Oregon Sales Tax Rate

Sales tax in Oregon is a fascinating topic, as the state has a unique approach to taxation compared to many other U.S. states. With a robust economy and a diverse range of industries, understanding the sales tax landscape is crucial for businesses and consumers alike. In this comprehensive guide, we will delve into the specifics of Oregon's sales tax rate, exploring its intricacies, variations, and impact on the state's economy.

The Uniqueness of Oregon’s Sales Tax System

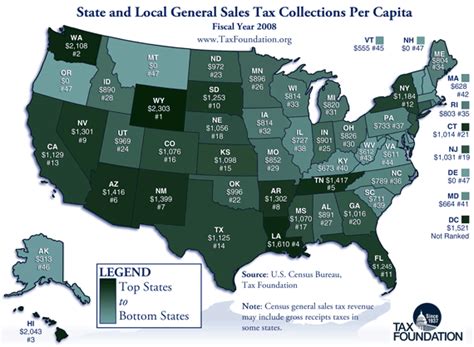

Oregon is one of the few states in the U.S. that does not impose a general sales tax on most retail transactions. Instead, it relies on a combination of other tax measures to generate revenue. This distinctive approach has shaped the state’s economic landscape and presents an interesting case study for tax policy enthusiasts.

Oregon's sales tax exemption for most goods and services sets it apart from many other states. However, this does not mean that consumers and businesses are entirely free from taxation. Instead, Oregon has implemented a series of targeted taxes and fees that contribute to its overall revenue stream.

Understanding Oregon’s Tax Structure

While Oregon does not have a traditional sales tax, it has implemented various taxes and fees that are applicable to specific industries and transactions. These taxes are designed to capture revenue from different economic activities, ensuring a diverse and stable source of income for the state.

State and Local Taxes

Oregon operates with a state-wide tax system, where the state sets the framework for taxation. However, it also allows local jurisdictions, such as cities and counties, to impose additional taxes or fees to support local initiatives and infrastructure projects.

The state-wide tax system includes:

- Corporate Income Tax: Oregon levies a corporate income tax on businesses operating within the state. This tax contributes significantly to the state's revenue.

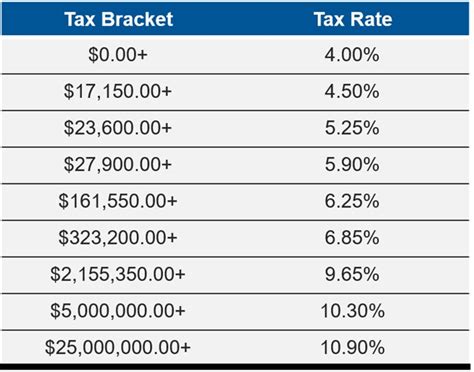

- Personal Income Tax: Individuals earning income in Oregon are subject to a progressive income tax rate, with rates varying based on income brackets.

- Excise Taxes: These are taxes imposed on specific goods or services, such as fuel, tobacco, and alcohol. Excise taxes are often used to fund specific programs or initiatives related to the taxed product.

Local Taxes and Fees

Local governments in Oregon have the authority to impose additional taxes and fees to support their operations and development projects. These taxes can vary widely across the state, leading to a diverse tax landscape.

Some common local taxes and fees include:

- Local Option Taxes: Cities and counties can opt to impose additional taxes on certain goods or services to generate revenue for local projects.

- Lodging Taxes: Many tourist destinations in Oregon have lodging taxes, which are applied to hotel and motel stays.

- Vehicle Registration Fees: Vehicle registration fees are common across the state, with rates varying based on the type of vehicle and its value.

Impact on Oregon's Economy

Oregon's unique tax structure has had a significant impact on the state's economy. By relying on a diverse range of taxes, the state has been able to maintain a stable revenue stream, even during economic downturns. This stability has contributed to the overall economic health of the state.

Economic Growth and Investment

The absence of a general sales tax has made Oregon an attractive destination for businesses and investors. Companies can operate without the burden of a traditional sales tax, allowing them to allocate resources more efficiently and potentially reduce their tax liabilities.

This business-friendly environment has contributed to Oregon's economic growth, particularly in sectors such as technology, agriculture, and outdoor recreation. The state's diverse tax structure also provides incentives for businesses to invest in specific industries, as certain tax breaks or incentives may be available.

