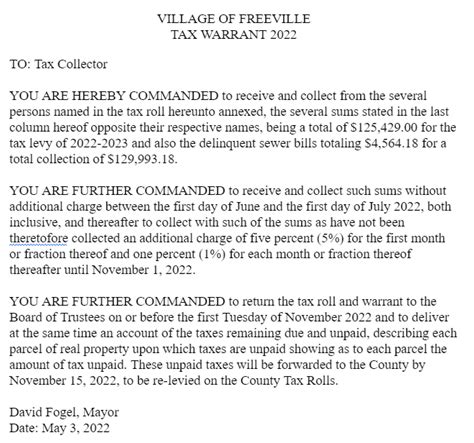

What Is A Tax Warrant

A tax warrant is a legal document issued by a governmental tax authority, such as the Internal Revenue Service (IRS) in the United States, when an individual or entity fails to meet their tax obligations. This document serves as a formal notice and a crucial step in the tax collection process, indicating a serious issue with tax compliance. Tax warrants are typically issued after multiple attempts to resolve tax debts have been unsuccessful, and they can have significant implications for the individuals or businesses involved.

Understanding the Process: From Tax Debt to Warrant

The journey to a tax warrant begins with an unpaid tax liability. When a taxpayer fails to remit the full amount of their tax debt, the tax authority initiates a series of collection actions. These actions often start with gentle reminders, followed by more assertive measures like penalty assessments and eventually, the filing of a federal tax lien.

A federal tax lien is a legal claim against a taxpayer's property, including real estate, vehicles, and even personal property like jewelry or artwork. This lien acts as a warning sign to other creditors, notifying them that the government has a right to the taxpayer's property if the debt remains unpaid. However, a tax lien alone does not grant the government the power to seize assets.

The situation escalates when the taxpayer continues to ignore their tax obligations. At this stage, the tax authority may issue a Notice of Levy. This notice authorizes the government to legally seize property or funds from the taxpayer to satisfy the outstanding tax debt. The levy can be applied to a wide range of assets, including bank accounts, wages, or even the proceeds from the sale of property.

If the taxpayer still fails to resolve the debt or engage in a payment plan, the tax authority may issue a tax warrant. This document empowers the government to take more aggressive collection actions, including the seizure and sale of assets. The tax warrant essentially grants the government the legal authority to pursue all available avenues to collect the tax debt, often resulting in significant financial hardship for the taxpayer.

Key Characteristics of a Tax Warrant

Tax warrants are official documents, typically signed by a high-ranking official within the tax authority, such as the IRS Commissioner or a state tax commissioner.

They include detailed information about the taxpayer, including their name, address, and the specific tax debt in question. This information is crucial for identifying the taxpayer and the nature of their tax liability.

Tax warrants also outline the actions that the taxpayer must take to resolve the debt. This often includes a demand for immediate payment in full or the initiation of a formal payment plan. Failure to comply with the terms of the warrant can result in further legal action, including asset seizure.

Once a tax warrant is issued, it becomes a public record. This means that it can be accessed by potential lenders, employers, and even business partners. As a result, tax warrants can have a significant impact on an individual's or business's credit score and overall financial reputation.

| Key Feature | Description |

|---|---|

| Issuing Authority | Typically a high-ranking official from the tax authority, such as the IRS Commissioner. |

| Taxpayer Information | Detailed personal or business details, including name, address, and tax identification number. |

| Tax Debt Details | Specific information about the outstanding tax liability, including the tax year(s) and amount(s) owed. |

| Actions Required | Instructions for the taxpayer to resolve the debt, often including a demand for immediate payment or the initiation of a payment plan. |

The Impact of a Tax Warrant on Individuals and Businesses

The issuance of a tax warrant can have far-reaching consequences for both individuals and businesses. For individuals, it can result in the seizure of personal assets, including bank accounts, vehicles, and even their primary residence. This can lead to significant financial strain and potential homelessness.

Businesses, on the other hand, may face the seizure of business assets, including equipment, inventory, and even the business itself. This can result in the disruption of operations, loss of revenue, and potential closure. Additionally, a tax warrant against a business can also affect its ability to secure loans or attract investors, further hindering its financial stability and growth prospects.

