Sbtpg Tax Refund Status

Welcome to the comprehensive guide on the Sbtpg Tax Refund Status. This article aims to provide you with all the information you need to understand and track your tax refund status through the Sbtpg system. With the ever-evolving tax landscape, staying informed about the status of your refund is crucial. Let's delve into the details and explore the features and processes associated with Sbtpg's tax refund tracking system.

Understanding Sbtpg and Its Tax Refund Process

Sbtpg, an acronym for Small Business Tax Payment Gateway, is a digital platform designed to streamline tax-related transactions for small businesses and individuals. This innovative system offers a user-friendly interface, allowing taxpayers to file their returns, make payments, and track the progress of their tax refunds efficiently.

When it comes to tax refunds, Sbtpg employs a systematic process to ensure prompt and accurate disbursement. Here's a breakdown of the key steps involved:

- Filing the Tax Return: Taxpayers begin by logging into their Sbtpg account and completing the necessary tax forms. The platform guides users through the process, ensuring all relevant information is captured accurately.

- Processing and Verification: Once the tax return is submitted, Sbtpg's system processes the data, verifying the information against government records. This step ensures the legitimacy of the claim and helps prevent fraudulent activities.

- Refund Approval: If the tax return is found to be valid and eligible for a refund, Sbtpg initiates the approval process. This involves cross-checking the details with the taxpayer's financial information and ensuring compliance with tax regulations.

- Refund Disbursement: Upon approval, Sbtpg authorizes the refund, which is then processed by the relevant tax authority. The refund amount is transferred to the taxpayer's designated bank account, usually within a specified timeframe.

Tracking Your Sbtpg Tax Refund Status

Staying informed about the status of your tax refund is made easy with Sbtpg’s dedicated tracking system. Here’s a step-by-step guide on how to access and interpret your refund status:

Step 1: Log into Your Sbtpg Account

To begin tracking your tax refund, you’ll need to access your Sbtpg account. Visit the official Sbtpg website and enter your login credentials. If you’re a new user, you can create an account by providing the required personal and tax-related information.

Step 2: Navigate to the Refund Status Section

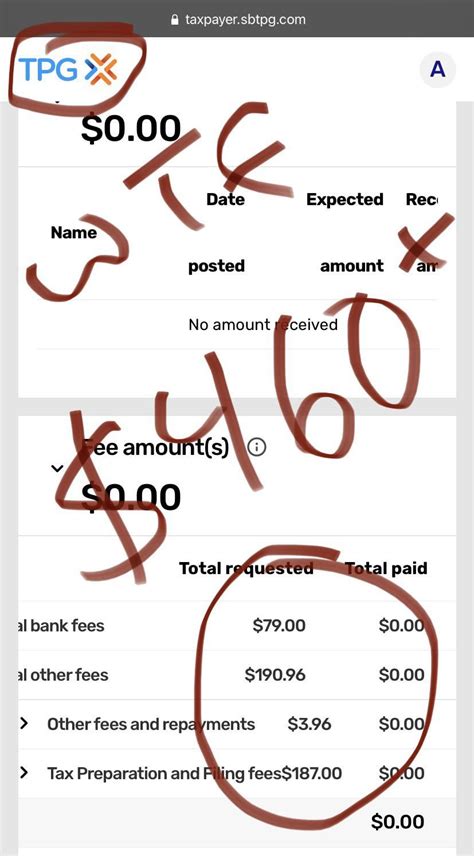

Once logged in, locate the “Refund Status” section on your dashboard. This section is designed to provide real-time updates on the progress of your tax refund. It displays a clear timeline, indicating the current stage of the refund process.

Step 3: Interpret the Refund Status

The refund status section will display a detailed breakdown of the refund journey. Here’s a guide to help you understand the different stages:

- Pending Verification: Your tax return is currently undergoing verification. This stage ensures the accuracy and authenticity of the information provided.

- Approval Pending: The tax authorities have received your return and are reviewing it for approval. This stage may involve additional checks and verifications.

- Refund Approved: Congratulations! Your tax refund has been approved, and the disbursement process is underway. You can expect the refund amount to be credited to your account soon.

- Refund Disbursed: The refund amount has been successfully transferred to your designated bank account. You can now access the funds and utilize them as needed.

It's important to note that the timeline for each stage may vary depending on various factors, including the complexity of your tax return and the workload of the tax authorities.

Features and Benefits of Sbtpg’s Tax Refund Tracking

Sbtpg’s tax refund tracking system offers several features and benefits that enhance the user experience and provide valuable insights. Let’s explore some of these advantages:

Real-Time Updates

Sbtpg ensures that taxpayers receive real-time updates on the status of their tax refunds. The system is designed to provide timely notifications, keeping users informed about any progress or changes in the refund process.

