Where To Mail Pa Tax Return

The Pennsylvania Department of Revenue provides several options for taxpayers to submit their state tax returns, ensuring convenience and flexibility. Whether you prefer traditional mail, electronic filing, or drop-off services, there are multiple ways to ensure your tax return reaches the right destination. This article will guide you through the process, covering the different methods, their advantages, and the necessary steps to ensure a smooth and timely submission.

Mailing Your Pennsylvania Tax Return

One of the most traditional methods of filing your Pennsylvania tax return is through the postal service. It's a straightforward process that allows you to prepare your return at your own pace and mail it when ready. Here's a step-by-step guide to help you through the process:

Step 1: Prepare Your Tax Return

Begin by gathering all the necessary documents and information. This includes your W-2 forms, 1099 forms, receipts for deductions, and any other relevant financial records. Use these to accurately complete your tax return, ensuring all the required information is included. There are several software options available to assist with this process, offering step-by-step guidance and calculations.

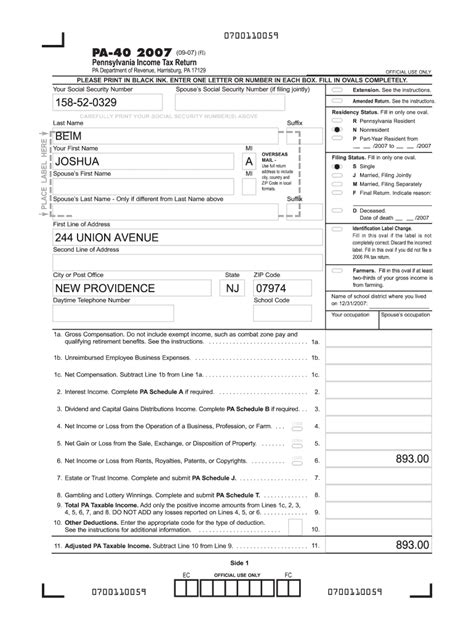

Step 2: Choose the Right Form

The Pennsylvania Department of Revenue offers various forms for different tax situations. The most common form is the PA-40, which is for individual income tax returns. However, if you’re a business owner, you may need to use a different form, such as the PA-40ES for estimated tax payments. Ensure you select the correct form based on your tax situation.

Step 3: Fill Out the Form

Carefully read the instructions provided with the form and fill it out accurately. Double-check all the information you’ve entered to avoid any errors that could delay the processing of your return. Remember to sign and date the form before proceeding to the next step.

Step 4: Prepare Your Payment (if Applicable)

If you owe taxes, you’ll need to include a payment with your return. You can pay by check, money order, or even credit card. Make sure the payment is for the correct amount and includes your Social Security number and tax year to ensure it’s properly credited to your account.

Step 5: Mail Your Return

Once your return is complete, place it in a standard envelope along with any necessary payment and supporting documents. Address the envelope to the Pennsylvania Department of Revenue and include the correct zip code, which can be found on the department’s website. Use regular postage and mail it at least a week before the due date to allow for processing time.

| Tax Return Type | Mailing Address |

|---|---|

| Individual Income Tax Returns | Pennsylvania Department of Revenue Department of Revenue - Mail Drop 18 Harrisburg, PA 17129-0018 |

| Business Tax Returns | Pennsylvania Department of Revenue Department of Revenue - Mail Drop 18 Harrisburg, PA 17129-0018 |

Step 6: Track Your Return (Optional)

If you wish to track the status of your return, you can use the PA e-TIDES system. This online tool allows you to check the processing status of your return and ensure it has been received and processed by the Department of Revenue. It’s a useful feature for those who want real-time updates on their tax return’s journey.

Electronic Filing Options

In today's digital age, electronic filing has become a popular and efficient way to submit tax returns. Pennsylvania offers several options for e-filing, each with its own benefits. Here's an overview of the electronic filing options available to taxpayers:

PA e-TIDES

PA e-TIDES is a web-based system that allows taxpayers to file their returns online. It’s a secure and convenient option, offering real-time updates on the status of your return. e-TIDES supports various tax forms, including the PA-40, PA-40ES, and PA-40X (amended returns). To use e-TIDES, you’ll need to create an account and follow the step-by-step instructions provided on the website.

Commercial Software

Many commercial tax preparation software programs offer the option to e-file your Pennsylvania tax return. These software solutions guide you through the filing process, ensuring accuracy and completeness. Once your return is prepared, you can choose to e-file directly from the software, often with the option to pay any taxes owed online as well. Popular software options include TurboTax, H&R Block, and TaxAct.

Tax Professionals

Engaging the services of a tax professional can be a convenient way to file your Pennsylvania tax return. Certified Public Accountants (CPAs) and enrolled agents are authorized to prepare and e-file tax returns on behalf of their clients. They can provide personalized advice and ensure your return is filed accurately and on time. Many tax professionals use specialized software to e-file returns, offering a seamless and efficient process.

Drop-Off Services

For those who prefer a more personal touch, Pennsylvania offers drop-off services at select locations. These services allow taxpayers to submit their completed tax returns in person, ensuring a secure and convenient delivery option. Here's what you need to know about drop-off services:

Pennsylvania Department of Revenue Offices

The Pennsylvania Department of Revenue has several district offices across the state. Taxpayers can visit these offices and submit their completed tax returns in person. This option is ideal for those who want to ensure their return is delivered directly to the department. It’s important to note that not all district offices accept drop-offs, so it’s best to check the department’s website for a list of participating locations.

Authorized Collection Agencies

In addition to department offices, Pennsylvania has authorized collection agencies that accept tax return drop-offs. These agencies are contracted by the Department of Revenue to provide this service. Taxpayers can visit these agencies and submit their completed returns, often with extended hours to accommodate various schedules. A list of authorized collection agencies can be found on the department’s website.

Tips for a Smooth Filing Process

To ensure a smooth and stress-free filing process, here are some additional tips to consider:

- Start early: Begin preparing your tax return well in advance of the due date to avoid last-minute rushes.

- Double-check your information: Accuracy is crucial. Review your return multiple times to catch any errors or omissions.

- Keep records: Retain copies of your tax return, supporting documents, and any correspondence with the Department of Revenue for future reference.

- Seek professional help: If you're unsure about any aspect of your tax return, consider consulting a tax professional for guidance.

- Stay informed: Keep up-to-date with the latest tax laws and regulations to ensure you're taking advantage of all available deductions and credits.

What is the deadline for filing my Pennsylvania tax return?

+The deadline for filing your Pennsylvania tax return is typically aligned with the federal tax deadline, which is usually April 15th. However, it’s important to check the official Pennsylvania Department of Revenue website for any updates or extensions, as the deadline may vary from year to year.

Can I file an extension for my Pennsylvania tax return?

+Yes, you can file for an extension if you’re unable to meet the regular filing deadline. To do this, you’ll need to submit Form PA-4868 by the regular filing deadline. An extension grants you additional time to file your return, typically until October 15th, but it does not extend the time for paying any taxes owed.

What happens if I don’t file my Pennsylvania tax return on time?

+Failing to file your Pennsylvania tax return on time can result in penalties and interest charges. The Department of Revenue may also impose late filing fees. It’s best to file your return as soon as possible to avoid these penalties and maintain compliance with state tax laws.