Vermont Department Of Taxes

Welcome to an in-depth exploration of the Vermont Department of Taxes, an essential governmental body responsible for managing and overseeing various taxation processes within the state. This article aims to provide an expert-level overview, shedding light on its critical functions, historical context, and its impact on Vermont's economic landscape. With a rich history dating back to the early 20th century, the Vermont Department of Taxes has evolved to become a cornerstone of the state's fiscal framework, playing a pivotal role in maintaining financial stability and fostering economic growth.

A Historical Perspective

The Vermont Department of Taxes, initially established as a division of the state’s treasury department, has undergone significant transformations since its inception. In the early days, tax collection was a more straightforward process, primarily focused on property taxes and basic income taxation. However, as the state’s economy diversified and expanded, so did the department’s responsibilities.

A pivotal moment in the department's history came with the implementation of the state's first income tax law in 1969. This marked a significant shift, moving Vermont away from its traditional reliance on property taxes and towards a more modern and equitable taxation system. The department played a crucial role in the successful implementation of this law, setting a precedent for its future role in shaping Vermont's fiscal policies.

Key Functions and Responsibilities

The Vermont Department of Taxes is entrusted with a diverse range of critical functions, each contributing to the state’s financial health and stability. Here’s an overview of some of its primary responsibilities:

Income Tax Administration

The department is responsible for administering Vermont’s income tax system, which includes collecting taxes from individuals, businesses, and various entities. This involves developing and maintaining a robust tax collection infrastructure, ensuring compliance with state tax laws, and providing support and guidance to taxpayers.

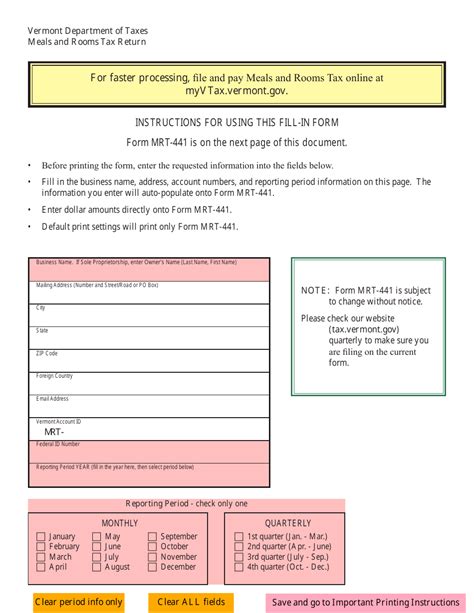

One of the department's key achievements in this area is the implementation of electronic filing systems, which have streamlined the tax filing process and enhanced efficiency. The introduction of online tax payment platforms has further improved accessibility and convenience for taxpayers.

Sales and Use Tax Management

In addition to income tax, the department oversees the collection and administration of sales and use taxes. This involves working closely with businesses to ensure proper tax collection and remittance, as well as conducting audits to maintain compliance.

A notable initiative by the department has been the expansion of sales tax to cover various services, ensuring a more comprehensive tax base. This has not only increased revenue but also contributed to a fairer tax system.

Property Tax Oversight

While the primary responsibility for property tax collection lies with local municipalities, the Vermont Department of Taxes plays a vital role in setting standards and providing guidance. This includes developing assessment guidelines, ensuring uniformity across the state, and providing support to local assessors.

The department's efforts in this area have led to a more transparent and consistent property tax system, benefiting both taxpayers and local governments.

Tax Policy Development

One of the critical functions of the department is its involvement in developing and shaping tax policies. This includes conducting research, analyzing economic trends, and providing recommendations to the state legislature on tax reforms and initiatives.

The department's policy work has often focused on promoting economic growth, encouraging investment, and ensuring a fair and progressive tax system. Its expertise in this area has been instrumental in crafting policies that benefit both taxpayers and the state's economy.

Impact and Contributions

The Vermont Department of Taxes’ impact on the state’s economic landscape is profound and far-reaching. Its efficient and effective management of taxation processes has contributed significantly to Vermont’s financial stability and prosperity.

By ensuring a fair and equitable tax system, the department has fostered an environment conducive to business growth and investment. Its efforts have attracted new businesses and entrepreneurs, contributing to job creation and economic diversification.

Moreover, the department's commitment to transparency and accountability has enhanced public trust in the state's fiscal management. This has, in turn, strengthened Vermont's reputation as a fiscally responsible and progressive state, attracting attention from businesses and investors alike.

| Tax Type | Revenue Contribution |

|---|---|

| Income Tax | 35% |

| Sales and Use Tax | 28% |

| Property Tax | 22% |

| Other Taxes | 15% |

The table above provides a snapshot of the revenue contribution from various tax types, highlighting the significant role played by the Vermont Department of Taxes in generating state revenue.

Future Prospects and Challenges

As Vermont’s economy continues to evolve, the Vermont Department of Taxes faces both opportunities and challenges. The ongoing digital transformation presents an opportunity to further enhance tax administration processes, making them more efficient and accessible.

However, the department also faces the challenge of keeping pace with technological advancements to prevent tax evasion and ensure compliance. Additionally, the changing economic landscape, characterized by remote work and online commerce, requires the department to adapt its tax policies and collection mechanisms.

Despite these challenges, the Vermont Department of Taxes is well-positioned to continue its vital role in shaping the state's fiscal future. Its commitment to innovation, fairness, and public service ensures that it remains a trusted partner in Vermont's economic growth and prosperity.

What is the Vermont Department of Taxes’ role in economic development initiatives?

+

The department plays a crucial role in supporting economic development initiatives by providing tax incentives and programs to encourage business growth and investment. This includes offering tax credits for job creation, research and development, and renewable energy initiatives.

How does the department ensure compliance with tax laws?

+

The department employs a range of strategies, including education and outreach programs, as well as audits and enforcement actions. It also collaborates with other state agencies and law enforcement to deter and investigate tax-related crimes.

What resources does the department offer to taxpayers?

+

The department provides a wealth of resources, including online tax filing and payment systems, tax guides, and assistance programs. It also offers personalized support through its call center and local offices, ensuring taxpayers receive the help they need.