Pay Arizona State Taxes

Arizona, like most states in the United States, requires its residents and businesses to pay taxes to fund various government operations and services. The process of paying Arizona state taxes can seem complex, especially for individuals and businesses new to the state. This comprehensive guide will walk you through the key aspects of paying Arizona state taxes, from understanding the different types of taxes to utilizing online resources and seeking professional assistance when needed.

Understanding Arizona State Taxes

Arizona imposes various taxes to generate revenue for state operations. These taxes can be categorized into several types, each serving a specific purpose. Here’s a breakdown of the main taxes you’ll encounter as a resident or business owner in Arizona:

Income Tax

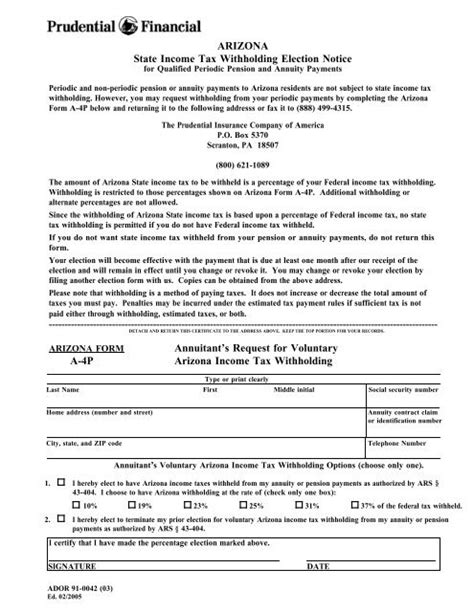

The Arizona Income Tax is a personal or corporate tax based on your earnings within the state. It’s a progressive tax system, meaning the tax rate increases as your income rises. Arizona’s income tax rates range from 2.59% to 4.50%, depending on your taxable income.

When filing your income tax return, you’ll need to report various sources of income, including wages, salaries, interest, dividends, and capital gains. The Arizona Department of Revenue (ADOR) provides detailed guidelines and forms for income tax filing.

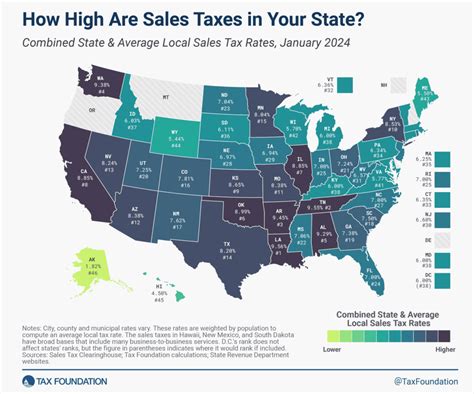

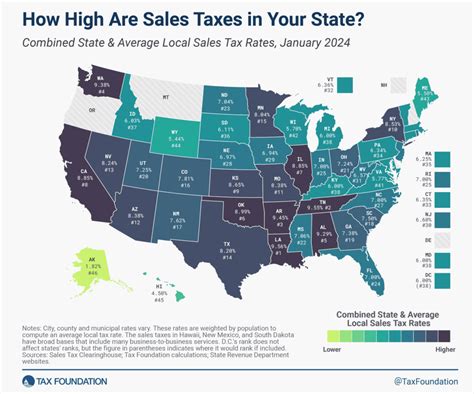

Sales and Use Tax

Arizona imposes a Sales and Use Tax on the sale of goods and some services within the state. The sales tax rate in Arizona varies by jurisdiction, with a base state rate of 5.6% and additional local and county taxes. Businesses are responsible for collecting and remitting these taxes to the ADOR.

If you own a business, you’ll need to register for a Transaction Privilege Tax (TPT) license and collect sales tax from your customers. The TPT is Arizona’s version of a sales tax license, and it’s essential for compliance with state tax laws.

Property Tax

The Arizona Property Tax is levied on real estate and personal property owned within the state. The tax is typically assessed by county assessors and collected by county treasurers. Property tax rates vary depending on the location and type of property.

As a homeowner or business owner, it’s crucial to understand the property tax assessment process and ensure that your property is accurately valued. You can appeal your property tax assessment if you believe it’s incorrect.

Other Taxes

Arizona also imposes various other taxes, including:

- Transaction Privilege Tax (TPT): A tax on the privilege of doing business in Arizona, often overlapping with sales tax.

- Rental Property Tax: A tax on the rental of residential and commercial properties.

- Excise Taxes: Taxes on specific goods and services, such as gasoline, tobacco, and telecommunications.

