Florida Sales Tax Orlando

Sales tax is an essential component of revenue generation for states in the United States, with each state implementing its own unique tax rates and regulations. Florida, known for its vibrant tourism industry, has a robust sales tax system that contributes significantly to its economic landscape. In this comprehensive article, we will delve into the intricacies of Florida's sales tax, specifically focusing on the city of Orlando, a renowned tourist destination.

Understanding Florida Sales Tax: A State-Wide Overview

Florida’s sales tax system operates under a comprehensive framework, aiming to balance the needs of businesses and consumers while generating revenue for the state. The tax is levied on the sale or lease of tangible personal property, as well as certain services. The state of Florida imposes a base sales tax rate of 6%, which serves as the foundation for the tax structure.

However, it is important to note that Florida allows local governments, including counties and municipalities, to levy additional taxes on top of the state rate. These local taxes, known as discretionary sales surtaxes, are used to fund specific projects and initiatives within the community. As a result, the total sales tax rate can vary depending on the location of the transaction.

For instance, in the year 2023, the combined sales tax rate in Florida ranged from 6% to 8.5%, with some counties opting for higher rates to support local development and infrastructure projects. This variability in tax rates is a key characteristic of Florida's sales tax system and requires businesses and consumers to be aware of the specific rates applicable to their transactions.

Orlando: A Hub of Tourism and Economic Activity

Orlando, located in the heart of Florida, is renowned for its world-class theme parks, vibrant entertainment options, and diverse cultural attractions. As one of the state’s top tourist destinations, Orlando plays a crucial role in Florida’s economy, contributing significantly to its sales tax revenue.

The city's thriving tourism industry attracts millions of visitors each year, generating substantial economic activity. From theme park admissions to hotel stays, restaurant meals, and retail purchases, Orlando's visitors contribute to the city's sales tax base. The city's ability to sustain and grow its tourism industry is closely tied to its efficient management of sales tax revenues, ensuring the continued development and improvement of its attractions.

Additionally, Orlando's diverse business landscape extends beyond tourism. The city boasts a strong presence in industries such as healthcare, technology, and aerospace, further enhancing its economic vitality. These diverse economic sectors contribute to Orlando's overall sales tax revenue, providing a stable foundation for the city's economic growth and development.

Sales Tax in Orlando: A Closer Look

Orlando’s sales tax rate is determined by a combination of the state’s base rate and any additional local surtaxes imposed by Orange County, the county in which Orlando is located. As of 2023, the total sales tax rate in Orlando stood at 7%, consisting of the 6% state rate and an additional 1% surtax levied by Orange County.

This sales tax rate applies to a wide range of transactions within Orlando, including but not limited to:

- Retail sales of tangible personal property, such as clothing, electronics, and souvenirs.

- Restaurant meals and prepared food sales.

- Admissions to theme parks and other entertainment venues.

- Leases and rentals of tangible personal property.

- Certain services, including automotive repairs and hair salon services.

It is worth noting that there are specific exemptions and exclusions from sales tax in Orlando, just as in other parts of Florida. These exemptions vary depending on the nature of the transaction and the products or services involved. For instance, certain essential items like groceries, prescription medications, and residential rent are exempt from sales tax in Orlando.

| Transaction Type | Sales Tax Rate |

|---|---|

| Retail Sales | 7% |

| Restaurant Meals | 7% |

| Theme Park Admissions | 7% |

| Automotive Repairs | 7% |

| Exemptions | Varies (Groceries, Medications, Rent) |

Compliance and Reporting for Businesses in Orlando

For businesses operating in Orlando, compliance with sales tax regulations is of utmost importance. The Florida Department of Revenue provides comprehensive guidelines and resources to assist businesses in understanding their sales tax obligations. This includes registering for a sales tax permit, collecting and remitting sales tax on taxable transactions, and maintaining accurate records.

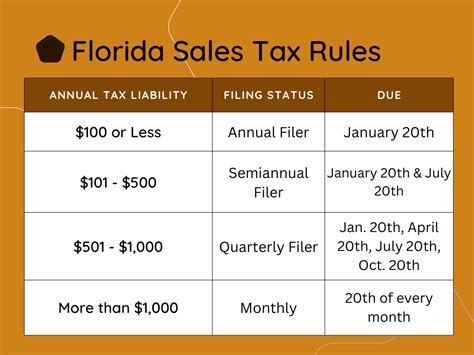

Businesses in Orlando must adhere to specific deadlines for sales tax reporting and remittance. Typically, sales tax returns are due on a monthly, quarterly, or annual basis, depending on the business's tax liability and filing preferences. Late filing or non-compliance with sales tax regulations can result in penalties and interest charges, underscoring the importance of timely and accurate reporting.

To facilitate compliance, the Florida Department of Revenue offers a range of resources, including online filing platforms, tax guides, and educational webinars. These resources aim to simplify the sales tax reporting process and ensure that businesses in Orlando can meet their tax obligations efficiently and effectively.

Sales Tax Exemptions and Special Considerations in Orlando

While Orlando’s sales tax rate applies to a broad range of transactions, there are certain exemptions and special considerations that businesses and consumers should be aware of. These exemptions vary based on the nature of the transaction and the products or services involved.

Taxable vs. Non-Taxable Transactions

Understanding the distinction between taxable and non-taxable transactions is crucial for both businesses and consumers in Orlando. Taxable transactions are those that are subject to sales tax, while non-taxable transactions are exempt from sales tax. The determination of taxability is based on the specific characteristics of the transaction and the products or services involved.

For instance, the sale of certain essential items, such as groceries, prescription medications, and residential rent, is generally exempt from sales tax in Orlando. These exemptions aim to reduce the financial burden on consumers and promote accessibility to essential goods and services.

