Navigating Common Challenges with Illinois Estate Tax Planning

When it comes to estate planning in Illinois—an idyllic state with a capital city that’s probably more famous for its deep-dish pizza than for its tax laws—tackling the seemingly straightforward task of estate tax planning can suddenly transform into an elaborate game of chess, complete with legal pitfalls, archane regulations, and the occasional unexpected pawn promotion. If you’ve ever wondered whether your descendants will be able to inherit your prized collection of vintage comic books without a hefty slice taken out by the state, then you’re in the right place. Because Illinois estate tax planning is less of a walk in the Chicago Botanic Garden and more akin to navigating a swamp of procedural quagmires with the efficiency of a stork in a swamp—not impossible, but definitely requiring some serious know-how, and perhaps a good sense of humor.

Navigating the Topography of Illinois Estate Tax Laws

Illinois estate tax law is an intricate tapestry woven from legislative threads that have evolved dramatically since the state first dipped its toes into estate taxation in the early 20th century. Today, Illinois imposes a state estate tax on estates exceeding a threshold of $4 million. But what makes this tax particularly insidious—like finding a rat in your bagel—is that it operates alongside the federal estate tax, creating a tax labyrinth comparable to the legendary Grover’s Mill maze in the dark. The interplay between these two levels can turn a simple inheritance plan into a complex combinatorial game, especially when accounting for deductions, exemptions, and ever-changing legislation.

Historical context and evolution of Illinois estate tax policy

Historically, Illinois was among the first states to adopt an estate tax in 1941, during a period when the nation was embroiled in its second World War. Its original purpose was to bolster state coffers, but over time it morphed into a subtle tool for wealth redistribution—or, more accurately, a siphon for government revenues. The estate tax rate, which peaks at 16%, is applied on top of federal estate taxes, although the federal layer has undergone considerable reforms—most notably the Tax Cuts and Jobs Act of 2017, which dramatically increased the federal exemption. In Illinois, however, the state estate tax remains a steadfast obstacle for estates exceeding that $4 million threshold.

Major challenges in Illinois estate tax planning

Despite the relatively modest exemption threshold compared to other states, many estate planners are caught off guard by the nuanced hurdles Illinois presents—like climbing a mountain of legal documents only to find a cliff at the summit. Among these challenges, the most notorious include:

- Complex valuation rules that treat every asset—be it a family heirloom or that eclectic collection of vintage sneakers—as a potential taxable event, often requiring appraisers whose fees could rival the estate’s entire tax liability;

- State-specific deductions and exemptions that demand an intimate familiarity with Illinois law, including exemptions for certain family-owned farms and small businesses that might otherwise seem straightforward but hide their own traps;

