprepared foods and non-alcoholic beverages are tax-exempt, while prepared foods are subject to a higher rate of 8.875%.

How does the Prepared Food Surcharge affect the pricing of meals in NYC restaurants?

+The Prepared Food Surcharge is an additional tax on top of the sales tax. It varies based on the transaction amount, with higher surcharges for larger purchases. This surcharge can significantly impact the final bill for consumers.

Are there any tax exemptions for nonprofit organizations regarding food sales in NYC?

+Yes, nonprofit organizations and religious institutions can apply for tax-exempt status, allowing them to avoid certain taxes on food sales. This helps support their missions and reduce their financial burden.