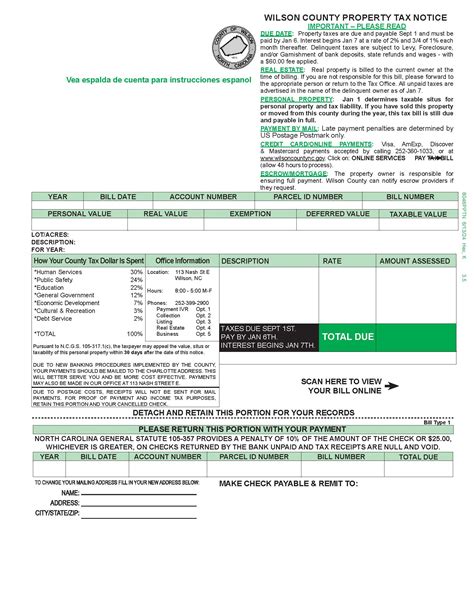

Wilson County Property Tax

Property taxes are an essential part of the revenue stream for local governments and play a crucial role in funding various public services and infrastructure. In Wilson County, Tennessee, property taxes are a significant source of funding for schools, emergency services, and other vital community needs. This article delves into the intricacies of Wilson County's property tax system, exploring its assessment process, tax rates, exemptions, and the overall impact on property owners.

Understanding the Wilson County Property Tax Assessment Process

The property tax assessment process in Wilson County is a comprehensive and meticulous endeavor, overseen by the Wilson County Assessor’s Office. This office is responsible for ensuring that all properties within the county are accurately valued and assessed for tax purposes. The assessment process involves several key steps, each contributing to a fair and equitable taxation system.

Data Collection and Property Inspection

The first step in the assessment process is data collection. The Assessor’s Office gathers information on all properties in the county, including physical characteristics, improvements, and ownership details. This data is sourced from various records, such as deed transfers, building permits, and aerial imagery.

In addition to data collection, the Assessor's Office also conducts physical inspections of properties. These inspections are vital for verifying the accuracy of the collected data and ensuring that any recent changes or improvements to the property are accounted for in the assessment.

Property Valuation Methods

Once the data is collected and verified, the Assessor’s Office employs various valuation methods to determine the fair market value of each property. These methods include the cost approach, which estimates the replacement cost of the property, and the income approach, which is applicable for income-producing properties and considers the potential rental income. However, the most commonly used method in Wilson County is the sales comparison approach.

The sales comparison approach involves comparing the subject property to similar properties that have recently sold in the same area. By analyzing these comparable sales, the Assessor's Office can estimate the fair market value of the property in question. This method takes into account factors such as location, size, condition, and any unique features of the property.

Assessment Notices and Appeals

After the valuation process is complete, property owners in Wilson County receive an assessment notice detailing the assessed value of their property. This notice serves as an official communication of the property’s assessed value and the basis for the upcoming tax bill. Property owners have the right to review their assessment and, if they believe it to be inaccurate, they can file an appeal with the Assessor’s Office.

The appeal process in Wilson County is designed to ensure fairness and transparency. Property owners can present evidence, such as recent appraisals or sales data, to support their case. The Assessor's Office carefully considers each appeal and may adjust the assessment if warranted. This process helps maintain public confidence in the property tax system and ensures that assessments are as accurate as possible.

Wilson County Property Tax Rates and Calculation

The property tax rate in Wilson County is determined by the local government and is used to calculate the tax liability for each property. The tax rate is expressed as a millage rate, which represents the amount of tax owed per $1,000 of assessed value. This rate can vary across different areas within the county, depending on the funding needs of various local entities, such as schools and municipalities.

Tax Rate Structure in Wilson County

Wilson County has a two-tier tax rate structure, which means that properties are subject to both a countywide tax rate and a municipal tax rate. The countywide tax rate applies to all properties within the county, while the municipal tax rate is specific to each incorporated municipality.

For example, let's consider a property located in the city of Lebanon, which is one of the municipalities in Wilson County. This property would be subject to both the countywide tax rate and the Lebanon municipal tax rate. The combined tax rate for this property would be the sum of these two rates.

| Tax Jurisdiction | Millage Rate |

|---|---|

| Wilson County | 2.50 mills |

| Lebanon City | 1.75 mills |

| Total Tax Rate | 4.25 mills |

Property Tax Calculation

To calculate the property tax liability, the assessed value of the property is multiplied by the applicable tax rate. The resulting amount is the annual property tax bill for the property owner. For instance, consider a residential property in Wilson County with an assessed value of $250,000. Using the example tax rates from the previous section, the calculation would be as follows:

Property Tax = Assessed Value x Total Tax Rate

Property Tax = $250,000 x 0.00425

Property Tax = $1,062.50

So, the annual property tax bill for this residential property would be $1,062.50.

