How Is Rental Income Taxed

Understanding how rental income is taxed is crucial for anyone venturing into the world of real estate investments or property management. In this comprehensive guide, we delve into the intricacies of rental income taxation, providing a detailed analysis of the key considerations and strategies to navigate this complex landscape.

Taxation of Rental Income: A Comprehensive Overview

When it comes to rental properties, the taxation process can vary depending on several factors, including the location of the property, the type of rental agreement, and the taxpayer's personal circumstances. However, a general understanding of the fundamental principles can provide a solid foundation for effective tax management.

Let's begin by exploring the basic principles of rental income taxation, followed by a detailed examination of the various aspects that influence the tax liability of rental property owners.

Understanding Rental Income Tax Categories

Rental income is typically categorized as passive income, which means it is not earned through active participation in a business or trade. This categorization has significant implications for tax reporting and deduction allowances.

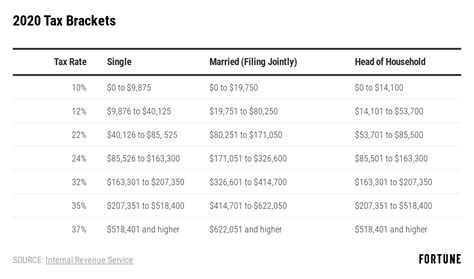

Passive income from rental properties is generally taxed at the taxpayer's ordinary income tax rate, which can vary depending on their overall income level and filing status. For instance, a single filer with a rental property might face a tax rate of 22% on their rental income if their total income falls within the $85,526 to $163,301 bracket for the 2023 tax year.

| Tax Bracket | Tax Rate |

|---|---|

| $0 - $10,275 | 10% |

| $10,276 - $41,775 | 12% |

| $41,776 - $89,075 | 22% |

| $89,076 - $170,050 | 24% |

| $170,051 - $215,950 | 32% |

| $215,951 - $539,900 | 35% |

| $539,901 and above | 37% |

It's important to note that the tax rates and brackets can vary from year to year, so it's essential to refer to the latest tax guidelines for accurate information.

Calculating Rental Income

Rental income is not just the rent collected; it includes various other sources of revenue related to the property. Here's a breakdown of the components that typically contribute to rental income:

- Rent Received: The primary source of rental income is the rent paid by tenants for the use of the property.

- Security Deposits: Security deposits, when refunded to tenants, are considered part of rental income.

- Late Fees: Late fees charged to tenants for delayed rent payments are also taxable.

- Application Fees: Fees collected from tenants during the application process are generally taxable.

- Pet Fees: If you charge tenants a fee for having pets, this is included in rental income.

- Laundry Fees: Income from coin-operated laundry machines or other amenities provided to tenants is taxable.

- Other Income: Any other revenue generated from the property, such as parking fees or storage unit rentals, is considered rental income.

It's crucial to maintain accurate records of all income sources to ensure proper tax reporting.

Deductions and Expenses

One of the key strategies for minimizing tax liability is understanding the deductions and expenses associated with rental properties. Here are some of the common deductions that can help offset rental income:

- Mortgage Interest: Interest paid on mortgages for rental properties is typically deductible. This includes both interest on acquisition debt and home equity loans used for improvements.

- Property Taxes: Property taxes paid on the rental property are deductible, including state, local, and foreign real estate taxes.

- Maintenance and Repairs: Costs incurred for maintaining and repairing the property, such as plumbing repairs, roof maintenance, and landscaping, are deductible.

- Insurance: Premiums paid for insurance coverage on the rental property, including liability and property insurance, are tax-deductible.

- Depreciation: Rental property owners can deduct a portion of the property's value each year, known as depreciation. This is calculated based on the cost of the property and its expected useful life.

- Advertising and Management Fees: Expenses related to advertising the rental property and management fees paid to property managers are deductible.

- Travel and Transportation: Costs incurred for travel to and from the rental property for maintenance or management purposes are deductible.

- Legal and Professional Fees: Fees paid to lawyers or accountants for tax or legal advice related to the rental property are tax-deductible.

It's important to maintain thorough records of all expenses and consult with a tax professional to ensure compliance with the applicable regulations.

Tax Filing and Reporting

Rental income must be reported on your tax return, and the specific form used depends on your filing status and the nature of your rental activities.

For most taxpayers, rental income is reported on Schedule E of Form 1040, which is used for reporting income and expenses from rental properties, royalties, partnerships, S corporations, and trusts. However, if you actively participate in the management of your rental properties, you might qualify for passive activity loss rules, which could allow you to deduct losses from rental activities against other types of income.

Additionally, if you have rental real estate income or losses from a business, you might need to file Form 8582, Passive Activity Loss Limitations, to determine how much of your loss you can deduct.

It's crucial to consult with a tax professional to ensure accurate reporting and to take advantage of all applicable deductions and credits.

Tax Strategies for Rental Property Owners

Navigating the tax landscape for rental properties can be complex, but there are several strategies that property owners can employ to optimize their tax situation.

Structuring Your Ownership

The way you structure your ownership of rental properties can have tax implications. Consider the following options:

- Sole Proprietorship: If you own the property outright, you'll report rental income and expenses on your personal tax return.

- Limited Liability Company (LLC): Forming an LLC for your rental properties can provide liability protection and offer tax advantages, such as pass-through taxation and the ability to deduct losses against other income.