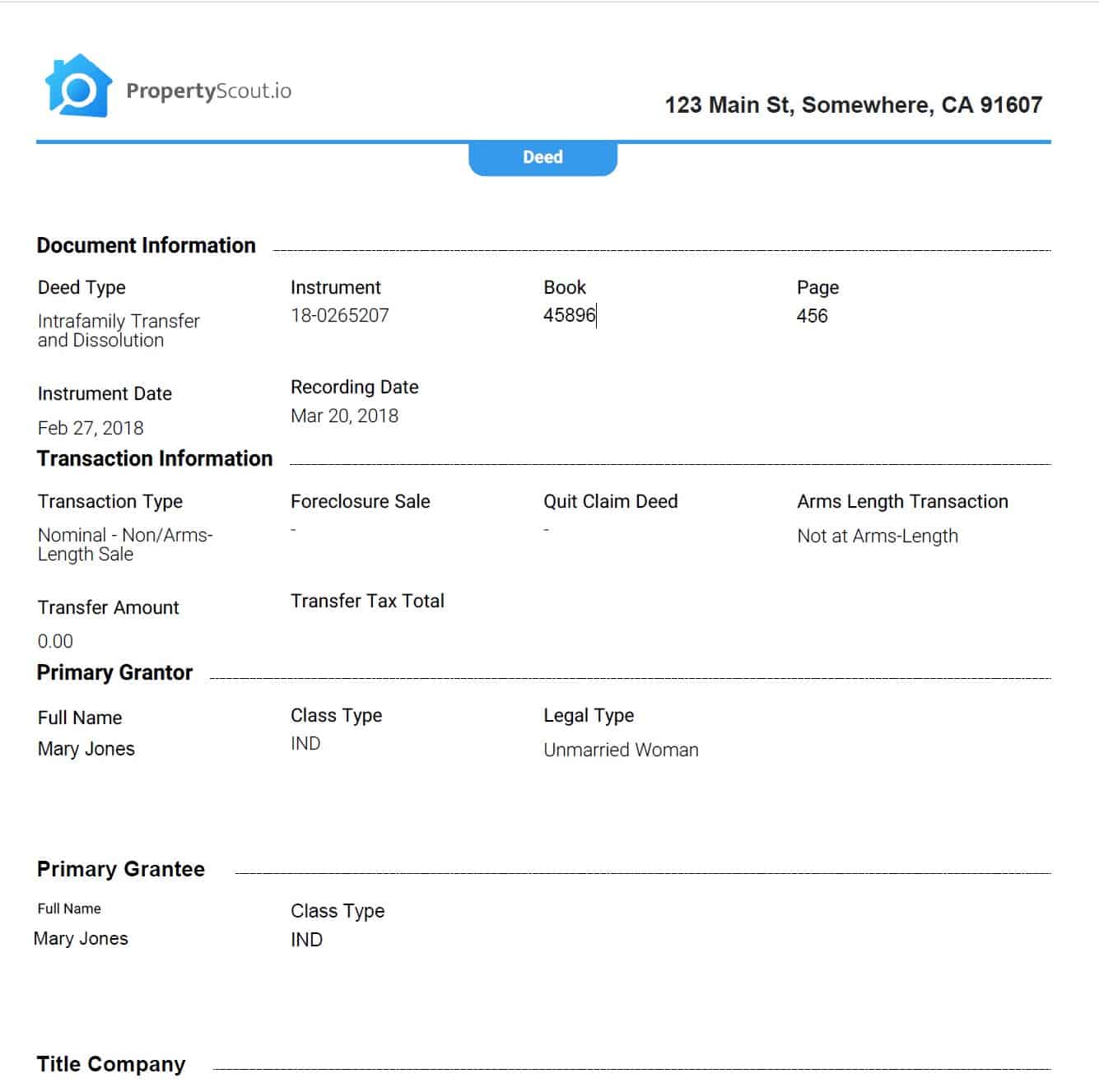

- Cross-border issues—for estates with assets or beneficiaries in neighboring states—creating an interstate legal puzzle that would challenge even the most adept legal sleuths.

Ticking clock and the probate process

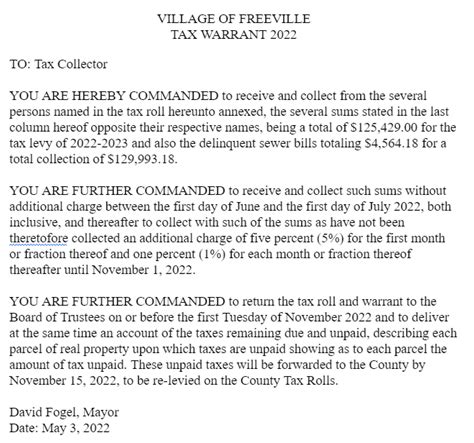

The timeline adds another layer of challenge. Illinois law requires that estate tax returns be filed within nine months of the decedent’s death, giving heirs a countdown clock that’s as merciless as an Illinois winter. Delay or improper documentation can lead to penalties, interest, or even a court battle that turns the inheritance process into a season of “Game of Thrones.”