- Inheritance and Estate Taxes: Taxes on the transfer of property upon death.

Registration and Filing Requirements

To pay your Arizona state taxes correctly, you’ll need to fulfill certain registration and filing requirements. These requirements vary depending on your tax type and whether you’re an individual or a business.

Individual Taxpayers

As an individual taxpayer, you’re typically required to file an Arizona Form 140 (Individual Income Tax Return) if your income exceeds a certain threshold. The filing deadline is typically April 15th each year. However, if you’re due a refund, you have until October 15th to file your return.

You can choose to file your taxes electronically using the ADOR’s Arizona Taxpayer Access Point (ATAP) system or by mailing a paper return to the ADOR. The ADOR provides detailed instructions and resources to guide you through the filing process.

Business Taxpayers

Businesses operating in Arizona have different registration and filing requirements, depending on their legal structure and tax obligations.

For instance, corporations are required to file an Arizona Form 120 (Corporation Income Tax Return), while partnerships and LLCs file an Arizona Form 166 (Partnership Return). Sole proprietors typically report their business income on their individual income tax return.

Additionally, businesses that collect sales tax must register for a Transaction Privilege Tax (TPT) license and file periodic TPT returns, usually on a quarterly basis. The ADOR provides specific guidelines and due dates for business tax filings.

Utilizing Online Resources

The Arizona Department of Revenue offers a wealth of online resources to help taxpayers navigate the state’s tax system. These resources can simplify the tax payment process and provide valuable information tailored to your specific tax needs.

Arizona Taxpayer Access Point (ATAP)

The ATAP is a secure online portal that allows taxpayers to manage their accounts, file tax returns, and make payments. With ATAP, you can:

- Register for new tax accounts.

- File and pay your taxes electronically.

- Check your refund status.

- View and print your tax forms and notices.

- Update your personal or business information.

ATAP is user-friendly and provides step-by-step guidance to ensure a smooth tax filing experience.

Arizona Tax Information and Assistance

The ADOR’s website offers a comprehensive collection of tax information, including:

- Tax forms and instructions.

- Publication guides for specific tax topics.

- Tax calculators and estimators.

- News and updates on tax laws and regulations.

- Answers to frequently asked questions.

This resource is especially useful for taxpayers seeking general information about Arizona state taxes.

Seeking Professional Assistance

While Arizona’s tax system is relatively straightforward, certain complex situations may require professional assistance. Engaging a tax professional can ensure accurate tax filing and help you maximize your tax benefits.

When to Consider Professional Help

Consider seeking professional assistance if you:

- Have complex financial situations, such as multiple sources of income or investments.

- Are starting a new business and need guidance on tax registration and compliance.

- Are facing an audit or have received a tax notice from the ADOR.

- Want to optimize your tax strategy to minimize your tax liability.

- Need help resolving tax-related issues, such as back taxes or penalties.

A qualified tax professional, such as a Certified Public Accountant (CPA) or Enrolled Agent (EA), can provide personalized advice and ensure your tax obligations are met.

Finding a Tax Professional

To find a reputable tax professional, consider the following steps:

- Ask for recommendations from friends, family, or business associates.

- Check online reviews and ratings of tax professionals in your area.

- Consider their experience and expertise in Arizona state taxes.

- Schedule a consultation to discuss your tax needs and ensure a good fit.

Remember, choosing a reliable tax professional can save you time, reduce stress, and help you avoid costly mistakes.

Conclusion: Stay Informed and Compliant

Paying Arizona state taxes is a responsibility for all residents and businesses. By understanding the different types of taxes, meeting registration and filing requirements, and utilizing online resources, you can ensure compliance with state tax laws.

Remember, staying informed about tax changes and seeking professional assistance when needed can make the tax payment process more manageable. With the right approach, you can navigate Arizona’s tax system with confidence and contribute to the state’s prosperity.

What is the deadline for filing Arizona state taxes?

+The deadline for filing Arizona state taxes typically aligns with the federal tax deadline, which is April 15th. However, if you’re due a refund, you have until October 15th to file your return.

How do I register for a Transaction Privilege Tax (TPT) license in Arizona?

+To register for a TPT license, you can visit the ADOR’s website and complete the online registration process. You’ll need to provide basic business information and select the appropriate tax types for your business.

Are there any tax breaks or incentives for Arizona taxpayers?

+Yes, Arizona offers various tax credits and deductions to eligible taxpayers. These can include credits for investments in renewable energy, research and development, and certain business expenses. It’s advisable to consult with a tax professional to determine if you qualify for any tax breaks.