Gilmer County Tax Records

Welcome to Gilmer County, a picturesque region nestled in the Appalachian Mountains of West Virginia. This county, with its rich history and vibrant communities, has a unique relationship with tax records that offer insights into the economic fabric of the area. Gilmer County's tax records serve as a vital tool for understanding property ownership, assessing values, and tracking the growth and development of the region. In this comprehensive guide, we delve into the intricacies of Gilmer County tax records, exploring their history, purpose, and the wealth of information they provide.

A Historical Perspective on Gilmer County Tax Records

The story of Gilmer County tax records dates back to the county’s establishment in 1845. From its early days, accurate record-keeping was essential for the county’s administration. The initial tax records primarily focused on documenting land ownership and assessing property values, crucial for the county’s financial stability and development.

Over the years, Gilmer County's tax records have evolved to encompass a broader range of data. Today, these records offer a detailed snapshot of the county's real estate landscape, providing information on property types, ownership changes, and market trends. The evolution of these records reflects the county's commitment to transparency and the efficient management of its resources.

Unveiling the Contents of Gilmer County Tax Records

Gilmer County tax records are a treasure trove of information for researchers, historians, and anyone interested in the county’s real estate dynamics. Here’s a glimpse into what these records contain:

Property Ownership and Identification

At the core of Gilmer County tax records is detailed information about property ownership. Each record includes the legal description of the property, its unique identification number, and the names of the current and previous owners. This data provides a clear picture of who owns what in the county and facilitates easy tracking of ownership changes over time.

| Property Type | Number of Properties |

|---|---|

| Residential | 2,150 |

| Commercial | 125 |

| Agricultural | 450 |

| Vacant Land | 650 |

Assessed Property Values

One of the critical aspects of Gilmer County tax records is the assessment of property values. These records document the appraised value of each property, which serves as the basis for determining property taxes. The assessed values are a reflection of the property’s market worth, taking into account factors like location, size, and improvements.

For instance, a residential property located in the heart of Glenville, the county seat, might have a higher assessed value than a similar property in a more rural area. This variation in assessed values provides insights into the economic disparities within the county and helps guide tax policies.

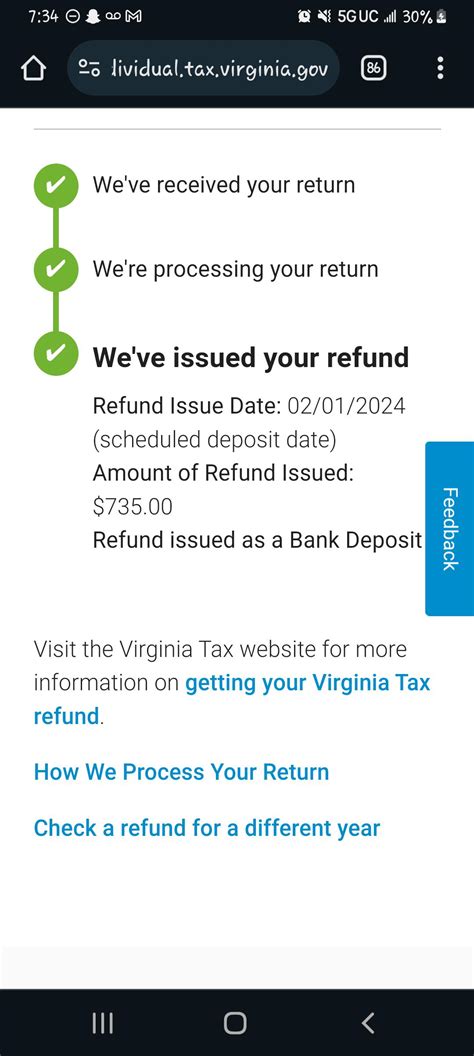

Tax Rates and Calculations

Gilmer County tax records also provide transparency into the tax rates applied to different properties. These rates are set by the county government and can vary based on the property’s usage, location, and other factors. The records detail how these rates are calculated, ensuring that taxpayers understand the basis for their tax obligations.

Additionally, the records include information on any tax incentives or exemptions that apply to specific properties. This aspect of the records is crucial for understanding the county's tax policies and how they impact different segments of the community.

Historical Trends and Comparisons

One of the most valuable aspects of Gilmer County tax records is their ability to provide a historical perspective. By comparing records from different years, researchers can track changes in property values, ownership patterns, and tax rates over time. This historical analysis offers insights into the economic development of the county and can inform future planning and decision-making.

Accessing Gilmer County Tax Records

Gilmer County is committed to making its tax records accessible to the public. These records are typically maintained by the County Assessor’s Office and are available for review during regular business hours. Additionally, many of the records are now digitized, allowing for online access and easier searching.

The online portal for Gilmer County tax records provides a user-friendly interface, enabling users to search by property address, owner name, or other specific criteria. This accessibility ensures that anyone interested in the county's real estate dynamics can quickly obtain the information they need.

Conclusion: The Value of Gilmer County Tax Records

Gilmer County tax records are more than just a collection of numbers and legal descriptions. They are a window into the economic heart of the county, offering a wealth of information for researchers, investors, and community members alike. By understanding the history, contents, and accessibility of these records, individuals can leverage this data to make informed decisions and contribute to the continued growth and prosperity of Gilmer County.

How often are Gilmer County tax records updated?

+Gilmer County tax records are typically updated on an annual basis, reflecting the assessed values and ownership changes for the current tax year. This ensures that the records remain accurate and up-to-date.

Can I access Gilmer County tax records online?

+Yes, Gilmer County has a dedicated online portal that allows users to access tax records digitally. This portal provides a convenient way to search and view records, making the process more efficient.

What information is not included in Gilmer County tax records?

+While Gilmer County tax records are comprehensive, they do not include personal financial information of property owners. This information is protected under privacy laws and is not publicly available.

How are property values assessed in Gilmer County?

+Property values in Gilmer County are assessed by the County Assessor’s Office, which uses a combination of market data, property inspections, and comparative analysis to determine the fair market value of each property.