Potential Outcomes and Strategies

While a tax warrant is a serious matter, there are still avenues for resolution. Taxpayers can consider the following strategies:

- Payment in Full: If the taxpayer has the means, paying the full amount owed can immediately resolve the issue and prevent further legal action.

- Installment Agreement: Negotiating an installment agreement with the tax authority can allow the taxpayer to repay the debt over time, often with a reduced penalty.

- Offer in Compromise: In some cases, the taxpayer can propose an offer to settle the debt for less than the full amount owed. This is often a last resort and requires careful consideration and preparation.

- Bankruptcy: For individuals or businesses with significant debt, bankruptcy may be an option. However, it's crucial to consult with a legal professional as bankruptcy has its own set of complexities and consequences.

It's important to note that ignoring a tax warrant will not make it go away. In fact, it can lead to more severe consequences, including wage garnishment, the sale of assets, and even criminal charges in extreme cases. Seeking professional advice from a tax attorney or certified public accountant (CPA) is highly recommended to explore all available options and develop a strategic plan to resolve the tax debt.

The Role of Tax Professionals in Resolving Tax Warrants

Tax professionals, including tax attorneys and CPAs, play a crucial role in helping taxpayers navigate the complex world of tax warrants and debt resolution. These professionals are well-versed in tax laws and regulations, and they can provide valuable guidance and representation throughout the process.

Expertise and Experience

Tax attorneys and CPAs have extensive knowledge of tax laws, procedures, and regulations. They understand the intricacies of tax debt collection, including the rights and responsibilities of taxpayers and tax authorities. This expertise allows them to develop tailored strategies to resolve tax warrants and minimize the financial impact on their clients.

Their experience in handling tax matters provides them with a unique perspective. They have seen a wide range of tax situations and have successfully negotiated with tax authorities on behalf of their clients. This experience enables them to anticipate potential challenges and develop proactive solutions.

Representation and Negotiation

Tax professionals can represent taxpayers in negotiations with tax authorities. They can communicate directly with the IRS or state tax agencies, advocating for their clients’ best interests. This representation can be especially valuable when dealing with complex tax issues or when the taxpayer feels overwhelmed or intimidated by the process.

Through their negotiation skills, tax professionals can work towards reducing penalties, setting up manageable payment plans, or even obtaining tax debt forgiveness in certain circumstances. They can also help taxpayers understand the tax consequences of different actions and make informed decisions about their financial future.

Compliance and Future Planning

Beyond resolving immediate tax issues, tax professionals can also help taxpayers establish compliance going forward. They can assist with tax planning, ensuring that taxpayers meet their future tax obligations and avoid similar issues in the future.

Additionally, tax professionals can provide ongoing support and guidance. They can help taxpayers understand their tax rights, monitor changes in tax laws that may impact their situation, and ensure that all necessary forms and documents are filed accurately and on time.

In summary, tax warrants are a serious matter, but with the right guidance and strategies, taxpayers can work towards resolving their tax debt and regaining financial stability. Seeking the expertise of tax professionals can be a crucial step in this process, offering specialized knowledge, negotiation skills, and a comprehensive understanding of tax laws and procedures.

What happens if a tax warrant is issued against me?

+If a tax warrant is issued, it means the tax authority has taken a serious step to collect your outstanding tax debt. You may face the seizure of your assets, including bank accounts, wages, or property. It’s crucial to take immediate action by contacting a tax professional to explore your options for resolving the debt.

Can a tax warrant be removed or resolved?

+Yes, tax warrants can be resolved. You can consider options like paying the debt in full, negotiating an installment agreement, or proposing an offer in compromise. Working with a tax professional can increase your chances of successfully resolving the warrant and avoiding further legal consequences.

What are the long-term consequences of a tax warrant?

+A tax warrant can have long-lasting consequences, including a negative impact on your credit score, difficulty obtaining loans or mortgages, and even potential issues with employment or business partnerships. It’s essential to address the warrant promptly to minimize these impacts.