Detailed Refund Timeline

The refund status section provides a comprehensive timeline, breaking down the refund journey into distinct stages. This feature allows taxpayers to track the progress of their refund, from filing to disbursement, with clarity and ease.

Customizable Notifications

Sbtpg offers customizable notification settings, allowing users to receive updates via email, SMS, or push notifications. This flexibility ensures that taxpayers can choose the communication channel that suits their preferences and stay informed on the go.

Secure and Confidential

Sbtpg prioritizes data security and confidentiality. The platform employs advanced encryption technologies to protect users’ personal and financial information. Rest assured that your tax refund status is accessible only to authorized individuals.

Quick Resolution of Queries

Sbtpg provides a dedicated support system to address any queries or concerns related to tax refunds. The platform’s customer service team is readily available to assist taxpayers, offering prompt resolutions and ensuring a seamless experience.

Tips for a Smooth Tax Refund Experience

To ensure a smooth and hassle-free tax refund process, here are some valuable tips to keep in mind:

- Accurate Filing: Double-check your tax return for any errors or omissions before submission. Inaccurate information may lead to delays or even rejection of your refund claim.

- Keep Records: Maintain a record of your tax-related documents, including receipts, invoices, and any supporting evidence. These records can be crucial in case of audits or queries from the tax authorities.

- Regularly Check Status: Make it a habit to regularly check your Sbtpg account for updates on your tax refund status. This proactive approach ensures that you're aware of any changes or requirements that may impact the refund process.

- Contact Support: If you encounter any issues or have specific questions, don't hesitate to reach out to Sbtpg's customer support team. They are equipped to provide guidance and assistance, ensuring a positive tax refund experience.

Case Study: Success Stories of Sbtpg Tax Refund Tracking

To illustrate the effectiveness of Sbtpg’s tax refund tracking system, let’s explore a few success stories:

John’s Efficient Refund Experience

John, a small business owner, utilized Sbtpg to file his tax returns and track his refund status. With the help of the platform’s user-friendly interface, he successfully filed his returns within a few minutes. The real-time updates on his refund status kept him informed, and he received his refund within the estimated timeframe, allowing him to reinvest the funds into his business.

Emily’s Peace of Mind

Emily, a busy professional, found Sbtpg’s tax refund tracking system to be a lifesaver. With a busy schedule, she appreciated the convenience of receiving customizable notifications. The detailed refund timeline provided her with peace of mind, knowing exactly where her refund stood at each stage. She could focus on her work without worrying about the refund process.

Michael’s Quick Resolution

Michael encountered an issue with his tax refund, as the status showed a discrepancy. However, Sbtpg’s dedicated support team promptly addressed his concern. They guided him through the resolution process, ensuring a swift and satisfactory outcome. Michael’s refund was successfully processed, and he expressed gratitude for the efficient support provided by Sbtpg.

Future Developments and Enhancements

Sbtpg is committed to continuous improvement and innovation. The platform is constantly evolving to enhance the tax refund tracking experience for users. Here’s a glimpse into some future developments:

- Enhanced Security Measures: Sbtpg plans to implement additional security protocols to safeguard user data, ensuring even greater protection against potential threats.

- AI-Powered Assistance: The integration of artificial intelligence will further streamline the refund tracking process. AI-powered chatbots and assistants will provide instant support, answering common queries and guiding users through the platform.

- Mobile App Integration: Sbtpg aims to develop a dedicated mobile application, allowing users to track their tax refund status on the go. The app will offer a seamless experience, providing real-time updates and convenient access to tax-related information.

Conclusion

The Sbtpg Tax Refund Status system offers a seamless and efficient way for taxpayers to track the progress of their tax refunds. With its user-friendly interface, real-time updates, and dedicated support, Sbtpg ensures a positive and stress-free experience. By staying informed and leveraging the platform’s features, taxpayers can navigate the tax refund process with confidence and ease.

How long does it typically take to receive a tax refund through Sbtpg?

+The timeframe for receiving a tax refund through Sbtpg varies based on several factors, including the complexity of your tax return and the workload of the tax authorities. On average, it takes approximately 2-4 weeks for the refund to be processed and disbursed. However, it’s important to note that this timeline may differ for each individual case.

Can I check my tax refund status without logging into my Sbtpg account?

+No, accessing your tax refund status requires logging into your Sbtpg account. The platform prioritizes data security and confidentiality, ensuring that only authorized individuals can view sensitive information. By logging in, you can access real-time updates and track the progress of your refund securely.

What should I do if I encounter an issue with my tax refund status?

+If you encounter any issues or have concerns regarding your tax refund status, it’s recommended to reach out to Sbtpg’s customer support team. They are equipped to assist with a range of queries and can guide you through the resolution process. Their expertise ensures a smooth and efficient experience.