Consumer Spending and Retail Industry

The lack of a general sales tax has also influenced consumer spending patterns in Oregon. Without the added cost of sales tax, consumers may have more disposable income to allocate towards discretionary purchases. This can stimulate the retail industry and contribute to a vibrant local economy.

However, it is important to note that Oregon's tax structure still impacts consumer spending indirectly through other taxes and fees. For instance, excise taxes on fuel and tobacco can affect consumer choices and overall spending habits.

Oregon’s Sales Tax Rate: A Detailed Breakdown

While Oregon does not have a general sales tax, certain transactions and industries are subject to specific tax rates. Understanding these rates is crucial for businesses operating in the state and for consumers making informed purchasing decisions.

Retail Sales Tax

Oregon does not impose a retail sales tax on most goods and services. However, there are a few exceptions, primarily related to specific industries and transactions.

Some notable exceptions include:

- Lodging Tax: As mentioned earlier, lodging taxes are common in tourist destinations. The tax rate for lodging can vary across different cities and counties.

- Vehicle Sales Tax: While Oregon does not have a general sales tax, it does impose a vehicle sales tax when purchasing a new or used vehicle. The tax rate is calculated based on the vehicle's value and may vary depending on the county of registration.

- Construction and Remodeling: Certain construction and remodeling services may be subject to a tax. This tax is often levied at the local level and can vary depending on the jurisdiction.

Specific Industries and Transactions

Oregon has implemented targeted taxes for specific industries and transactions to capture revenue from these sectors. These taxes can vary widely based on the industry and the nature of the transaction.

| Industry/Transaction | Tax Rate |

|---|---|

| Alcoholic Beverages | 20% Excise Tax on Liquor, Beer, and Wine |

| Tobacco Products | $2.80 Excise Tax per pack of cigarettes |

| Fuel and Gasoline | 31.4 cents per gallon Excise Tax |

| Telecommunications | Varies based on service type and provider |

| Gambling and Lotteries | Specific taxes and fees applicable |

Future Outlook and Potential Changes

Oregon’s sales tax landscape is subject to continuous evaluation and potential changes. As the state’s economic needs evolve, so too may its tax policies.

Potential Tax Reforms

There have been ongoing discussions and proposals for tax reforms in Oregon. Some of these reforms aim to address budget concerns, while others focus on making the tax system more equitable and sustainable.

Potential tax reforms could include:

- Introducing a general sales tax to broaden the tax base and generate additional revenue.

- Modifying existing tax rates or implementing new taxes to address specific economic or social issues.

- Streamlining the tax system to reduce complexity and improve compliance.

Economic and Legislative Factors

The future of Oregon's sales tax rate and tax structure will be influenced by various economic and legislative factors. Economic trends, such as shifts in consumer behavior, technological advancements, and industry growth, can impact the state's revenue needs and tax policies.

Legislative decisions, such as ballot measures and initiatives, can also bring about significant changes to the tax landscape. Oregon's unique system of direct democracy, where citizens can propose and vote on legislative changes, plays a crucial role in shaping the state's tax policies.

Conclusion

Oregon’s sales tax rate is a fascinating and complex topic, offering a unique insight into the state’s tax policy and economic landscape. By understanding the intricacies of Oregon’s tax system, businesses and consumers can navigate the state’s economic environment with confidence and make informed decisions.

As Oregon continues to adapt and evolve, its tax structure will likely undergo changes to meet the evolving needs of its citizens and economy. Staying informed and engaged with the state's tax policies is essential for all stakeholders.

Does Oregon have a sales tax?

+Oregon does not have a general sales tax on most goods and services. However, there are specific taxes and fees applicable to certain industries and transactions.

What is the vehicle sales tax rate in Oregon?

+The vehicle sales tax rate in Oregon varies based on the vehicle’s value and the county of registration. It is calculated as a percentage of the vehicle’s price.

Are there any sales tax exemptions in Oregon?

+Oregon exempts most goods and services from sales tax. However, there are exceptions, such as lodging taxes and vehicle sales taxes.

How do Oregon’s tax policies impact businesses?

+Oregon’s tax policies can impact businesses by providing a competitive advantage due to the absence of a general sales tax. However, businesses must navigate specific taxes and fees applicable to their industry.

Where can I find the latest tax information for Oregon?

+The Oregon Department of Revenue provides comprehensive information on the state’s tax policies, including tax rates, exemptions, and filing requirements. Their website is a valuable resource for staying updated on Oregon’s tax landscape.