Tax Rebate Wisconsin

For residents of the state of Wisconsin, understanding the intricacies of tax rebates is crucial for optimizing financial outcomes. This comprehensive guide delves into the specific tax rebate system in Wisconsin, offering insights into eligibility, calculations, and strategies to maximize returns. With a focus on the unique aspects of Wisconsin's tax laws, this article aims to empower individuals and businesses to navigate the tax landscape effectively and ensure they receive the rebates they're entitled to.

Navigating the Tax Rebate System in Wisconsin

Wisconsin’s tax structure, like many other states, offers a range of rebates and incentives to its residents and businesses. These rebates are designed to provide financial relief and encourage economic growth. This section provides an overview of the key aspects of Wisconsin’s tax rebate system, shedding light on the benefits available to taxpayers.

Eligibility Criteria for Wisconsin Tax Rebates

Determining eligibility is the first step in the tax rebate process. In Wisconsin, eligibility is typically based on income levels, residency status, and specific criteria related to the type of rebate being claimed. For instance, the state offers a Homestead Credit, which provides a rebate on property taxes for eligible homeowners and renters. To qualify for this credit, individuals must have a total household income below a certain threshold, which varies based on family size and county of residence.

Another notable rebate is the Earned Income Tax Credit (EITC), which is available to working individuals and families with low to moderate income. The EITC is designed to offset the burden of social security taxes and provide a financial boost to those who need it most. To be eligible for the EITC, taxpayers must meet specific criteria regarding income, marital status, and the number of qualifying children.

| Rebate Type | Eligibility Criteria |

|---|---|

| Homestead Credit | Income below a certain threshold, residency requirements, and ownership or rental of a homestead property. |

| Earned Income Tax Credit (EITC) | Low to moderate income, work-related requirements, and specific rules regarding marital status and qualifying children. |

Calculating Your Wisconsin Tax Rebate

Once eligibility is established, the next step is to calculate the amount of the tax rebate. Wisconsin’s tax system employs a series of formulas and tables to determine rebate amounts. For the Homestead Credit, the calculation is based on the total household income, the county’s median income, and the property tax liability. The formula takes into account factors such as income brackets, family size, and the homestead property’s assessed value.

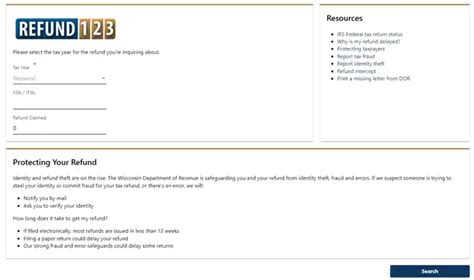

The EITC, on the other hand, has a more complex calculation that involves multiple factors. The amount of the credit depends on the taxpayer's earned income, investment income limits, and the number of qualifying children. The Internal Revenue Service (IRS) provides a Tax Refund Calculator tool that can assist taxpayers in estimating their EITC amount based on their specific circumstances.

Maximizing Your Tax Rebate in Wisconsin

To ensure you receive the maximum tax rebate, it’s essential to understand the various deductions and credits available in Wisconsin. These include deductions for medical and dental expenses, charitable contributions, and certain business-related expenses. Additionally, taxpayers can take advantage of tax credits for energy-efficient home improvements, childcare expenses, and education-related costs.

Furthermore, staying informed about any changes to Wisconsin's tax laws and regulations is crucial. The state may introduce new rebates or modify existing ones based on economic conditions and legislative decisions. Taxpayers can refer to the Wisconsin Department of Revenue's website for the latest information and updates on tax rebates and incentives.

Strategies for Optimizing Your Wisconsin Tax Rebate

Maximizing your tax rebate in Wisconsin involves a strategic approach. This section provides practical tips and strategies to help taxpayers make the most of the state’s tax rebate system.

Utilizing Tax Preparation Software

One of the most efficient ways to navigate Wisconsin’s tax rebate system is by utilizing tax preparation software. These software tools are designed to guide taxpayers through the process, ensuring all eligible deductions and credits are claimed. They can also calculate the rebate amount accurately based on the taxpayer’s specific circumstances.

Popular tax preparation software options for Wisconsin residents include TurboTax, H&R Block, and TaxAct. These platforms offer step-by-step guidance, ensuring a smooth and accurate tax filing process. Additionally, many of these software providers offer free versions for simple tax returns, making them accessible to a wide range of taxpayers.

Seeking Professional Tax Advice

For complex tax situations or when navigating the intricacies of Wisconsin’s tax laws, seeking professional tax advice can be invaluable. Certified Public Accountants (CPAs) and Enrolled Agents (EAs) are highly trained professionals who can provide personalized guidance based on an individual’s unique financial situation.

A tax professional can help identify additional deductions and credits that a taxpayer may be eligible for, ensuring they receive the maximum rebate possible. They can also assist with tax planning strategies to minimize future tax liabilities and maximize rebates. To find a qualified tax professional, residents of Wisconsin can utilize the search tools provided by the Wisconsin Society of Certified Public Accountants or the National Association of Enrolled Agents.

Staying Informed About Tax Changes

Wisconsin’s tax laws are subject to change, and staying informed about these changes is crucial for optimizing tax rebates. The state may introduce new tax incentives, modify existing ones, or adjust eligibility criteria based on budgetary considerations and legislative decisions.

To stay updated, taxpayers can subscribe to email alerts from the Wisconsin Department of Revenue. The department's website also provides a dedicated section for tax updates and news, ensuring taxpayers are aware of any changes that may impact their tax rebate. Additionally, reputable tax blogs and news sources can provide valuable insights into tax law changes and their potential impact on rebates.

Wisconsin’s Tax Rebate System: A Summary

Wisconsin’s tax rebate system offers a range of benefits to its residents and businesses, providing financial relief and incentives for economic growth. By understanding the eligibility criteria, calculation methods, and available deductions and credits, taxpayers can maximize their rebates and minimize their tax liabilities.

Utilizing tax preparation software and seeking professional tax advice are strategic moves to ensure an accurate and optimized tax rebate. Staying informed about tax law changes is also crucial for adapting to the evolving tax landscape and taking advantage of new incentives. With a proactive approach and a solid understanding of Wisconsin's tax laws, taxpayers can navigate the rebate system successfully and receive the financial benefits they deserve.

How often can I claim the Homestead Credit in Wisconsin?

+

The Homestead Credit can be claimed annually, provided you meet the eligibility criteria each year. It’s a recurring benefit designed to provide ongoing property tax relief.

Are there any restrictions on using the Earned Income Tax Credit (EITC) in Wisconsin?

+

Yes, the EITC in Wisconsin is subject to certain restrictions. For instance, it’s only available to taxpayers with a valid Social Security Number (not an Individual Taxpayer Identification Number). Additionally, there are income limits and specific rules regarding marital status and qualifying children.

Can I claim both the Homestead Credit and the Earned Income Tax Credit (EITC) in Wisconsin?

+

Yes, it’s possible to claim both rebates if you meet the eligibility criteria for both. The Homestead Credit and EITC are designed to provide financial relief to different segments of the population, so they can be claimed together if applicable.

What is the average tax rebate for Wisconsin residents?

+

The average tax rebate for Wisconsin residents can vary widely depending on factors such as income, property taxes, and the specific rebates claimed. However, the state’s tax system is designed to provide significant rebates to eligible taxpayers, especially those with low to moderate incomes.