On the other hand, transactions involving tangible personal property, such as clothing, electronics, and furniture, are typically taxable. Similarly, restaurant meals, admissions to entertainment venues, and certain services like automotive repairs are subject to sales tax. It is important for businesses to accurately identify taxable and non-taxable transactions to ensure compliance with sales tax regulations.

Sales Tax Holidays

Florida, including Orlando, occasionally offers sales tax holidays as a means to stimulate economic activity and provide relief to consumers. During these designated periods, specific categories of items are exempt from sales tax, allowing consumers to save money on their purchases. Sales tax holidays are typically announced in advance and are designed to target specific shopping seasons or categories of products.

For instance, Florida may offer a back-to-school sales tax holiday, during which school supplies, clothing, and certain electronics are exempt from sales tax for a limited time. These holidays provide an opportunity for consumers to make necessary purchases while enjoying tax-free savings. Businesses in Orlando should stay informed about upcoming sales tax holidays to effectively communicate these savings opportunities to their customers.

Impact of Sales Tax on Orlando’s Economy

Orlando’s sales tax revenue plays a vital role in the city’s economic development and infrastructure. The revenue generated from sales tax contributes to a range of public services and projects, including but not limited to:

- Maintenance and improvement of roads, bridges, and transportation infrastructure.

- Funding for public safety initiatives, including police and fire departments.

- Support for local schools and educational programs.

- Development and maintenance of parks, recreational facilities, and cultural attractions.

- Investment in economic development initiatives to attract and retain businesses.

By efficiently managing and allocating sales tax revenues, Orlando can enhance its infrastructure, improve the quality of life for residents, and create a more attractive environment for businesses and visitors. The city's ability to leverage sales tax revenue for sustainable economic growth and development is a key factor in its long-term success.

Comparative Analysis: Orlando vs. Other Florida Cities

While Orlando’s sales tax rate is relatively moderate compared to some other cities in Florida, it is important to consider the overall economic context and the city’s unique advantages. Orlando’s thriving tourism industry and diverse business landscape contribute significantly to its economic vitality, providing a strong foundation for sales tax revenue generation.

In comparison to other Florida cities, Orlando's sales tax rate may be seen as competitive, particularly given its robust economic activity. However, it is essential for businesses and consumers to consider the broader economic environment, including factors such as cost of living, business incentives, and the overall business climate, when assessing the impact of sales tax rates.

By striking a balance between revenue generation and maintaining a competitive business environment, Orlando can continue to thrive as a major economic hub in Florida. The city's ability to adapt to changing economic conditions and leverage its sales tax revenue for sustainable growth is a key differentiator in its success.

Future Implications and Potential Changes

As economic conditions evolve and technological advancements reshape the business landscape, Florida’s sales tax system, including Orlando’s sales tax rate, may undergo adjustments and reforms. The state and local governments continuously evaluate the sales tax structure to ensure it remains effective and responsive to the needs of businesses and consumers.

Potential future changes may include adjustments to the base sales tax rate, modifications to the discretionary sales surtaxes, or the introduction of new tax exemptions or incentives. These changes aim to address emerging economic challenges, promote economic growth, and adapt to the evolving needs of the business community.

For businesses and consumers in Orlando, staying informed about potential sales tax changes is crucial. By understanding the evolving tax landscape, stakeholders can make informed decisions, adapt their strategies, and ensure compliance with the latest regulations. The Florida Department of Revenue and local government agencies play a vital role in providing timely updates and guidance on any sales tax reforms.

Conclusion: Navigating Orlando’s Sales Tax Landscape

Orlando’s sales tax system, with its state-wide base rate and local surtax, plays a critical role in the city’s economic vitality and infrastructure development. By understanding the intricacies of sales tax, including the rate, exemptions, and compliance requirements, businesses and consumers can navigate the tax landscape with confidence.

From compliance and reporting to leveraging sales tax holidays and staying informed about potential changes, Orlando's sales tax system offers both opportunities and challenges. By embracing these challenges and adapting to the evolving tax landscape, businesses and consumers can contribute to the continued success and growth of Orlando's vibrant economy.

What is the current sales tax rate in Orlando, Florida, as of 2023?

+

The current sales tax rate in Orlando, Florida, as of 2023, is 7%, consisting of the state’s base rate of 6% and an additional 1% surtax levied by Orange County.

Are there any sales tax exemptions or special considerations in Orlando?

+

Yes, there are certain exemptions and special considerations in Orlando. Essential items like groceries, prescription medications, and residential rent are generally exempt from sales tax. Additionally, Florida may offer sales tax holidays for specific categories of items, providing tax-free savings opportunities.

How often do businesses in Orlando need to file sales tax returns?

+

Businesses in Orlando typically file sales tax returns on a monthly, quarterly, or annual basis, depending on their tax liability and filing preferences. It’s important for businesses to stay updated on the filing deadlines and comply with the reporting requirements to avoid penalties.

What happens if a business fails to comply with sales tax regulations in Orlando?

+

Non-compliance with sales tax regulations in Orlando can result in penalties and interest charges. It’s crucial for businesses to understand their sales tax obligations, register for a sales tax permit, and accurately collect and remit sales tax on taxable transactions to avoid legal consequences.

How does Orlando’s sales tax revenue contribute to the city’s economy and infrastructure?

+

Orlando’s sales tax revenue is a vital source of funding for public services and projects. It supports the maintenance and improvement of infrastructure, funds public safety initiatives, and contributes to the development of parks, recreational facilities, and cultural attractions. Efficient management of sales tax revenue is crucial for Orlando’s economic growth and sustainability.