- S Corporation: Converting your rental property business to an S corporation can provide tax benefits, such as the ability to deduct reasonable compensation for your services as a property manager.

Consult with a tax advisor to determine the best ownership structure for your situation.

Timing of Rental Income and Expenses

The timing of when you receive rental income and incur expenses can impact your tax liability. Consider these strategies:

- Accrual vs. Cash Basis: You can choose to report income and expenses on an accrual basis, recognizing them when they're earned or incurred, or on a cash basis, recognizing them when payment is received or made. The choice can affect when deductions are taken and when income is reported.

- Prepaying Expenses: Prepaying expenses, such as property taxes or insurance premiums, can help you deduct those expenses in the current tax year, potentially reducing your taxable income.

- Delaying Income: If possible, consider delaying rental income to a future tax year, especially if you expect your income to be lower in that year, which could result in a lower tax rate.

Leveraging Deductions and Credits

Take advantage of the various deductions and tax credits available to rental property owners. Some key considerations include:

- Section 179 Deduction: If you make qualifying purchases of business property, you can deduct the cost in the year the property is placed in service, up to a certain limit. This can include equipment, vehicles, and improvements to rental properties.

- Bonus Depreciation: Certain business assets are eligible for bonus depreciation, which allows you to deduct a larger portion of the asset's cost in the first year.

- Energy-Efficient Credits: If you make energy-efficient improvements to your rental property, you might be eligible for tax credits. These credits can offset your tax liability.

- Low-Income Housing Credits: If your rental property qualifies as low-income housing, you might be eligible for tax credits. These credits can be substantial and provide a significant benefit to your tax situation.

Stay updated on the latest tax laws and consult with a tax professional to ensure you're taking advantage of all applicable deductions and credits.

Tax Implications for Different Rental Scenarios

The tax implications of rental income can vary depending on the specific circumstances of your rental activities. Here's a look at some common scenarios and their tax considerations:

Full-Time Landlord

If you're a full-time landlord, managing multiple rental properties as a primary business activity, you might qualify for certain tax benefits. You can deduct ordinary and necessary business expenses, such as advertising, travel, and vehicle expenses, against your rental income. Additionally, you might be eligible for the Qualified Business Income Deduction, which allows you to deduct up to 20% of your qualified business income.

Part-Time Landlord

If you have a full-time job and own one or a few rental properties on the side, you might be considered a part-time landlord. In this case, you can still deduct expenses related to your rental activities, but you might have more limitations on deducting losses. Consult with a tax professional to understand the specific rules for your situation.

Rental Property as a Second Home

If you own a vacation home that you rent out for part of the year, the tax treatment can be more complex. You might be able to deduct mortgage interest and property taxes, but the rules for depreciation and other deductions can be different. It's essential to keep accurate records and consult with a tax advisor to navigate the specific tax implications of this scenario.

Short-Term Rentals

Short-term rentals, such as those listed on platforms like Airbnb or VRBO, are subject to different tax rules. You'll need to report the income from these rentals and may be able to deduct expenses associated with the rental activity. The tax treatment can vary depending on the frequency and duration of your rentals, so it's crucial to seek professional tax advice.

Future Implications and Tax Planning

Understanding the current tax landscape for rental income is just the first step. Effective tax planning involves staying informed about potential changes to tax laws and regulations. Here are some key considerations for future tax planning:

- Tax Reform: Keep an eye on potential tax reforms that might impact rental income taxation. Changes in tax rates, brackets, or deductions could significantly affect your tax liability.

- Inflation and Cost-of-Living Adjustments: Inflation can impact the value of deductions and credits. Stay updated on cost-of-living adjustments and ensure you're taking advantage of any increases in deduction limits or credit amounts.

- Tax Strategies for Retirement: If you're approaching retirement, consider tax-efficient strategies for managing your rental properties. This might include strategies like 1031 exchanges or utilizing retirement accounts to purchase rental properties.

- Inheritance and Estate Planning: If you plan to pass on rental properties to your heirs, consult with an estate planning professional to ensure a smooth transition and minimize tax implications.

Regularly review your tax situation and consult with tax advisors to stay proactive in your tax planning.

How often do I need to report rental income and expenses?

+You must report rental income and expenses annually on your tax return. If you expect to owe taxes on your rental income, you may need to make estimated tax payments throughout the year to avoid penalties.

Can I deduct the full cost of improvements to my rental property?

+The answer depends on the nature of the improvement. Major improvements that significantly extend the property’s useful life are typically depreciated over time. Smaller repairs and maintenance expenses can often be deducted in the year they’re incurred.

Are there any tax benefits for energy-efficient improvements to rental properties?

+Yes, the IRS offers tax credits for certain energy-efficient improvements. These credits can offset your tax liability. Consult the IRS website or a tax professional for the latest information on eligible improvements and credit amounts.

Can I deduct the cost of my time spent managing my rental properties?

+No, the cost of your time is not a deductible expense. However, you can deduct other expenses related to managing your rental properties, such as advertising, travel, and vehicle expenses.

What records should I keep for my rental property taxes?

+Keep detailed records of all rental income and expenses, including receipts, invoices, and documentation of improvements or repairs. These records are essential for accurate tax reporting and may be requested by the IRS during an audit.