Effective strategies for overcoming Illinois estate tax challenges

If the idea of navigating this legal labyrinth seems daunting, consider the following strategies—crafted with a keen understanding of Illinois’s particular pitfalls:

Proactive estate valuation and asset classification

Accurate valuation is the bedrock of sound estate planning. This involves regular appraisals and clear documentation, especially for assets subject to Illinois estate tax. Overvaluation can lead to unnecessary tax charges, while undervaluation invites legal scrutiny—and possibly, audits. Employing qualified appraisers and integrating valuation clauses into estate documents is akin to installing a sturdy fence around your legal estate city.

Maximizing exemptions and deductions

Illinois offers a few strategic avenues—such as exemptions for farms and small businesses. These are often overlooked by those who rely solely on federal planning. Proper structuring can include irrevocable trusts, gifting strategies, and even charitable donations, which serve as loopholes rather than loopholes, and should be tailored to each estate’s unique profile.

Timely filings and comprehensive estate documentation

The ticking clock is real and ruthless. Late filings or incomplete documentation lead directly to penalties—sometimes more than the tax itself. Making sure all paperwork is prepared and filed on time, with the help of seasoned professionals, ensures the estate’s longevity and the heirs’ peace of mind.

| Relevant Category | Substantive Data |

|---|---|

| Federal exemption (2023) | $12.92 million, up from $11.7 million in 2021 |

| Illinois exemption threshold | $4 million (flat rate applies above this) |

| Maximum Illinois estate tax rate | 16% |

| Tax Filing Deadline | Within 9 months of death |

Key Points

- Early valuation and asset classification prevent future disputes and tax surprises.

- Utilizing Illinois-specific exemptions can significantly minimize estate tax exposure.

- Timely filing and precise documentation are non-negotiable for estate preservation.

- Professional guidance tailored to Illinois law remains the safest route through this maze.

- Adapting estate plans with evolving laws ensures long-term wealth preservation and peace of mind.

Mitigating potential pitfalls: case studies and practical lessons

In the flesh-and-blood world of estate planning, cautionary tales often speak louder than legal treatises. Consider the case of the McAllister family—whose estate, valued at just above the $4 million exemption, encountered an administrative nightmare when an overlooked farm exemption failed to materialize due to a misapplied classification. The subsequent tax bill could have funded a small country, had they not caught the mistake in time. Or the Smiths, whose cross-border assets in Illinois and Wisconsin required meticulous legal coordination to avoid double taxation. These real-world examples underscore the importance of expert guidance and meticulous planning.

Recommendations for estate executors and heirs

Executors should double down on documentation, stay informed about legislative changes, and consider creating a detailed estate plan that includes potential tax liabilities and strategies for mitigation. Heirs, meanwhile, must be prepared for the possibility of audit and should always consult professionals before making estate-related decisions—preferably ones with a proven track record in Illinois law.

Looking ahead: the future of Illinois estate tax legislation

As political winds shift and economic realities tighten their grip, Illinois estate tax laws are likely to evolve—perhaps with adjustments to exemption thresholds, tax rates, or both. With the state’s ongoing fiscal challenges, expect a landscape where estate planning becomes more complicated rather than less. Savvy estate planners will keep tabs on legislative proposals and adapt swiftly—seeing the tax code not as an obstacle but as a puzzle to solve creatively.

What is the current Illinois estate tax exemption?

+As of 2023, Illinois exempts estates valued at 4 million or less from estate tax liability, with estates exceeding this threshold taxed at a maximum rate of 16%.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>How does Illinois estate tax interact with federal estate tax?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Illinois estate tax applies separately to estates exceeding 4 million, irrespective of federal exemptions, which are significantly higher. However, in estates above federal thresholds, planning must consider both layers of taxation for optimal strategy.

Are there legal strategies to reduce Illinois estate tax liability?

+Yes. Strategies include taking advantage of Illinois-specific exemptions, gifting assets during lifetime, establishing trusts, and ensuring proper valuation and timely filing. Consulting estate planning professionals well-versed in Illinois law is an essential step.