New York State Death Tax

The New York State Death Tax, officially known as the Estate Tax, is a complex and often confusing aspect of estate planning and taxation. It is a crucial consideration for residents and heirs of the state, as it can significantly impact the distribution of an estate and the financial well-being of beneficiaries.

In this comprehensive guide, we will delve into the intricacies of the New York State Death Tax, providing an expert analysis of its structure, calculation, exemptions, and strategies to minimize its impact. By understanding the nuances of this tax, individuals can make informed decisions to protect their estates and ensure a smoother transition of assets to their loved ones.

Understanding the New York State Estate Tax

The Estate Tax in New York is a tax levied on the transfer of a decedent’s estate to their heirs. It is distinct from the federal estate tax, as states have the authority to impose their own tax regulations on estates. The state of New York has its own set of rules and thresholds, which can differ significantly from federal guidelines.

The primary purpose of the New York Estate Tax is to generate revenue for the state government while also ensuring a fair distribution of wealth among beneficiaries. The tax is calculated based on the value of the estate and the relationship of the beneficiaries to the deceased.

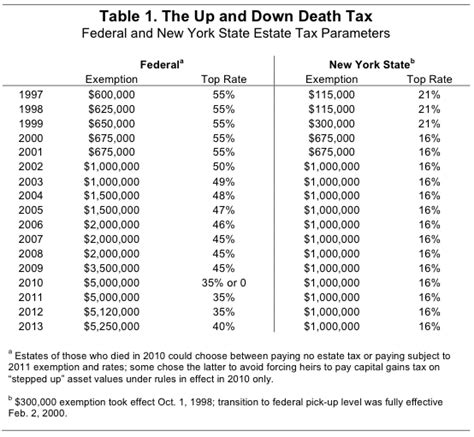

Estate Tax Thresholds and Rates

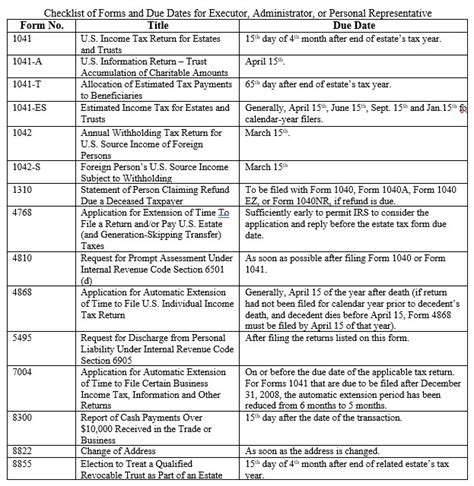

The New York Estate Tax is a graduated tax, meaning that the tax rate increases as the value of the estate grows. As of [current year], the tax rates and thresholds are as follows:

| Estate Value | Tax Rate |

|---|---|

| $5,000,001 - $10,000,000 | 3.06% |

| $10,000,001 - $15,000,000 | 3.61% |

| $15,000,001 - $25,000,000 | 4.51% |

| $25,000,001 - $50,000,000 | 5.84% |

| Over $50,000,000 | 7.55% |

These rates are applicable to the taxable value of the estate after deductions and exemptions have been applied. The tax is calculated on a sliding scale, meaning that the entire estate is not taxed at the highest rate; instead, different portions of the estate are taxed at varying rates.

Exemptions and Deductions

New York offers several exemptions and deductions to reduce the taxable value of an estate. These provisions aim to provide relief to heirs and ensure that a larger portion of the estate can be distributed to beneficiaries without being subject to high tax rates.

- Spousal Exemption: The entire estate is exempt from tax if the decedent's surviving spouse is the sole beneficiary.

- Charitable Deduction: Contributions made to qualified charities and educational institutions can be deducted from the taxable estate.

- Federal Estate Tax Credit: New York allows a credit for the federal estate tax paid, reducing the state tax liability.

- Specific Exemptions: Certain assets, such as life insurance proceeds and property held in qualified trusts, may be exempt from the estate tax.

It is crucial to consult with an estate planning professional to understand the specific exemptions and deductions applicable to your situation.

Estate Planning Strategies to Minimize the New York Estate Tax

Given the complexity of the New York Estate Tax, it is essential to employ strategic planning to minimize its impact. Here are some effective strategies:

Gifting and Trust Planning

Gifting assets during one’s lifetime can reduce the value of the estate at the time of death. New York allows annual exclusions and lifetime exemptions for gifts, making it an effective way to transfer wealth. Additionally, establishing trusts, such as irrevocable trusts or qualified personal residence trusts, can help remove assets from the taxable estate.

Life Insurance and Retirement Accounts

Life insurance proceeds and retirement accounts, such as IRAs and 401(k)s, are generally exempt from the New York Estate Tax. However, the tax treatment of these assets can vary based on the beneficiary designations and the structure of the plan. Proper planning can ensure that these assets are distributed efficiently and tax-effectively.

Charitable Giving

Donating assets to qualified charitable organizations not only supports a cause close to your heart but also reduces the taxable value of your estate. Charitable gifts can be made during your lifetime or as part of your estate plan, providing a tax-efficient way to distribute wealth.

Marital Deduction and Joint Ownership

The unlimited marital deduction allows for the transfer of assets to a surviving spouse without incurring estate tax. Joint ownership of assets, such as real estate or financial accounts, can also ensure a smooth transfer of ownership upon the death of one spouse.

Calculating the New York Estate Tax

The calculation of the New York Estate Tax involves several steps. Here’s a simplified breakdown:

- Determine the Gross Estate Value: This includes all assets owned by the decedent at the time of death, such as real estate, personal property, business interests, and financial assets.

- Apply Deductions and Exemptions: Subtract applicable deductions, such as funeral expenses, administration costs, and the charitable deduction. Additionally, consider the spousal exemption and other specific exemptions.

- Calculate the Taxable Estate: The remaining value after deductions is the taxable estate. This amount is then subject to the graduated tax rates outlined earlier.

- Compute the Tax Liability: Apply the appropriate tax rate to the taxable estate value to determine the estate tax due.

It is advisable to consult with a tax professional or an estate planning attorney to ensure an accurate calculation and to explore potential tax-saving strategies.

Future Implications and Updates

The New York Estate Tax regulations are subject to change, and it is essential to stay informed about any updates or proposed amendments. Recent years have seen efforts to simplify and harmonize state and federal estate tax laws, but the future direction of these policies remains uncertain.

Staying proactive in estate planning ensures that your assets are protected and distributed according to your wishes. Regular reviews of your estate plan can help you adapt to changing tax laws and personal circumstances.

Conclusion

The New York State Death Tax, or Estate Tax, is a complex and critical aspect of estate planning for residents and heirs. By understanding the tax thresholds, exemptions, and strategic planning options, individuals can minimize the impact of this tax and ensure a more secure financial future for their loved ones.

How does the New York Estate Tax compare to other states?

+New York’s estate tax is relatively higher compared to many other states. While some states have abolished their estate tax or set higher exemption thresholds, New York’s graduated tax rates can result in a higher tax liability for larger estates.

Are there any penalties for underpaying or not paying the estate tax?

+Yes, underpaying or failing to pay the New York Estate Tax can result in penalties and interest. It is crucial to accurately calculate and pay the tax to avoid additional financial burdens.

Can I transfer my residence to another state to avoid the New York Estate Tax?

+Changing your residency to avoid estate taxes is a complex decision. It is essential to consult with tax and legal professionals to understand the implications and potential benefits or drawbacks of such a move.