Property Tax Exemptions and Discounts in Wilson County

Wilson County offers various property tax exemptions and discounts to eligible property owners, providing relief and reducing their tax burden. These exemptions and discounts are designed to support specific groups and encourage certain behaviors or activities.

Homestead Exemption

One of the most significant tax relief programs in Wilson County is the homestead exemption. This exemption applies to the primary residence of homeowners and reduces the assessed value of their property for tax purposes. To qualify for the homestead exemption, property owners must meet certain residency requirements and submit an application to the Assessor’s Office.

For example, let's consider a homeowner in Wilson County who has lived in their home for at least two years. By applying for the homestead exemption, they can reduce the assessed value of their property by up to $25,000. This reduction in assessed value directly lowers their annual property tax bill, providing significant savings.

Senior Citizen Discount

Wilson County also offers a discount for senior citizens, aiming to support the county’s elderly population. To qualify for this discount, property owners must be at least 65 years old and meet certain income requirements. The discount is applied as a percentage reduction in the property tax bill, providing financial relief for eligible senior citizens.

Imagine a senior couple in Wilson County who has lived in their home for many years. By applying for the senior citizen discount, they can receive a 20% reduction in their annual property tax bill. This discount helps ease the financial burden of property taxes for our county's senior residents.

Other Exemptions and Discounts

In addition to the homestead exemption and senior citizen discount, Wilson County provides other exemptions and discounts to support various groups and activities. These include exemptions for disabled veterans, agricultural properties, and historic properties. There are also discounts for early payment of property taxes and for properties that utilize renewable energy systems.

For instance, a disabled veteran who owns a home in Wilson County may be eligible for a full exemption on their property taxes. This exemption recognizes the service and sacrifice of our veterans and provides significant financial relief.

The Impact of Wilson County Property Taxes on Residents and Businesses

Property taxes in Wilson County have a profound impact on both residents and businesses, influencing their financial planning, investment decisions, and overall quality of life. The tax revenue generated through property taxes plays a critical role in funding essential services and maintaining the county’s infrastructure.

Funding Public Services and Infrastructure

Property tax revenue is a primary source of funding for public services in Wilson County. These services include schools, emergency services, road maintenance, parks, and recreational facilities. By investing in these services, Wilson County aims to provide a high quality of life for its residents and create an attractive environment for businesses.

For example, property tax revenue is used to fund the Wilson County School District, ensuring that students have access to quality education and resources. It also supports the county's fire and rescue services, ensuring prompt and efficient emergency response.

Impact on Property Owners

Property taxes can be a significant expense for homeowners and businesses in Wilson County. The annual tax bill can represent a substantial portion of a property owner’s budget, and fluctuations in tax rates or assessed values can have a notable impact on their financial planning.

However, Wilson County's property tax system also offers benefits to property owners. The tax revenue generated supports the development and maintenance of infrastructure, which can enhance property values over time. Additionally, the various exemptions and discounts available to property owners can provide substantial savings, making property ownership more affordable.

Attracting Businesses and Economic Development

Wilson County’s property tax system plays a crucial role in attracting businesses and promoting economic development. A competitive and stable property tax environment can encourage businesses to locate or expand in the county, leading to job creation and economic growth.

By offering a reasonable and predictable property tax structure, Wilson County provides businesses with the certainty they need to make long-term investment decisions. This, in turn, can lead to increased employment opportunities, improved tax revenues, and a stronger local economy.

Frequently Asked Questions

How often are properties reassessed for tax purposes in Wilson County?

+Properties in Wilson County are typically reassessed every four years. However, certain circumstances, such as significant improvements or damage to the property, may trigger an earlier reassessment.

Can I appeal my property’s assessed value if I disagree with it?

+Yes, property owners in Wilson County have the right to appeal their assessed value if they believe it is inaccurate. The appeal process involves submitting an appeal application and providing evidence to support the requested change.

Are there any online resources available to estimate my property tax bill in Wilson County?

+Yes, the Wilson County Assessor’s Office provides an online tax estimator tool on their website. This tool allows property owners to estimate their tax bill based on their property’s assessed value and the current tax rates.

What happens if I don’t pay my property taxes on time in Wilson County?

+Unpaid property taxes in Wilson County can result in late fees, interest charges, and potential legal consequences. In extreme cases, the county may place a tax lien on the property or even pursue foreclosure proceedings.

Are there any tax relief programs for low-income homeowners in Wilson County?

+Yes, Wilson County offers a tax relief program called the “Senior/Disabled Citizen Tax Relief” program. This program provides a reduction in property taxes for eligible low-income senior citizens and disabled individuals.